High mortgage rates continued to hamper home sales in San Diego County in June 2024, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

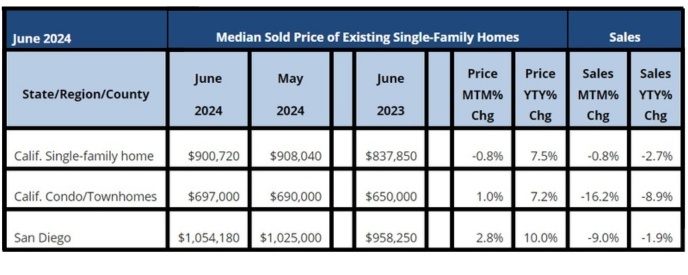

The sales pace for San Diego County home sales declined in June 2024 in both monthly and yearly comparisons. Sales of existing, single-family homes in June 2024 in San Diego County decreased 9% from May 2024, and 1.9% from June 2023.

Statewide, the sales pace in June 2024 decreased 0.8% from May 2024, and 2.7% from June 2023. Year-to-date statewide home sales edged lower by 0.5%. California home sales remained stagnant for the second consecutive month in June 202, as mortgage rates remained above 7% throughout most of May when escrows were opened for most of June’s sales.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 270,200 in June 2024, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

The sales pace has remained below the 300,000-threshold for 21 consecutive months, and year-to-date home sales have fallen behind last year’s level by -0.5 percent through the first half of this year.

“With interest rates coming down to the lowest levels since February and the availability of homes loosening up further in the last few months, the housing market is gearing up for another run in the second half of the year,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “We could see a pickup in market momentum at the start of the third quarter if rates decline in a more sustainable way in the coming weeks and buyers decide to take advantage of lower costs of borrowing.”

Meanwhile, the average price for an existing, single-family detached home in San Diego remained at more than $1 million in June 2024. It was the fourth consecutive month for the median price to exceed $1 million (March, $1,020,000; April, $1,047,500; May, $1,025,000; June $1,054.180).

June 2024 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

San Diego’s median sales price in June 2024 was $1,054,180, a 2.8% increase from the $1,025,000 posted in May 2024. A year ago, in June 2023, the median price for a San Diego home was $958,250, a difference of 10.0%.

Statewide, the median home price took a step back in June 2024. The California median price was $900,720 in June 2024, compared to $908,040 in May 2024, a difference of 0.8%, and $837,850 in June 2023, a difference of 7.5%.

Home prices will likely continue recording positive year-over-year gains in the second half of the year, though the pace of growth could moderate if the rest of the year follows the traditional seasonal pattern.

Sales of higher-priced homes are a contributing factor to California’s rising median home price, especially since homes priced at $1 million and above are selling faster than lower-priced homes.

In a year-over-year comparison between June 2024 and June 2023, the million-dollar-and-higher market segment rose 2.0%, while the sub-$500,000 segment declined by 21.0% in the same time period. Currently, sales of homes priced above $1 million now make up 36.3 percent of all sales, nearly the biggest share in at least the last five years. California easily boasts the most cities with million-dollar-priced homes, followed by New York and New Jersey.

“Home sales pulled back in June as interest rates remained volatile at the end of the second quarter. The average 30-year fixed rate mortgage began to decline since early July though and recently reached the lowest level in five months as the inflation cooling trend continued,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “While it will take a couple of more reports for the Federal Reserve to begin cutting rates, housing affordability for qualified buyers should begin to see some improvement in the coming months.”

Other key points from C.A.R.’s June 2024 resale housing report include:

- At the regional level, home sales in all major regions continued to be softer than year-ago levels, including -11.5% for Southern California.

- At the regional level, all major regions registered an increase in their median price from a year ago, including a gain of 7.4% for Southern California.

- The unsold inventory statewide index, which measures the number of months needed to sell the supply of homes on the market at the current sales rate, improved from both the prior month and year. The index was 3.0 months in June, up from 2.6 months in May and up 2.2 months in June 2023.

June 2024 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- The unsold inventory index of available existing homes for sale in June 2024 in San Diego County was 2.7 months. The figure was 2.0 months in June 2023. For previous 2024 months, the figures were 2.4 months in May, 2.2 months in April and March, 2.3 months in February and 2.6 months in January. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

- Active listings at the state level rose on a year-over year basis for the sixth consecutive month.

- The median number of days it took to sell a California single-family home was 18 days in June and 15 days in June 2023.

- In San Diego, the median number of days it took to sell an existing, single-family home was 14 days in June 2024. The figure was 11 days in June 2023. For previous 2024 months, the figures were 12 days in May, April and March.

- C.A.R.’s statewide sales-price-to-list-price ratio was 100.0 percent in June 2023 and 100.0 percent in June 2023. Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its original list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

- The statewide average price per square foot for an existing single-family home was $440, up from $412 in June a year ago. Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 53 counties.

- The 30-year, fixed-mortgage interest rate averaged 6.92 percent in June 2024, up from 6.71 percent in June 2023, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.