Interest rates are still on the rise, along with the price of homes in San Diego County and statewide, according to the latest home sales and price report for July 2023 from the California Association of REALTORS® (C.A.R.).

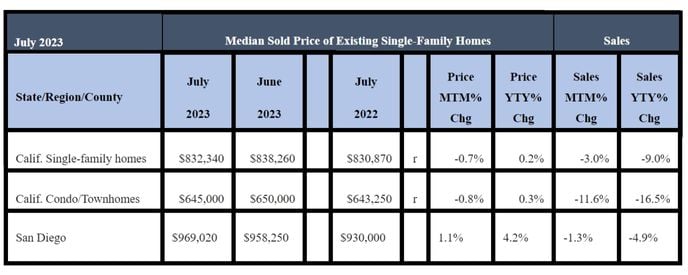

In San Diego, the median sales price for an existing, single-family detached home in July 2023 increased to $969,020, an increase of 1.1 percent from June 2023’s median price of $958,250. In a year-over-year comparison with July 2022, the median price was $930,000, an increase of 4.2 percent.

Statewide, the median home price exceeded $800,000 in July 2023 for the fourth straight month. It was the first year-over-year gain since October 2022, nine months ago.

July 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

The statewide median home price dipped 0.7 percent from June 2023’s $838,260 to $832,345 in July 2023, and it was up 0.2 percent from a revised $830,870 a year ago in July 2022.

As the housing market transitions into the off-peak homebuying season in the coming months, the statewide median price will likely soften as market competition cools. Home prices, nevertheless, should continue to improve from last year as tight housing supply conditions persist.

Meanwhile, higher interest rates are reducing the number of home sales. Year-to-date statewide home sales were down 30.3 percent in July 2023.

Sales of existing, single-family homes in San Diego in July 2023 declined by 1.3 percent in a month-over-month comparison with June 2023, while the figures was 4.9 percent lower in a year-over-year comparison with June 2022.

Statewide, the sales pace for existing, single-family homes in July 2023 was down 3.0 percent, compared to June 2023, and down by 9 percent from a year ago in July 2022.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 269,180 in July 2023, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the July pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

July 2023’s sales pace was down on a monthly basis from 277,490 in June 2023, and down 9.0 percent from a year ago in June 2022, when a revised 295,770 homes were sold on an annualized basis.

Sales of existing single-family homes in California remained below the 300,000-unit pace for the 10th consecutive month. The yearly drop was the smallest since April 2022 and marked the first time in more than a year that sales dropped by less than 10 percent from the previous year. However, the small decline was due partly to a lower sales base last July, when sales dropped below 300,000 for the first time in over two years.

“Despite slowing home sales in the past couple of months, housing demand remains resilient, and the market continues to be competitive,” said C.A.R. President Jennifer Branchini, a Bay Area REALTOR®. “Many in the market aspire to become homeowners and are actively looking to buy, but the shortage of homes for sale and elevated mortgage rates remain challenging headwinds for them.”

“Housing supply continued to be tight in California as rates remain well above levels observed in 2020-2021, when homeowners locked in their long-term mortgages,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “While home sales have been negatively impacted by the shortage of homes for sale during this year’s homebuying season, home prices continue to stabilize and have provided consumers with some confidence that market conditions are still solid. Interest rates should moderate later this year if inflation eases further, and home sales could see some improvement in the winter season.”

Other key points from C.A.R.’s July 2023 resale housing report include:

- At the regional level for Southern California, year-over-year sales declined in July 2023 by 14 percent.

- At the regional level for Southern California, median home prices in July 2023 increased from a year ago by 2.7 percent.

- Home prices across the state stabilized somewhat in July 2023, as fewer counties (27) posting year-over-year median price declines in July 2023, compared with 37 counties in June 2022.

- Housing inventory in California climbed month-over-month in July for the second straight month after inching up in June but continued to trail last year’s level as a lack of new listings remained the norm.

- The statewide unsold inventory in July 2023 increased 13.4 percent compared to June 2023, but dropped sharply by 19.4 percent on a year-over-year comparison with June 2022.

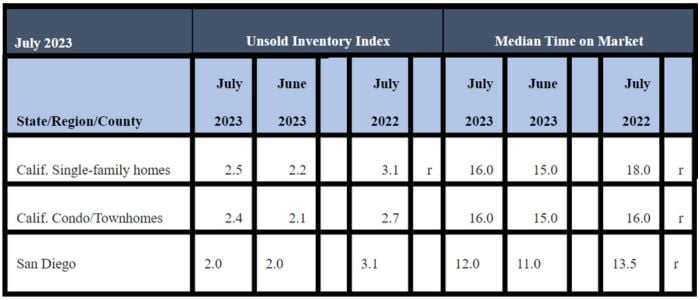

July 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- Active listings at the state level in July 2023 fell more than 30 percent from a year ago in July 2022. It was the largest annual decline since May 2021.

- With mortgage rates expected to remain high in August and September, the “lock-in effect” may prevent any meaningful improvement in supply conditions for the remainder of the third quarter, as homeowners are reluctant to sell their homes and buy something new due to the financial shock of trading their historically low mortgage rates for a higher interest rate with their new property.

- Unsold inventory declined in all price ranges in July 2023 in year-over-year comparisons from a year ago in July 2022. The mid-price segment of $750,000-$999,000 dipped the most by 25.8 percent in a year-over-year comparison. The $500,000-$749,000 price range, with a decrease of 20 percent, posted the second largest decline from last year, followed by the sub-$500,000 at 18.8 percent lower and the $1 million price segment at 16.1 percent lower.

- Statewide unsold inventory on a monthly basis was at 2.5 months in July 2023, compared to 2.2 months in June 2023 and 3.1 months in July 2022.

- In San Diego in July 2023, the inventory of available homes for sale was 2.0 months, which was the same figure for June 2023. In July 2022, the figure was 3.1 months. Other unsold inventory figures in 2023 in San Diego included 1.7 months in May, 1.9 months in April, 1.7 months in March, 2.3 months in February and 2.7 months in January. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

- Statewide, the median number of days it took to sell a California single-family home was 16 days in July 2023, compared to 15 days in June 2023, 17 days in May 2023, 20 days in April 2023 and 18 days a year ago in July 2022.

- In San Diego, the median number of days it took to sell an existing, single-family home was 12 days in July 2023, compared to 11 days in June 2023, 12 days in May 2023 and a revised 13.5 days a year ago in July 2022. Other median-time-on-the-market figures for San Diego in 2023 include 12 days in April, 15 days in March, 17 days in February and 26 days in January. The median represents a time when half the homes sell above it and half below it.

- The statewide, sales-price-to-list-price ratio this year was at 100 percent in July and June, May and April, 99.1 percent in March, 97.7 percent in February and 96.5 percent in January. A year ago, in July 2022, the ratio was 100.0 percent. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

- The 30-year, fixed-mortgage interest rate averaged 6.84 percent in July 2023, up from 5.41 percent in July 2022, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.