California’s housing market faltered in August for the fourth straight month as high home prices continue to take a toll on demand statewide, according to the latest report from the California Association of REALTORS® (C.A.R.).

Home sales in San Diego County declined by 10.4 percent in August in a year-over-year comparison. Regionally, Southern California had the largest decline, with sales falling 8 percent in year-over-year. Orange and Los Angeles counties saw year-over-year declines of 10.4 percent and 8.9 percent, respectively.

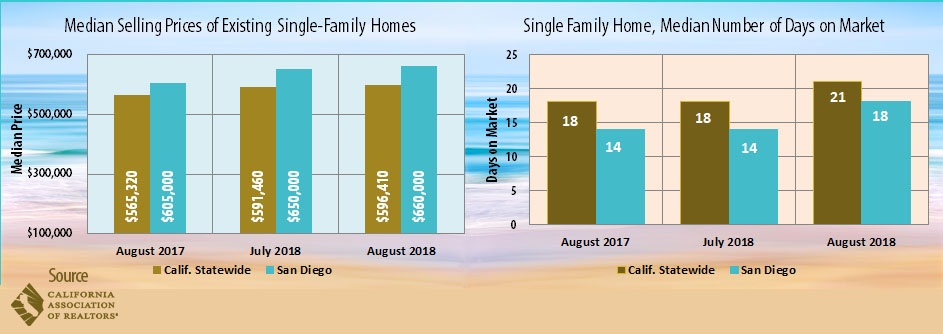

In its August home sales and price report, C.A.R. said the statewide median home price edged higher $596,410, up 0.8 percent from $591,460 July 2018 and up 5.5 percent from a revised $565,320 in August 2017.

In San Diego County, C.A.R. reported that the median single-family housing price was $660,000 in August 2018, compared to $650,000 in July 2018. The August 2018 figure was 9.1 percent higher from the $605,000 registered in August 2017.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 399,600 units in August, according to information collected by C.A.R. from more than 90 local REALTOR® associations and multiple leasing services statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

It was the first time in two years for single-family detached home sales to fall below the 400,000 sales benchmark. August’s sales figure was down 1.8 percent from the revised 406,920 level in July and down 6.6 percent compared with home sales in August 2017 of 427,630.

“Home sales activity remained on a downward trend for the fourth straight month as uncertainty about the housing market continues to mount,” said C.A.R. President Steve White. “Buyers are being cautious and reluctant to make a commitment as they are concerned that home prices may have peaked and instead are waiting until there’s more clarity in the market.”

“While home prices continued to rise modestly in August, the deceleration in price growth and the surge in housing supply suggest that a market shift is underway,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “We are seeing active listings increasing and more price reductions in the market, and as such, the question remains, ‘How long will it take for the market to close the price expectation gap between buyers and sellers?’”

Other key points from C.A.R.’s August 2018 resale housing report included:

- The median number of days it took to sell a California single-family home was 21 days in August 2018, compared to 18 days in July 2018 and 18 days in August 2017. Meanwhile, in San Diego County, the median number of days a home remained unsold on the market was 18 days in August 2018, compared to 14 days in both July 2018 and August 2017.

- Statewide active listings rose for the fifth consecutive month after 33 straight months of declines, increasing 17.2 percent from the previous year. August’s listings increase was the biggest in nearly four years. Much of the listings increase is attributable to lower-priced properties. The number of homes available for sale and priced below $750,000 grew more than twice as much as homes priced above that price level. With fewer homes being sold, statewide inventory is starting to climb. The unsold inventory index, which is a ratio of inventory over sales, rose again in August from 2.9 months from August 2017 to 3.3 months in August 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

- California condominium/townhome median price in August 2018 was $474,570, compared to $486,330 in July 2018 and $446,850 in August 2017.

- The 30-year, fixed-mortgage interest rates averaged 4.55 percent in August, up from 3.88 percent in August 2017, according to Freddie Mac. The five-year, adjustable mortgage interest rate also increased in August to an average of 3.87 percent from 3.15 from August 2017.

- San Diego County home prices in July increased 6.2 percent in the past year year, faster than the nationwide average of 5.9 percent, but slower than other California cities, according to the most recent S&P CoreLogic Case-Shiller 20-city index. In July, Las Vegas was the number-one metro area yet again with a 13.7 percent annual increase. It was followed by Seattle at 12.1 percent and San Francisco at 10.8 percent. The monthly change for local home prices from June to July 2018 was 0.0 percent, according to the report.

- Realtor.com, operated by the National Association of REALTORS®, reports that the coastal cities of San Jose, Seattle and San Diego were the three markets with the biggest inventory jumps over last year, all posting increases of 28 percent or more. As a result, the increased inventory has led to an increase in price discounts. Realtor.com found that Seattle had an 8 percent increase in price discounts, San Jose had a 7 percent rise in price discounts, and the cities of San Diego, Riverside, Indianapolis, Riverside, and Los Angeles all had a 5 percent spike in price discounts from a year ago. Nearly 40 of the 45 largest markets saw an increase in the share of price discounts over last year.

- LendingTree reports that San Diego is the second most difficult place in the U.S. to get into a home, behind only Los Angeles. San Francisco came in third. San Diego has an average leverage ratio of 3.62, or the ratio of mortgage cost to borrower's income. The region's leverage ratio is based on a median mortgage amount of $442,000, and a median borrower household income of $122,000. The study used Home Mortgage Disclosure Act (HMDA) data, which includes more than 7 million mortgages originated in 2017, to calculate the leverage rate of borrowers in the 50 largest cities in America. The median amount borrowed was divided by the median borrower income for all purchases in the HMDA database for 2017.

- Foreclosures and delinquency rates have dipped to a 12-year low, according to CoreLogic. Measuring the number of homeowners who were late on their mortgage payments by more than 30 days, the monthly analysis found that only 4.3 percent of mortgages in June were delinquent nationwide, compared to 4.6 percent the year previous and the same 4.3 percent in March. While the downtick may seem small, the number of Americans failing to make payments on their homes has been falling steadily over the past decade. Neither the delinquency rate nor foreclosure rate has been this low since 2006.

- WalletHub, a company that offers free credit scores and credit reports updated daily, compared 182 U.S. cities based on 65 key metrics, including movie costs, open hours of breweries and fitness centers per capita, and San Diego came in as the tenth most fun city in America. More specifically, San Diego came in at #10 in number of attractions, #9 in parkland acres per capita, #8 in festivals per capita and #1 for fitness centers per capita. Other categories in which the city scored well included: playgrounds per capita (#19), restaurants per capita (#16, dance clubs per capita (#11) and bar accessibility (#30). Overall, San Diego hosts more than 35 million visitors each year, with that number expected to increase by 3.5 percent in 2018, according to the San Diego Tourism Authority.

- Near record-low unemployment in the San Diego metropolitan region continued in August, with the rate falling to 3.4 percent from 3.5 percent in July. The state Employment Development Department reported there were 1,529,800 employed in San Diego County in July and just 54,300 unemployed. The unemployment rate in San Diego was below the state level of 4.2 percent and the national level of 3.9 percent. Economists say that even with a strong economy, there will be some “frictional unemployment” due to workers changing jobs. The lowest unemployment rate in San Diego in recent years was 2.9 percent in December 1999, while the highest was 10.9 percent — more than one in 10 workers — in March 2010 during the Great Recession.

- For the first time in at least 20 years, there are now more job openings than there are people looking for work. There are more jobs than people out of work, something the American economy has never experienced before. There are 6.7 million job openings and just 6.4 million available workers to fill them, according to the Bureau of Labor Statistics.