California’s housing market recovery from the coronavirus pandemic nosedive is continuing in high gear as buyers and sellers apparently have brushed off economic uncertainty, according to the most recent monthly home sales and price report from the California Association of REALTORS® (C.A.R.).

In July, home sales climbed to their highest level in more than two-and-a-half years, while median home prices set another record high. The July numbers are the latest evidence of a housing market rebound from spring, when stay-at-home orders and fears over the coronavirus slowed activity.

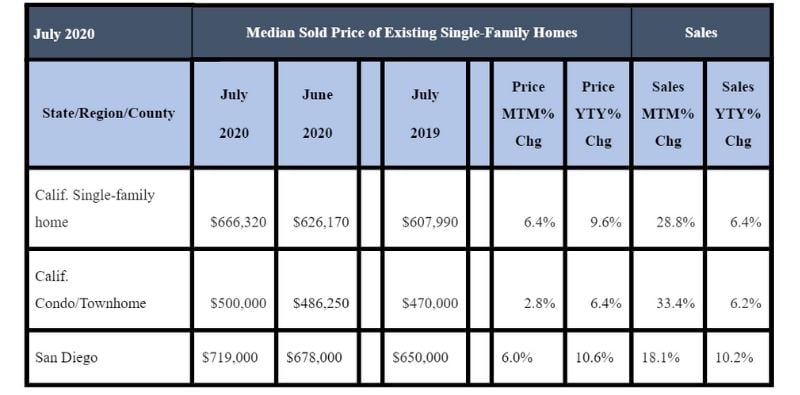

The state’s existing, single-family home sales totaled 437,890 in July 2020 on a seasonally adjusted annualized rate, up 28.8 percent from June 2020’s sales of 339,910, and 6.4 percent higher from July 2019, when 411,630 homes were sold.

The July sales total climbed above the 400,000 level for the first time since February, before the COVID-19 effect depressed the housing market. July 2020 also was the first time in five months that home sales posted an annual gain. Year-to-date statewide home sales were down 10 percent in July, however.

In San Diego County, July 2020 home sales were 18.1 percent higher, compared to that of June 2020, with a 10.2 percent increase since July 2019.

“A housing market trifecta of strong pent-up demand, record-low interest rates and a renewed interest in the value of homeownership bolstered July’s home sales,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “With this year’s delayed start of the homebuying season due to the pandemic, we expect home sales to remain robust in August and September, extending the season later than what’s typical.”

The median price for a single-family home in California was $666,320 for July 2020, up 6.4 percent from June 2020’s price of $626,170, and up 9.6 percent from July 2019’s price of $607,990.

July 2020 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

In San Diego, the median price for a single-family home in San Diego County in July 2020 was $719,000, 6 percent higher than the $678,000 figure in June 2020 and 10.6 percent higher than the $650,000 figure for July 2019.

Sales of higher-priced properties contributed to a new high for the statewide median price in July 2020, after setting a previous record in June 2020. The monthly price increase was higher than the historical average change from June to July and was the highest ever recorded June-to-July change.

Sales of higher-priced properties continued to outpace sales of lower-priced homes. Homes priced below $500,000, which made up 44 percent of total sales in the California market in June 2020, only comprised 40 percent of all sales in July 2020.

Homes priced below $500,000 made up 40 percent of total sales in the state in July 2020, compared to 44 percent in June 2020. Sales of million-dollar properties increased in market share to 20.4 percent in July 2020, compared with 18.1 percent in June 2020.

“Stronger sales of higher-priced properties continue to propel the statewide median home price, as those who tend to purchase more expensive homes are less impacted by the economic recession,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “High demand in resort communities is another variable that’s fueling the increase in home prices, as a new wave of remote workers are leaving cities in search of more space and a healthier lifestyle in what used to be the second/vacation home market.”

Reflecting the rise in home prices, a monthly Google poll conducted by C.A.R. in early August found that 54 percent of consumers said it is a good time to sell, up from 44 percent a month ago, and up from 52 percent a year ago. Meanwhile, low interest rates continue to fuel the optimism for homebuying; 33 percent of the consumers who responded to the poll believed that now is a good time to buy a home, sharply higher than last year, when 23 percent said it was a good time to buy a home.

Other key points from the July 2020 resale housing report include:

-- Sales increased in all major regions over last year and were particularly strong in the Central Coast region, which posted a 21.9 percent gain. Sales increased 14.8 percent in the San Francisco Bay Region, 6.6 percent in the Central Valley and 5.4 percent in Southern California.

-- Nearly nine of ten of counties, 44 of 51 overall, experienced a year-over-year gain in closed sales in July 2020.

-- Median home prices increased in all regions in July, with both the Central Coast and San Francisco Bay Area climbing more than 10 percent from last year. The Central Valley and Southern California also grew solidly with high-single-digit increases.

-- Housing inventory continued to trend downward on a year-over-year basis, with active listings falling more than 25 percent for the eighth consecutive month. The year-over-year 48 percent decline was the biggest drop in active listings since January 2013.

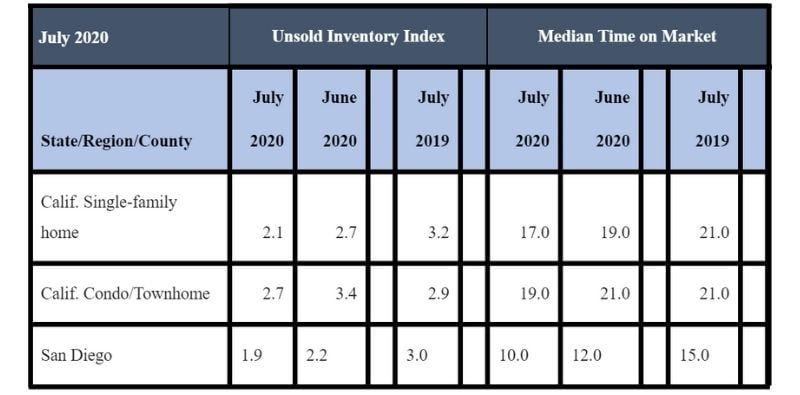

-- The continued recovery in closed escrow sales, combined with a sharp drop in active listings, led to a plunge in the Unsold Inventory Index (UII) to 2.1 months in July, down from 3.2 months a year ago. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales. The July UII was the lowest level since November 2004.

-- The supply of homes for sale continued to decline significantly across the state, with all regions falling more than 30 percent in active listings from last year. Southern California had the biggest annual drop in inventory in July at 50.7 percent, which was less than half the number of sale properties from a year ago.

July 2020 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- The median number of days it took to sell a California single-family home was 17 days in July 2020. July’s time-frame compares to 19 days in June 2020, 17 days in May 2020, 13 days in April 2020, 15 days in March 2020, 23 days in February 2020 and 21 days in July 2019.

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was 10 days in July 2020, which compares to 12 days in June 2020, 11 days in May 2020, eight days in April 2020, 10 days in March 2020, 12 days in February 2020, 23 days in January 2020 and 15 days in July 2019.

-- The 30-year, fixed-mortgage interest rate averaged 3.02 percent in July, down from 3.77 percent in July 2019, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 3.02 percent, compared to 3.47 percent in July 2019.

In other recent real estate and economic news, according to news reports:

-- Median home prices in San Diego hit a record high of $634,000 in July 2020, according to CoreLogic. That median price is 9.3 percent higher from same time a year ago. In June 2020, the figure hovered just over $600,000. Los Angeles, Orange and Ventura counties all saw home selling prices touch record levels. The median price of a home in the region was $585,000 in July, up 8.5 percent year-over-year and up almost $30,000 from June’s record high. It was the largest one-month price hike in CoreLogic’s 32-year-old history of tracking.

-- According to Redfin, San Diego County had the third-highest rate of competitive bids for homes in the country, trailing only Salt Lake City and San Francisco. San Diego home buyers faced competitive bids in 65 percent of the cases in July, which was down somewhat from 70 percent in June.

-- According to Zillow, San Diego County’s home inventory is down 28.4 percent year-over-year, as of the week ending Aug. 15, meaning there are more than 400,000 fewer homes listed on the market than there were a year ago. Inventory also is down in each of the 50 largest metros surveyed by Zillow from a year ago. Inventory decreased the most in Riverside (minus-46.5 percent), Baltimore (minus-43.8 percent), and Hartford, Conn. (minus-43.1 percent).

-- The median list price of a single-family home in the U.S. grew 10.1 percent year-over-year, the fastest pace of growth since January 2018, according to Realtor.com’s weekly recovery report for the week ending Aug. 15. Realtor.com also reported the price in San Diego is up about 11 percent year-over-year, while the number of active listings is down by 44 percent since last year.

-- The National Association of REALTORS® reports that 96 percent of the nation’s metropolitan areas experienced an increase in home prices in the second quarter of 2020, even in the midst of the pandemic. San Diego was the fifth most expensive metro area for housing. San Jose maintained its place as the most expensive area in the nation during the second quarter as its median price for an existing, single-family home rose 3.8 percent year-over-year to $1.38 million. Others median prices among the top five included San Francisco ($1.05 million), Anaheim ($859,000), urban Honolulu ($815,700) and San Diego ($670,000).

-- San Diego was the nation’s second least affordable housing market in June, according to First American Financial Corp.’s Real House Price Index (RHPI). The higher the RHPI score, the less affordable the home. New York City had the highest RHPI at 29.3 percent, followed by San Diego at 19.4 percent, and Pittsburgh at 15 percent.