California’s housing market in August sees a notable increase in sales - a first in five months. Sales rebounded as home prices are stabilizing.

For the first time in five months, California home sales increased in August 2022, according to the latest home sales and price report from the California Association of REALTORS® (C.A.R.). The increase in home sales in August was attributed to a brief retreat in mortgage rates that created a slightly more favorable lending environment.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 313,540 in August, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the August pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

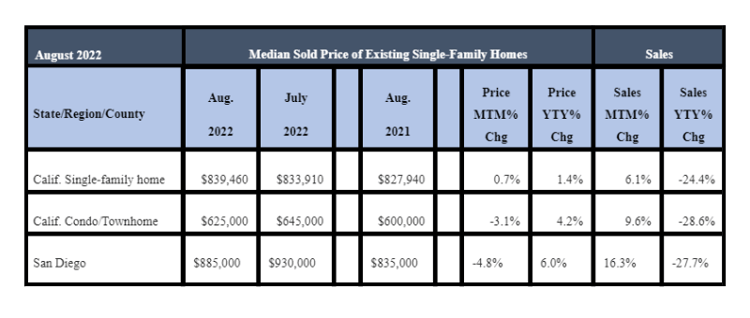

Statewide, the rate of home sales in August 2022 was up 6.1 percent in a monthly comparison with July 2022, when 295,460 homes were sold, and down 24.4 percent from a year ago in August 2021, when 414,860 homes were sold on an annualized basis.

The monthly sales increase for August 2022 was higher than the long-run average of 0.4 percent for July-August in the past 43 years and marked the first monthly sales increase in five months.

In San Diego County, home sales dropped 27.7 percent in August 2022, compared to a year ago in August 2021, but were up 16.3 percent in a month-over-month comparison from July 2022.

Statewide, home prices stabilized in August 2022 as the statewide median price increased on both a monthly and yearly basis, but at a less-than-2-percent growth pace.

The statewide median price edged up 0.7 percent in August 2022 to $839,460 from the $833,910 recorded in July 2022 and was up 1.4 percent from the $827,940 recorded a year ago in August 2021.

The year-over-year price gain was the smallest in more than two years. The nominal price increase was attributed partly to a change in the mix of sales in August. With sales in the million-dollar segment rising 6.8 percent from the prior month, the August 2022 statewide median price also pushed slightly by 0.7 percent from July 2022.

Locally, the median sales price for an existing, single-family detached home in San Diego County dropped in August 2022 to $885,000, a 4.8 percent decline from the $930,000 median price in July 2022. The August 2022 median price was still 6.0 percent higher than the year-ago price of $835,000 in August 2021. The median is the price at which half of the homes sell for more and half for less.

“California’s housing market stabilized briefly as a reprieve on mortgage rates in July and early August brought buyers into the market,” said C.A.R. President Otto Catrina, a Bay Area real estate broker, and REALTOR®. “Active listings have passed their annual peak, and while homes are taking slightly longer to sell, the share of homes seeing price reductions has also stabilized to near pre-pandemic levels. Price growth in August picked up on both a monthly and annual basis, and pending sales suggest a bounce-back for homes priced $2 million and above.”

“It’s encouraging to see that August’s sales pace rebounded above an annualized 300,000 units sold,” said C.A.R. Vice President and Chief Economist Jordan Levine. “Although we do not expect a rapid bounce-back because the Fed is expected to continue raising interest rates to get inflation under control, the monthly increase in closed and pending sales suggests that the market may have already priced in most of the rate increases to date. Still, buyers will continue to grapple with rising costs of borrowing, which will keep home sales below the 350,000 annualized pace for the remainder of the year.”

Other key points from C.A.R.’s August 2022 resale housing report included:

-- At the regional level, sales continued to fall sharply from last year, but the declines in August 2022 moderated slightly from the prior month. Southern California dropped 28.8 percent in a year-over-year comparison.

-- Forty-seven California counties experienced a year-over-year sales decline in August 2022, and 30 of them plunged more than 20 percent.

-- More than two-thirds of all California counties experienced a year-over-year increase in their median prices in August 2022, but their growth rates have been decelerating in the past three months.

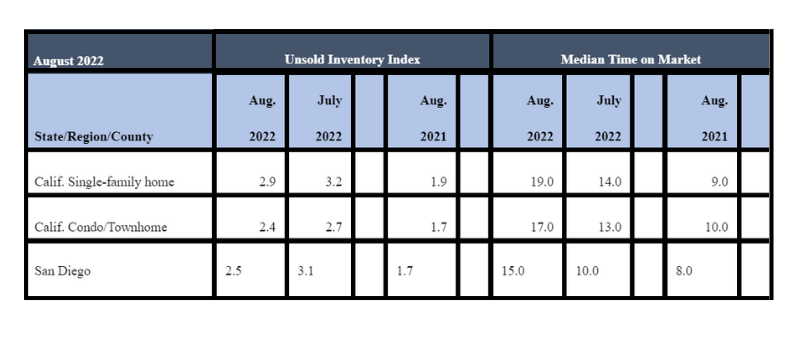

-- Housing supply in California improved in August 2022 from a year ago but tightened slightly from July 2022, as housing demand rose in August. The statewide unsold inventory index decreased to 2.9 months in August 2022, compared to 3.2 months in July, but the figure was higher than 1.9 months a year ago in July 2022. Weaker demand continued to be the primary factor for the improvement in the index.

-- With both closed sales and pending sales slowing by more than 20 percent, active listings have been staying on the market longer, resulting in a year-over-year surge of 57.1 percent in homes for sale in August 202.

-- In San Diego, the inventory of available homes for sale dropped to 2.5 months in August 2022, compared to 3.1 months in July 2022, 2.4 months in June 2022, 1.9 months in May 2022, 1.6 months in April 2022, 1.4 months in March 2022 and 1.7 months in August 2021. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell out given the current rate of sales.

-- Forty-seven of the 51 counties tracked by C.A.R. recorded an increase in active listings on a year-over-year basis in August 2022, a slight increase from July 2022’s 46 counties.

-- The median number of days it took to sell a California single-family home was 19 days in August 2022, 14 days in July 2022, and 9 days in August 2021.

-- In San Diego, the median number of days it took to sell an existing, single-family home was 15 days in August 2022, compared to 10 days in July 2022, 8 days in June 2022, 7 days in May 2022, and April 2022. A year ago, in August 2021, the figure was 8 days. The median represents a time when half the homes sell above it and half below it.

August 2022 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

-- The statewide sales-price-to-list-price ratio was 98.4 percent in August 2022, which was below 100 percent for the first time since June 2020. The statewide sales-price-to-list-price ratio was 102.8 percent in August 2021. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio of 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold is below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 5.22 percent in August, up from 2.84 percent in August 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 4.36 percent, compared to 2.42 percent in August 2021.

(Regional and condo sales data not seasonally adjusted)

-- The statewide median sales-price-to-list-price ratio remained above 100 percent at 101.3 percent in Jun 2022, compared to 103.4 percent in May 2022, 104.2 percent in April 2022, 103.3 percent in March 2022, and 104.1 percent in June 2021. Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and sellers under current market conditions. The ratio, expressed as a percentage, is calculated by dividing the final sales price of a property by its last list price. A sales-to-list ratio of 100 percent or above suggests that the property sold for more than the list price, while a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 5.52 percent in June, up from 2.98 percent in June 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 4.28 percent, compared to 2.56 percent in June 2021.