Mirroring a statewide trend, both home prices and home sales declined across San Diego County in December 2023, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

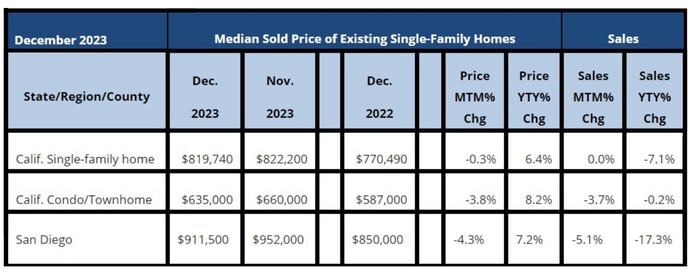

The median sales price of an existing single-family detached home in San Diego County in December 2023 was $911,500, which was a 4.3 percent difference from November 2023, when the median price was $952,000. A year ago, in December 2022, the median home sales price was $850,000, a difference of 7.2 percent with December 2023.

December 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

Also, in December 2023, sales of existing, single-family homes in San Diego County declined by 5.1 percent in a month-over-month comparison with November 2023. In a year-over-year comparison between December 2023 and December 2022, the sales pace was 17.3 percent lower.

Statewide, the numbers for home sales and home prices in December 2023 showed a stagnant California housing market.

For the 2023 year as a whole, the state recorded an annual sales level of 257,630 for 2023, a decline of 24.8 percent from the revised sales level of 342,530 reported at the end of 2022. The annual sales decline comparing 2023 with 2022 was the steepest decline in existing home sales in California since 2007.

Statewide, December 2023 home sales remained near the 16-year low reached in November 2023.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 224,000 in December 2023, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the December 2023 pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

The December 2023 sales pace was essentially unchanged from the revised 223,940 homes sold in November 2023 and was down 7.1 percent from a year ago in December 2022, when a revised 241,070 homes were sold on an annualized basis.

Sales of existing single-family homes in California have been below the 300,000 threshold since September 2022, and will likely stay below that level throughout the first quarter of 2024.

While the deceleration in the year-over-year loss was due primarily to the low level of pending sales recorded a year ago, the slowdown could be a sign that the market is turning the corner, especially since rates in the past couple of weeks have remained well-below the recent peak recorded in late October 2023.

Statewide, the median price of an existing single-family home was $819,740 in December 2023, down slightly by 0.3 percent from $822,200 in November 2023, but above the $770,490 price, a difference of 6.4 percent, posted in December 2022. It was the largest year-over-year gain since May 2022.

With mortgage rates softening since mid-October, home prices will likely maintain their upward momentum, and the market should continue to observe a mid- to single-digit, year-over-year growth rate in California’s median price during the early part of 2024.

For the 2023 year, California’s median home price slipped 0.6 percent to $813,980 from 2022’s $818,900 figure, but it is expected to climb to $860,300 in 2024.

“The housing market had a tough year in 2023 as a shortage of homes for sale and high costs of borrowing continued to have a negative impact on housing inventory and demand,” said 2024 C.A.R. President Melanie Barker, a Yosemite REALTOR®. “With mortgage rates expected to come down in the next 12 months, home sales will bounce back as buyers and sellers return to a more favorable housing market. Home prices should see a moderate increase in 2024 as well.”

“Easing inflationary pressure and a soft economic outlook suggest that we will see some interest rate cuts in the upcoming year, which bode well for a housing market recovery,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “With rates declining to a 7-month low in late 2023, Americans are feeling more positive about the market, and we could begin to see some increase in market activity at the start of the year. The improvement is expected to be gradual as tight housing supply will remain the norm in 2024.”

Other key points from C.A.R.’s December 2023 resale housing report include:

- Home sales in all major regions in the state dipped in December 2023 on a year-over-year basis, including 6.2 percent in Southern California.

- At the regional level, home prices increased in December 2023 in all major regions from a year ago in December 2022, including 6.3 percent in Southern California.

- The unsold inventory statewide decreased 16.7 percent on a month-over-month basis and dipped slightly from December 2022 by -3.8 percent. The index, which measures the number of months needed to sell the supply of homes on the market at the current sales rate declined from 3.0 months in November to 2.5 months in December. The index was 2.6 months in December 2022.

December 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- In San Diego County in December 2023, the inventory of available homes for sale was 2.2 months, compared to 2.5 months in November 2023 and 2.2 months in December 2022. Other unsold inventory figures on a monthly basis in 2023 for San Diego County included 2.5 months in November and September, 1.9 months in August, 2.0 months in July, 2.0 months in June, 1.7 months in May, 1.9 months in April, 1.7 months in March, 2.3 months in February and 2.7 months in January. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

- New active listings at the state level dipped again from a year ago for the 18th consecutive month, but the annual decline remained below 3 percent for the second month in a row. With mortgage rates dropping at the end of 2023, sliding back to the lowest level since early August, the market could see a slight uptick in the number of for-sale properties being listed for sale, as we kick-off the New Year.

- The median number of days it took to sell a California single-family home was 26 days in December 2023, 21 days in November 2023 and 33 days in December 2022.

- In San Diego, the median number of days it took to sell an existing, single-family home was 18 days in December 2023, compared to 15 days in November 2023 and 23 days in December 2022. Other median-time-on-the-market figures on a monthly basis for San Diego in 2023 include 14 days in October and September, 13 days in August, 12 days in July, 11 days in June, 12 days in May and April, 15 days in March, 17 days in February and 26 days in January. The median represents the time when half the homes sell above it and half below it.

- C.A.R.’s statewide sales-price-to-list-price ratio was 99 percent in December 2023 and 96.1 percent in December 2022.

- The statewide, sales-price-to-list-price ratio on a monthly basis in 2023 was at 100 percent in November, October, September, August, July, June, May and April, 99.1 percent in March, 97.7 percent in February and 96.5 percent in January. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

- The 30-year, fixed-mortgage interest rate averaged 6.82 percent in December, up from 6.36 percent in December 2022, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.