The lowest mortgage interest rates in five months helped boost California home sales for the third straight month in February 2023, even as home sales prices continue to slide lower, according to the latest home sales and price report from the California Association of REALTORS® (C.A.R.).

In San Diego, both home sales and home prices were higher in month-over-month comparisons between February and January 2023.

On a statewide basis, closed escrow sales of existing, single-family detached homes totaled a seasonally adjusted annualized rate of 284,010 in February 2023, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the February pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

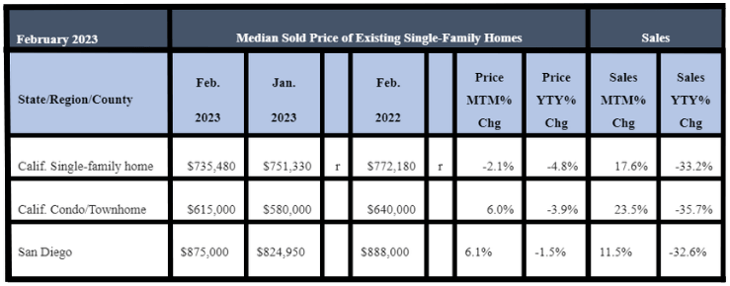

The statewide sales pace in February 2023 was up 17.6 percent on a monthly basis from 241,520 in January 2023 but down 33.2 percent from a year ago in February 2022, when a revised 425,120 homes were sold on an annualized basis.

Despite the third straight month of improvement, sales of existing single-family homes in February 2023 in California remained below the 300,000-unit pace for the fifth consecutive month.

Year-to-date statewide home sales were down 39.6 percent in February 2023.

California’s median home price retreated for the sixth straight month, declining 2.1 percent from the January 2023 median price of $751,330 to $735,480 in February 2023, the lowest price level in two years.

The February 2023 price also was lower on a year-over-year basis for the fourth consecutive month, declining 4.8 percent from the revised $772,180 recorded a year ago in February 2022.

The statewide median price for a typical home has declined 18.3 percent from May 2022, when it reached its recent peak of $900,170.

With home prices to remain soft throughout the rest of 2023, home shoppers can expect to see larger price drops moving through the spring home-buying season.

In San Diego, home sales increased month-over-month by 11.5 percent in February 2023, compared to January 2023. In a year-over-year comparison, between February 2023 and February 2022, home sales decreased by 32.6 percent.

February 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

The San Diego median sales price for an existing, single-family detached home increased in February 2023 to $875,000, compared to $824,950, a 6.1 percent difference. In a year-over-year comparison, the median price was $888,000 in February 2022, a difference of 1.5 percent. The median is the price at which half of the homes sell for more and half for less.

“A brief interest rate reprieve and softer home prices during January created a window of opportunity for homebuyers to dip their toes into the home-buying waters, which helped boost home sales to the highest level in five months,” said C.A.R. President Jennifer Branchini, a Bay Area REALTOR®. “A shift toward more home sales in the lower-price segments is expected to continue to further soften home prices. However, with the availability of homes remaining extremely tight and housing supply conditions not expected to improve any time soon, prices should find bottom later this year as interest rates stabilize.”

“The recent failure of a handful of tech-focused banks caused an unexpected drop in interest rates, which could offer an opportunity in the near term for homebuyers who have been waiting on the sidelines to lock in a lower rate,” said C.A.R. Vice President and Chief Economist Jordan Levine. “However, any decline in rates is not likely to be sustainable since inflation remains high, and the Federal Reserve is willing to take some calculated risks in order to keep inflation under control.”

Other key points from C.A.R.’s February 2023 resale housing report include:

-- At the regional level, all major regions recorded year-over-year sales declines. Southern California declined 33.8 percent.

-- At the regional level, median home prices dropped from a year ago in all major regions. Prices in Southern California declined by 2 percent.

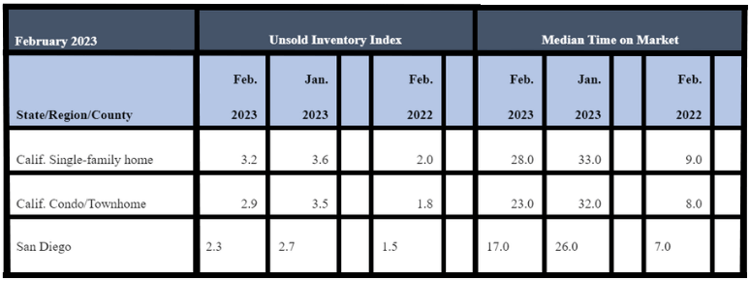

-- Housing inventory in California slipped to its lowest level in four months. The statewide unsold inventory was 3.2 months in February 2023 and 2.0 months in February 2022, a difference of 60 percent. The unsold inventory in January 2023 was 3.6 months.

-- In San Diego, in February, the inventory of available homes for sale was 2.3 months, compared to 2.7 months in January 2023 and 1.5 months in February 2022. Other inventory figures in San Diego in 2022 include 2.2 months in December 2022, 2.9 months in November 2022, 3.0 months in October, 2.7 months in September, 2.5 months in August, 3.1 months in July, 2.4 months in June, 1.9 months in May, 1.6 months in April and 1.4 months in March. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell out given the current rate of sales.

February 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- Unsold inventory in various home price ranges increased in February 2023 from a year ago by at least 30 percent or higher in the state. The sub-$500,000 range gained the most in unsold inventory (45.9 percent), followed by the $500,000-$750,000 range (42.3 percent), the $1 million and up (33.4 percent) and $750,000-$999,000 category (30.0 percent).

-- Weak housing demand continued to create carryover and elevate inventory on the surface, as 46 of the 51 counties tracked by C.A.R. registered an increase in active listings in February 2023 compared to February 2022.

-- The median number of days it took to sell a California single-family home was 28 days in February, compared to 33 days in January 2023 and 9 days in February 2022. Other statewide inventory figures for 2022 include 28 days in December, 24 days in November, 23 days in October, 22 days in September, and 19 days in August.

In San Diego, the median number of days it took to sell an existing, single-family home was 17 days in February 2023, compared to 26 days in January 2023 and 7 days in February 2022. Other inventory figures for 2022 in San Diego were 20 days in December, 18 days in both November and October, 19 days in September, 15 days in August, 10 days in July, eight days in June, and seven days in May and April. The median represents a time when half the homes sell above it and half below it.

-- Once again, the statewide, sales-price-to-list-price ratio remained at below 100 percent in February 2023 at 97.7 percent, compared to 96.5 percent in January 2023. A year ago, in February 2022, the ratio was 102.6 percent. Other 2022 statewide ratio percentage figures include 96.2 percent in December, 96.7 percent in November, 97.3 percent in October, 97.7 percent in September and 98.4 percent in August. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 6.26 percent in February 2023, up from 3.76 percent in February 2022, according to Freddie Mac.