While California’s statewide housing market lost momentum in March after lower home sales, the sales pace did not slow down in San Diego County with a jump of more than 15 percent, plus a return to median home prices exceeding $1 million, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

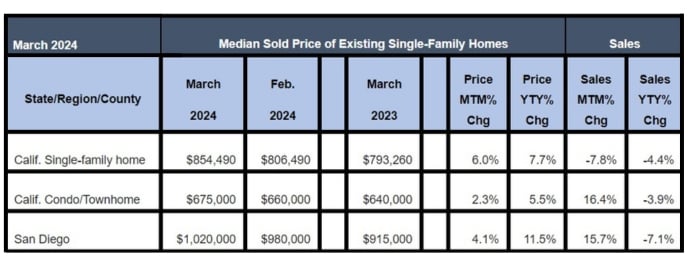

Statewide, the sales pace for existing, single-family homes fell 7.8 percent from February 2024 to March 2024, and a drop of 4.4 percent from March 2024 to March 2023. March was the first time in three months for statewide home sales to decline on a year-over-year basis.

Also, the statewide sales pace remained below the 300,000-threshold for the 18th consecutive month. On a year-to-date basis, California home sales still exceeded the level experienced in first-quarter 2023 by 0.7 percent, but the gain continued to shrink in March. Year-to-date statewide homes sales were up 0.7 percent.

In contrast, home sales in San Diego increased 15.7 percent in a month-over-month comparison between March 2024 and February 2024. However, in a year-over-year comparison between March 2024 and March 2023, the sales pace was lower, a decrease of 7.1 percent.

Similarly, San Diego home prices kept moving higher. The median sales price of an existing, single-family detached home in March 2024 was $1,020,000, a 4.1 percent difference from February 2024, when the median price was $980,000. A year ago, in March 2023, the median price for a San Diego home was $915,000, a difference of 11.5 percent with March 2024.

March 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

Home prices on a statewide basis also have been higher. The median price of an existing, single-family home in California was $854,490 in March 2024, compared to $806,490 in February 2024, and $793,260 in March 2023.

The year-over-year gain was the ninth straight month of annual price increases for the Golden State. March marked the 11th time in the last 12 months that the median price for an existing single-family home was above $800,000.

Sales of homes priced at or above $1 million dollars in California have been holding up better than their more affordable counterparts in the last few months.

The $1 million-and-higher market segment continued to grow year-over-year in March 2024 by a decent clip (9.9 percent), while the sub-$500,000 segment declined again modestly (-2.4 percent). The change in the mix of sales continued to provide upward support to the statewide median price and was partly responsible for the solid increase in year-over-year growth rate at the end of the first quarter.

“While home sales lost momentum in March, the housing market remains competitive as we’re seeing the statewide median home price reaching the highest level in seven months, and homes selling quicker than last year,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “On the supply side, the market continues to improve with an increasing number of properties being listed on the market as more sellers begin to accept the new normal.”

“With mortgage rates reaching the highest levels since mid-November 2023, the housing market struggled to build on the momentum exhibited in the first two months of this year,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. ”While sales could be hindered by higher rates in the coming weeks, the uptick in recent months suggests that we could see a bounce back in housing activity when the market digests the latest inflation report.”

Other key points from C.A.R.’s March 2024 resale housing report include:

- Home sales in most major regions of the state declined on a year-over-year basis in March 2024, including 7.8 percent in Southern California.

- At the regional level, all major regions registered an annual increase in their median price from a year ago, including a double-digit price gain of 11.1 percent in Southern California.

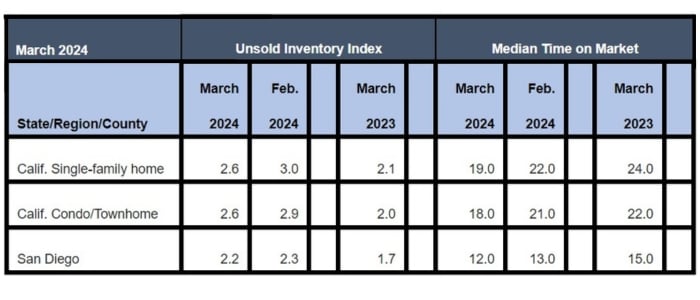

- Unsold inventory statewide decreased 13.3 percent in March 2024 on a month-over-month basis but increased from March 2023 by 23.8 percent. The index, which measures the number of months needed to sell the supply of homes on the market at the current sales rate, dipped from 3.0 months in February 2024 to 2.6 months in March 2023. The index was 2.1 months in March 2023.

March 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- Active listings at the state level in March 2024 increased on a year-over year basis for the second consecutive month, and the increase was the largest in 13 months. It’s an encouraging sign that housing supply could be heading in the right direction as the market enters the spring home-buying season. However, mortgage rates could reach a four-month-high in coming weeks and rates are expected to remain elevated longer than previously anticipated, which could delay some potential sellers in putting their house up on the market.

- New active listings at the state level increased from a year ago for the third consecutive month by double digits as more sellers listed their homes on the market ahead of the spring home-buying season. The jump in new housing supply, along with a modest slowdown in housing demand last month, contributed to an improvement in the overall active listings.

- The median number of days it took to sell a California single-family home was 19 days in March 2024, 22 days in February 2024, 32 days in January 2024 and 24 days in March 2023.

- In San Diego, the median number of days it took to sell an existing, single-family home was 12 days in March, 13 days in February 2024, 21 days in January 2024 and 15 days in March 2023. The median represents the time when half the homes sell above it and half below it.

- C.A.R.’s statewide sales-price-to-list-price ratio was 100 percent in March 2024 and February 2024, 98.9 percent in January 2024 and 99.1 percent in March 2023.

- The 30-year, fixed-mortgage interest rate averaged 6.82 percent in March, up from 6.54 percent in March 2023, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.