Lower mortgage rates at the beginning of this year failed to spark home sales across San Diego County in January 2024, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

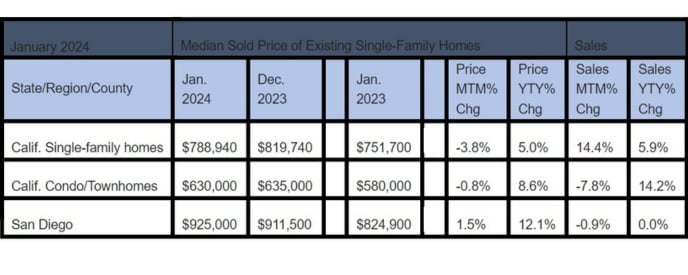

Sales of existing, single-family homes in San Diego County declined 0.9 percent in a month-over-month comparison between December 2023 and January 2024. In a year-over-year comparison between January 2024 and January 2023, the sales pace was unchanged, a difference of 0.0 percent.

In contrast, statewide home sales for January 2024 increased 14.4 percent in a month-over-month comparison and 5.9 percent year-over-year. It was the highest level for statewide existing home sales in six months.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 256,160 in January 2024, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

While the increase in January 2024 was the first year-over-year sales gain in 31 months, the sales pace stayed below the 300,000-unit threshold for the 16th straight month and will likely stay below that level in the first quarter of 2024. With interest rates moderating sharply at the end of 2023 and leveling off nearly 100 basis points below the most recent peak, home sales should continue to grow year-over-year in February, but the improvement will be modest.

Meanwhile, home prices continued to rise in San Diego County in January 2024. The median sales price of an existing, single-family detached home in San Diego County in January 2024 was $925,000, a 1.5 percent difference from December 2023, when the median price was $911,500. A year ago, in January 2023, the median home sales price was $824,900, a difference of 12.1 percent with January 2024.

January 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

However, in contrast, on a statewide basis, home prices declined in month-over-month and year-over-year comparisons. The median price of an existing, single-family home in California was $788,940 in January 2024, a 3.8 percent drop from the $819,740 figure in December 2023. A year ago, in January 2023, the statewide median home price was $751,700, a difference of 5.0 percent with January 2024.

It was the seventh straight month for annual price gains on a statewide basis. The monthly price decline was due primarily to seasonal factors, and the January figure marked the first time in ten months that the median price dropped below the $800,000 benchmark. With mortgage rates softening since mid-October, home prices will likely maintain their upward momentum, and the market should continue to observe a mid- to single-digit, year-over-year growth rate in California’s median price in at least the early part of 2024.

“It’s encouraging to see California’s housing market kick off the year with positive sales growth in January,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “While we’ll likely experience some ups and downs in home sales in the coming months as rates continue to fluctuate, the lending environment is expected to be more favorable in 2024, so the market should see more pent-up demand translate into sales.”

“The increase in new active listings for the first time in 19 months was great news for the California housing market,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “With rates climbing back up to a two-month high earlier this week due to the latest inflation concerns, potential home sellers could hit the pause button on listing their house on the market and wait until rates begin to ease again. In general, rates are expected to decline later this year, and available inventory should slowly improve throughout 2024.”

Other key points from C.A.R.’s January 2024 resale housing report include:

- Home sales in all major regions in the state rose in January 2024 on a year-over-year basis, including 2.2 percent in Southern California.

- At the regional level, home prices increased in January 2024 in all major regions from a year ago in January 2023, including 7.0 percent in Southern California

- Unsold inventory statewide index increased 28 percent on a month-over-month basis and declined by 8.6 percent from January 2023. The index, which measures the number of months needed to sell the supply of homes on the market at the current sales rate declined from 2.5 months in December 2023, to 3.2 months in January 2024. The index was 3.5 months in January 2023.

January 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- In San Diego County in January 2024, the inventory of available homes for sale was 2.6 months, compared to 2.2 months in December 2023, and 2.7 months a year ago in January 2023. Other unsold inventory figures on a monthly basis in 2023 for San Diego County included 2.5 months in November and September, 1.9 months in August, 2.0 months in July, 2.0 months in June, 1.7 months in May, 1.9 months in April, 1.7 months in March, 2.3 months in February and 2.7 months in January. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

- Existing active listings at the state level dipped again on a year-over-year basis for the 10th straight month in January 2024. However, the decline was small, a sign that active listings might be heading in the right direction as the market approaches the spring home-buying season. Still, the recent jump in mortgage rates the past couple of weeks could cause potential sellers to reconsider listing their homes for sale.

- New active listings at the state level increased from a year ago for the first time in 19 months, and the annual increase was the largest since May 2022. The jump in new active listings contributed to an improvement in overall active listings, and the sharp drop in rates at the end of 2023 was likely the motivating factor that convinced more homeowners to sell their homes.

- The median number of days it took to sell a California single-family home was 32 days in January 2024, 26 days in December 2023, and 39 days in January 2023.

- In San Diego, the median number of days it took to sell an existing, single-family home was 21.5 days in January 2024, compared to 18 days in December 2023, and 32 days in January 2023. Other median-time-on-the-market figures on a monthly basis for San Diego in 2023 include 15 days in November, 14 days in October and September, 13 days in August, 12 days in July, 11 days in June, 12 days in May and April, 15 days in March and 17 days in February. The median represents the time when half the homes sell above it and half below it.

- C.A.R.’s statewide sales-price-to-list-price ratio was 98.9 percent in January 2024, 99 percent in December 2023 and 96.5 percent in January 2023.The statewide, sales-price-to-list-price ratio on a monthly basis in 2023 was at 100 percent in November, October, September, August, July, June, May and April, 99.1 percent in March, 97.7 percent in February and 96.5 percent in January. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

- The 30-year, fixed-mortgage interest rate averaged 6.64 percent in January, up from 6.27 percent in January 2023, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.