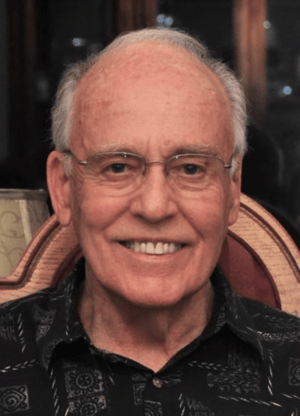

The newest member of the PSAR Government Affairs Committee has been an elected official for the past 22 years.

Mark Robak, a commercial broker with 33 years of experience in real estate, is currently serving as the 2023 Otay Water District (OWD) board president. He has represented OWD’s District 5 (Rancho San Diego, Mount Helix, Jamul, and eastern Chula Vista) for the past 18 years (since January 2005).

Robak recently became a PSAR member and soon thereafter joined the PSAR Government Affairs Committee.

“I believe in giving back, especially if you have the expertise to do something at a high level,” Robak said. “If you work in real estate, it’s important to get involved in your industry. Our committee members earnestly want to influence the government for the benefit of homeowners and property owners. We are dedicated to protecting private property rights.”

In 2015, Robak founded San Diego Commercial Real Estate (SDCRE), a La Mesa firm offering commercial real estate leasing, sales, and advisory services in San Diego County. Previously, he was a senior broker with other commercial brokerage firms.

“I’m impressed with the PSAR dynamic and its dedication to a collaborative atmosphere,” said Robak. “I was previously a member of another association, but I was attracted to PSAR because of its strong name recognition and positive public image in the real estate community.”

Robak was first elected to the Otay Water District (OWD) board in 2004 and was reelected in 2008, 2012, 2016, and 2020. Robak served as vice president of the board for four years from 2019 through 2022. Robak also previously held positions of treasurer in 2018 and president in 2017.

In addition to serving as the 2023 OWD board president, Robak will serve as the chair of the engineering, operations, and water resources, desalination project, and ad hoc Salt Creek Golf Course lease and property disposition committees.

In addition, he serves as the OWD representative for the California Special District’s Association for the state and county, the OWD and Sweetwater Authority Task Force to develop recycled water opportunities, the San Diego Area Wastewater Management District (Metro Commission), South County Economic Development Corporation, Association of California Water Agencies (ACWA), and ACWA-JPIA (Joint Powers Insurance Authority).

He serves as President of the Water Conservation Garden Authority, as well as the President of the Council of Water Utilities.

Robak is the Government Relations Director for the El Cajon Elks Lodge and serves on the government affairs committee of the East County Chamber of Commerce.

He has a bachelor’s degree in political science and public administration from San Diego State University. Robak also has been active in other community organizations as a volunteer, having served on the San Diego-Imperial Council of the Boys Scouts, Boys and Girls Club, Lions Club, and other local charitable organizations.

The five-member Otay Water District Board of Directors is the governing body of the District and is responsible for setting rates for service, taxes, policies, and ordinances, adopting the annual budget, and other matters related to the management and operation of the water agency. Each director is elected by voters within one of five divisions to represent the public’s interest on the board. Directors serve four-year terms in office. Following the vote of officers by the board at its meeting, each of the directors immediately assumed all powers and duties of an officer of the board of directors.

The Otay Water District is a public agency providing water, recycled water, and sewer service to approximately 228,000 customers within approximately 125 square miles of southeastern San Diego County, including the communities of eastern Chula Vista, Bonita, Jamul, Spring Valley, Rancho San Diego, unincorporated areas of El Cajon and La Mesa, and eastern Otay Mesa along the international border with Mexico.

# # #

.png?width=200&height=200&name=2024%20elections%20(2).png)

.jpg?width=258&name=Valerie%20Business%20Profile%20photo%20(1).jpg)