Lower seasonal home prices allowed more Californians to afford a home purchase in the fourth quarter of 2018, compared to the previous quarter, but higher interest rates pushed affordability lower compared to the previous year, according to the California Association of REALTORS®’ (C.A.R.) “Housing Affordability Index” (HAI).

Lower seasonal home prices allowed more Californians to afford a home purchase in the fourth quarter of 2018, compared to the previous quarter, but higher interest rates pushed affordability lower compared to the previous year, according to the California Association of REALTORS®’ (C.A.R.) “Housing Affordability Index” (HAI).

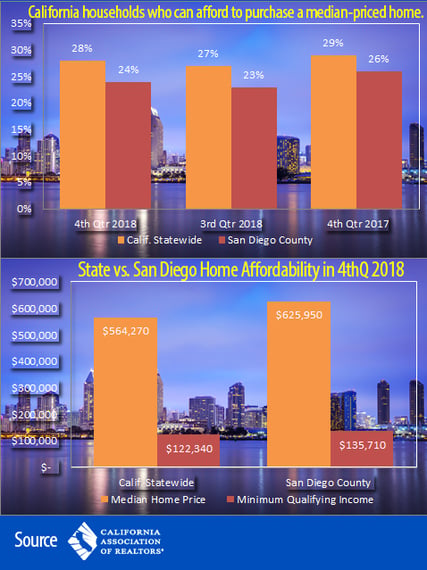

C.A.R. said 28 percent of California households could afford to purchase the existing $564,270 median-priced home in the fourth quarter of 2018, which was up from 27 percent in third quarter of 2018 but down from 29 percent a year ago.

In San Diego County, only 24 percent of local households could afford to purchase the $625,950 median-priced home in the 2018 fourth quarter, up from 23 percent in the 2018 third quarter but down from 26 percent a year ago.

"Affordability has been challenging the past few years in San Diego County. We’re facing a soft market right now in San Diego as prices remain flat while some buyers are remaining on the sidelines,” said Robert Calloway, 2019 PSAR President. “However, the market fundamentals, such as job growth, income growth and household formation, are still strong. Mortgage rates are down slightly and buyers are looking for deals because the time on market has gone up which has increased the housing supply, but they're no longer fighting each other tooth and nail to get in the front door.”

C.A.R. said its index has been below 30 percent for six of the past eight quarters. California’s housing affordability index hit a peak of 56 percent in the first quarter of 2012.

C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. The index is considered the most fundamental measure of housing well-being for homebuyers in the state.

To afford to qualify to purchase the statewide median-priced, single-family home of $564,270 in the fourth quarter 2018, a household would need a minimum annual income of $122,340 to make the necessary monthly payments of $3,060. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, assumes a 20 percent down payment and an effective composite mortgage interest rate of 4.95 percent. The effective composite interest rate was 4.77 percent in third-quarter 2018 and 4.17 percent in fourth-quarter 2017.

In San Diego County, C.A. R. said a minimum annual income of $135,710 would be needed to make monthly payments of $3,390 on a 4.95 percent interest rate mortgage loan.

“One of the biggest things with the affordability of homes here in San Diego is typically household income levels, but we’re in a more favorable position when compared to other markets like the Bay Area and the Silicon Valley,” said Calloway. “Too many builders have focused on luxury homes, and there hasn't been enough construction of affordable starter homes. Fortunately, recent inventory increases and the slowdown in house price appreciation is good news for home buyers.”

C.A.R. also said housing affordability for condominiums and townhomes edged up in fourth-quarter 2018 compared to the previous quarter with 37 percent of California households earning the minimum income to qualify for the purchase of a $460,000 median-priced condominium/townhome, up from 36 percent in the third quarter. An annual income of $99,730 was required to make monthly payments of $2,490. Thirty-eight percent of households could afford to buy a condominium-townhome a year ago.

Compared with California, more than half of the nation’s households (54 percent) could afford to purchase a $257,600 median-priced home, which required a minimum annual income of $55,850 to make monthly payments of $1,400.

Other key points from C.A.R.’s fourth-quarter 2018 Housing Affordability report included:

-- Housing affordability improved from fourth-quarter 2017 in 10 tracked counties and declined in 30 counties. Affordability in eight counties remained flat.

-- All but one county in the Southern California region posted a decrease in affordability compared to a year ago. Affordability declined in Los Angeles, Orange, Riverside, San Bernardino and San Diego counties. Only Ventura County recorded an improvement.

-- During the fourth quarter of 2018, the most affordable counties in California were Lassen (66 percent), Kern (53 percent) and Kings and Siskiyou (both at 50 percent). The minimum annual income needed to qualify for a home in these counties was $52,030 or less.

-- Mono (12 percent), Santa Cruz (12 percent), San Mateo (15 percent), San Francisco (15 percent) and Santa Clara (18 percent) counties were the least affordable areas in the state. San Francisco and San Mateo counties had the highest minimum qualifying incomes in the state. An annual income of $326,290 was needed to purchase a home in San Francisco County, and an annual income of $329,300 was required in San Mateo County.