California home sales edged up in January 2023 for the second straight month, while home prices continued to slide and interest rates took a breather, according to the latest home sales and price report from the California Association of REALTORS® (C.A.R.).

In San Diego, home sales and home prices were lower in January 2023 in monthly and yearly comparisons, said C.A.R.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 241,520 units in January 2023, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the January 2023 pace throughout the entire 2023 year. It is adjusted to account for seasonal factors that typically influence home sales.

The January 2023 sales pace was up 0.4 percent on a monthly basis from a revised 240,630 homes sold in December 2022, and down 45.7 percent compared to a year ago in January 2022, when a revised 444,400 homes were sold on an annualized basis.

January 2023 was the third straight month for home sales at below the 250,000-unit per month sales level.

California’s median home price receded in January 2023 to $751,330, down 3.0 percent from the $774,850 recorded in December 2022, which was the fifth straight monthly decline. The January 2023 home price figure also was lower on a year-over-year basis for the third consecutive month, declining 1.9 percent from the $766,250 recorded a year ago in January 2022.

In San Diego, home sales decreased month-over-month by 17.9 percent in January 2023, compared to December 2022. In a year-over-year comparison, between January 2023 and January 2022, home sales decreased by 35.1 percent.

January 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

-1.png?width=730&height=306&name=blog_220923_chart1%20(1)-1.png)

The San Diego median sales price for an existing, single-family detached home declined in January 2023 to $824,950, compared to $850,000 in December 2022, a 2.9 percent difference. In a year-over-year comparison, between January 2023 and January 2022, when the price was $875,000, the difference was a 5.7 percent decrease.

“Thanks to slightly waning interest rates and tempering home prices, California’s housing market kicked off the new year with another step up and continued to improve in January as buyers gained more confidence in purchasing a home and the affordability outlook improving slightly,” said C.A.R. President Jennifer Branchini, a Bay Area REALTOR®. “While the monthly sales gains have been nominal over the past two months, the market is moving in the right direction, and more gradual improvements could be coming in the months ahead as the market moves into the spring home-buying season in a few weeks.”

“Job layoffs in recent months, primarily in the tech sector, have contributed to a decline in both sales and prices in higher-priced housing markets, particularly in the San Francisco Bay Area,” said C.A.R. Vice President and Chief Economist Jordan Levine. “With home prices expected to remain soft and the mix of sales continuing to shift toward less expensive housing units throughout the rest of 2023, the market will see more downward price adjustments in the next few months.”

Other key points from C.A.R.’s January 2023 resale housing report include:

-- At the regional level, all major regions recorded year-over-year sales declines of more than one-third in January 2023. Southern California dropped 41.1 percent.

-- At the regional level, median home prices dropped from a year ago in all major regions in January 2023. Prices in Southern California declined by 0.2 percent.

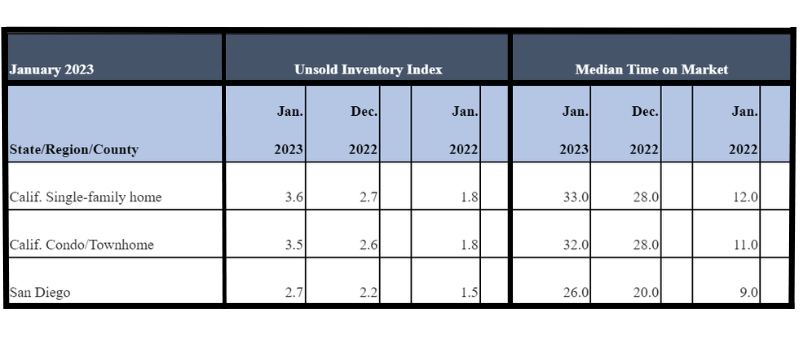

-- Housing inventory in California in January 2023 reached its highest level in 32 months. The January 2023 figure of 3.6 months was double the 1.8 months recorded in January 2022, the same month a year ago. The unsold inventory in December 2022 was at 2.7 months. The statewide January 2023 figure was at a level last seen in May 2020, during the government-mandated pandemic lockdown.

-- In San Diego, the inventory of available homes for sale in January 2023 increased to 2.7 months, compared to 2.2 months in December 2022 and 1.5 months a year ago in January 2022. Other inventory figures in San Diego in 2022 include 2.2 months in December 2022, 2.9 months in November 2022, 3.0 months in October, 2.7 months in September, 2.5 months in August, 3.1 months in July, 2.4 months in June, 1.9 months in May, 1.6 months in April and 1.4 months in March. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

January 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- Unsold inventory increased in January 2023, compared to a year ago in January 2022, by 88 percent or higher in all price ranges, with the $500,000-$749,000 price range gaining the most (112.5 percent), followed by the $1 million-and-up price tier (105.0 percent), the $750,000-$999,000 (100.0 percent) and the sub-$500,000 (88.9 percent).

-- Weak housing demand continued to create carryover and elevate inventory on the surface, as 48 of the 51 counties tracked by C.A.R. registered an increase in active listings in January 2023 compared to January 2022.

-- The median number of days it took to sell a California single-family home was 33 days in January 2023, compared to 28 days in December 2022 and 12 days in January 2022. Other statewide inventory figures for 2022 include 28 days in December, 24 days in November, 23 days in October 2022, 22 days in September 2022 and 19 days in August 2022.

-- In San Diego, the median number of days it took to sell an existing, single-family home was 26 days in January 2023, compared to 20 days in December 2022 and nine days a year ago in January 2022. Other inventory figures for 2022 in San Diego was 18 days in both November and October, 19 days in September, 15 days in August, 10 days in July, eight days in June and seven days in May and April. The median represents a time when half the homes sell above it and half below it.

-- Once again, the statewide, sales-price-to-list-price ratio remained at below 100 percent in January 2023 at 96.5 percent. A year ago, in January 2020, the ratio was 101.2 percent. Other 2022 statewide ratio percentage figures include 96.2 percent in December, 96.7 percent in November, 97.3 percent in October, 97.7 percent in September and 98.4 percent in August. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 6.27 percent in January 2023, up from 3.45 percent in January 2022, according to Freddie Mac.