California’s housing market continued to maintain a solid sales pace in February 2022, despite higher interest rates and geopolitical uncertainty caused by the Russia-NATO conflict in Ukraine, according to the latest home sales and price report from the California Association of REALTORS® (C.A.R.).

The number of homes sold statewide in February was lower than last year’s unusually strong market. The number of closed escrow sales of existing, single-family detached homes statewide on a seasonally adjusted annualized rate totaled 424,640 in February 2022, which was down 4.5 percent from January 2022, when 444,540 homes were sold on an annualized basis, and down 8.2 percent from February 2021, when 462,720 homes were sold on an annualized basis.

The year-over-year sales decrease between February 2022 and February 2021 was the eighth straight decline and the smallest in seven months. Year-to-date statewide home sales were down 8.3 percent in February 2022.

The statewide annualized sales figure, collected from more than 90 local REALTOR® associations and MLSs statewide, represents what would be the total number of homes sold during 2022 if sales maintained the February pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

In San Diego, home sales in February 2022 were higher in a month-over-month comparison and lower in a year-over-year comparison. San Diego home sales in February 2022 were up 7.3 percent, compared to January 2022, but were down 5.6 percent lower compared to February 2021.

February 2022 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted).png?width=800&name=blog_211210_chart1%20(3).png)

Meanwhile, the California median home price was below the $800,000 benchmark for the fifth straight month, although home prices are continuing to increase from the prior year and pick up momentum.

The statewide median price inched up to $771,270 in February 2022, up 0.7 percent from $765,610 in January 2022, and up 10.3 percent from the $699,000 recorded in February 2021.

The stronger-than-expected growth in the statewide median price is attributed partly to a change in the mix of sales toward homes in the million-dollar price range, as sales jumped in higher-priced regions, including the Central Coast and the San Francisco Bay Area.

Prices are expected to edge higher as the market moves into the spring homebuying season over the next few months.

In San Diego, the median sales price for an existing, single-family detached home was $888,000 in February 2022, a 1.5 percent increase compared to the $875,000 price in January 2022. The February median price was 16.1 percent higher than a year ago at $765,000 in February 2021, marking an increase of $110,000 in one year.

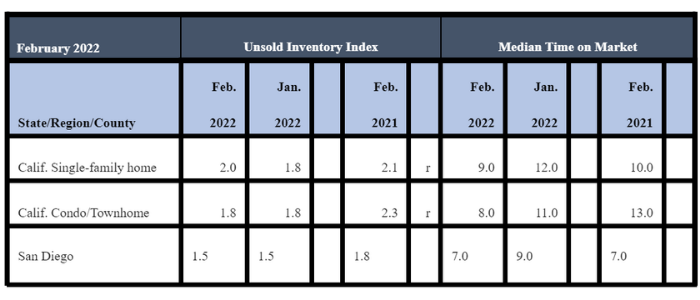

February 2022 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

“Despite higher mortgage rates, California’s housing market is holding up remarkably strong, with home prices reaccelerating, market competition growing, and signs that the listings crunch is thawing,” said C.A.R. President Otto Catrina, a Bay Area real estate broker, and REALTOR®. “Prospective buyers are taking advantage of still-low rates before they move higher and getting a jump on the competition before the start of the spring homebuying season.”

“While home sales declined from both the previous month and year, February’s sales pace was still the second-highest sales level for a February in the last 10 years and strong relative to pre-pandemic levels of 2018 and 2019,” said C.A.R. Vice President and Chief Economist Jordan Levine. “However, the invasion of Ukraine has created geopolitical headwinds and pushed up inflation a notch, which may keep mortgage rates elevated and cause the housing market to retreat amid the uncertainty.”

At an index of 67 in February, C.A.R.’s monthly Consumer Housing Sentiment Index dropped 2 points from last month as consumers acknowledged the current market challenges and felt increasingly pessimistic about home-buying opportunities. Consumers who thought it was a “good time to buy” dropped to 16 percent in February from 19 percent last month and from 28 points last year. Still, one in every four consumers is holding out hope that it will be easier to find a home in the next 12 months while nearly two in every three believe that home prices will rise over the same period of time.

Other key points from C.A.R.’s February 2022 resale housing report include:

-- At the regional level, all major regions except the Central Valley recorded a decrease in sales on a year-over-year basis, but lower-priced areas continued to fare better than higher-priced areas in the Golden State. The Central Coast region had the sharpest decline of all regions, with sales in February dropping 16.3 percent from a year ago. However, to put things into perspective, housing demand was abnormally strong early last year with sales in February 2021 surging 22.4 percent from the prior year. The San Francisco Bay Area and Southern California also experienced a double-digit or a near double-digit sales loss of 13.7 percent and 9.9 percent, respectively, in February 2022.

-- More than 70 percent of all counties tracked by C.A.R. experienced a dip in existing home sales from a year ago, with 24 counties declining more than 10 percent on a year-over-year basis.

-- Home prices continued to grow in all major regions in the state, with all five posting double-digit year-over-year gains in their median price. The San Francisco Bay Area recorded the highest year-over-year price gain at a 15.9 percent increase, followed by the Central Valley (14.8 percent), Southern California (12.6 percent), the Far North (11.9 percent), and the Central Coast (10.1 percent).

-- Despite slower price growth due to rising mortgage rates, home prices continued to increase across the state, with 24 California counties setting new record high median prices in February 2022.

-- California’s unsold inventory of homes index rose in February 2022 to its highest level in three months. The February 2022 figure was 2.0 months, compared to 1.8 months in January 2022, 1.2 months in December 2021, and 2.1 months in February 2021. The December 2021 figure of 1.2 months was the lowest level on record since CAR began tracking this figure in July 1988. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

-- In San Diego, the inventory of available homes for sales in February 2022 was at 1.5 months, the same figure in January 2022 and 1.8 months in February 2021. Inventory levels from previous months in 2021 included: December, 1.0; November, 1.3; October, 1.5; September, 1.6; August, 1.7; July, 1.7.

-- The median number of days it took to sell an existing, single-family home in San Diego County in February 2022 was 7 days, compared to 9 days in January 2022 and 7 days in February 2021. Numbers from previous months in 2021 included: December, 8; November, 9; October, 9; September, 9; August, 8; July, 7; June, 6; May, 7; April, 6. The median represents a time when half the homes sell above it and half below it.

-- Statewide, the median number of days it took to sell a California single-family home in February 2022 was 9 days, compared to 12 days in January 2022 and 10 days in February 2021. Numbers from previous months in 2021 included: December, 12; November, 11; October, 11; September, 10.

-- The statewide median sales-price-to-list-price ratio remained above 100 percent at 102.6 percent in February 2022 and 101.0 percent in February 2021. Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and sellers under current market conditions. The ratio, expressed as a percentage, is calculated by dividing the final sales price of a property by its last list price. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, while a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 3.76 percent in February, up from 2.81 percent in February 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 2.87 percent, compared to 2.83 percent in February 2021.