Despite an impressive performance in the first six months of the year, momentum appeared to be slowing for the California housing market with existing home sales in June dipping for the second month in a row.

According to the monthly home sales and price report from the California Association of REALTORS® (C.A.R.), home sales statewide on a seasonally adjusted annualized rate were 2.2 percent lower in June 2021, when 436,020 homes were sold, compared to May 2021, when 445,600 homes were sold. However, home sales increased 28.3 percent in June 2021, compared to June 2020, when 339,910 homes were sold on an annualized basis.

With strong sales growth in June, the state housing market ended the first half of the year with a year-to-date home sales increase of 33.6 percent.

Monthly numbers for closed escrow sales of existing, single-family detached homes in California is based on information collected from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

In San Diego, home sales in June 2021 were 16 percent higher compared to May 2021, and 29.2 percent higher than June 2020.

Meanwhile, home prices continued to increase in June 2021.

Statewide, the median price for a single-family detached home in June set a new record high for the fourth straight month. The median price increased slightly by 0.2 percent on a month-to-month basis to $819,630 in June 2021, up from $818,260 in May 2021, and 30.9 percent from the $626,170 price recorded in June 2020.

June 2021 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

The median price in California remained above the $800,000 benchmark for the third consecutive month. The median represents the point at which half of homes sell above a price, and the other half below it.

The pace of growth in home prices appeared to be decelerating, as the change between May and June remained below one percent, and the increase was the smallest in the past four months. On a month-to-month basis, the statewide median price increase in June 2021 was slightly below the average May-to-June growth rate of 1.0 percent observed between 1979 and 2020.

In San Diego, the median price for a single-family detached home in June 2021 reached a new record of $865,000, which was 1.6 percent higher than the May 2021 price of $851,000 and 27.6 percent higher compared to the June 2020 price of $678,000.

“We’re starting to see what a difference just a slight uptick in inventory and listings can do to help lessen the buying frenzy and create a sense of normalcy,” said C.A.R. President Dave Walsh. “The market is still extremely competitive, with 70 percent of homes selling above list price; however, the number of new listings increased in June, and both the share of listings with a reduced price and median reduction amount increased, giving buyers more opportunities to purchase.”

“On a year-over-year basis, the statewide median price increased more than 30 percent for the third consecutive month. Tight supply, low rates and the change in the mix of sales continue to be the primary factors pushing up home prices to record levels,” said C.A.R. Vice President and Chief Economist Jordan Levine. "However, we are expecting price growth to slow from this point on as the top end of the market begins moderating. With pending sales down for the first time in 14 months, closed sales – which have been declined 5 out of the last 6 months – will likely remain lackluster as the market enters the second half of the year.”

Other key points from C.A.R.’s June 2021 resale housing report included:

-- Home sales in June for four of the five major regions in the state set new record-high median prices in June, with each region increasing by more than 20 percent from a year ago. The San Francisco Bay Area continue to grow at the fastest pace with a year-over-year gain of 35.0 percent, followed by Southern California (30.3 percent), the Central Valley (23.8 percent), the Far North (22.0 percent) and the Central Coast (20.8 percent).

-- Sales growth statewide in the higher-priced markets remained strong in June 2021, while the number of sales of lower-priced properties remained below last year’s levels. The million-dollar market increased in demand by triple digits in a year-over-year comparison, with sales of homes priced $2 million and above surging 141 percent from a year ago. In contrast, sales of homes priced below $300,000 continued to fall precipitously with the year-over-year growth rate declining 48 percent in June. Tight housing supply continues to be the primary constraining factor for sales in the lower price segment. More homes were sold in the million-dollar market than the sub-$500k market in the 2021 second quarter of 2021, a condition that has not been observed in California in the past.

-- Active listings in California in June 2021 reached the highest level since last October 2020, signaling an improvement in the state’s housing supply condition. The number of for-sale properties increased 15.4 percent in June 2021, compared to May 2021, as more homes were being listed on the market. New active listings, while still down 12.3 percent from two years ago, increased in both a month-over-month basis and year-over-year basis by around 8 percent for June 2021. Housing supply typically climbs during this time of the year and remains on an upward trend throughout the late July-early August timeframe.

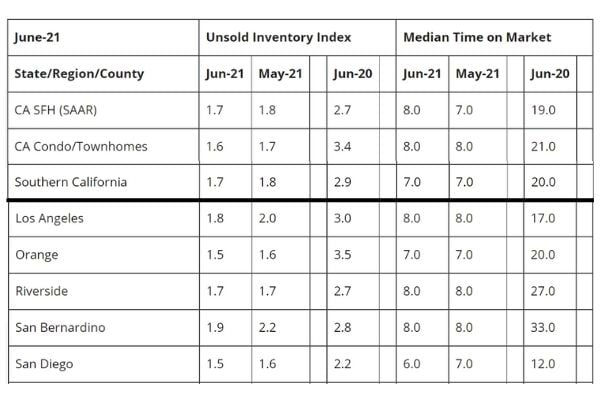

-- Statewide, the unsold inventory of available homes for sale decreased to 1.7 months in June 2021, compared to 1.8 months in May 2021, and below last year’s level of 2.7 months for June 2020. Inventory levels measured in months indicate the number it would take for the available supply of homes on the market to sell-out given the current rate of sales.

-- In San Diego County, the inventory of available homes for sales in June 2021 also decreased to 1.5 months, compared to 1.6 months in May 2021, and below last year’s level of 2.2 months in June 2020.

June 2021 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- The median number of days it took to sell a California single-family home was eight days in June 2021, compared to seven days in May 2021, which was the same number in April 2021, down from 21 days in June 2020. The eight-day figure compares to 10 days in February 2021, 11 days in January 2021, 11 days in December 2020, nine days in November 2020, 10 days in October 2020, 11 days in September 2020 and 15 days in March 2020. Prior to setting record low numbers this year, the previous statewide record was nine days in November 2020.

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was six days in June 2021. That number compares to seven days in May 2021, six days in April 2021 and March 2021 and seven days in February 2021 and January 2021, as well as eight days in December 2020 and seven days in November, October and September 2020. The timeframe a year ago in June 2020 was 12 days. The median represents a timeframe when half the homes sell above it and half below it.

-- The statewide sales-price-to-list-price radio posted a record high in June 2021 of 104.1 percent, compared to 99.5 percent in June 2020. Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 2.98 percent in June, down from 3.16 percent in June 2020, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 2.56 percent, compared to 3.09 percent in June 2020.