California’s housing market in May 2022 started showing signs of shifting to a more balanced market due to mortgage rates surpassing 5 percent for the first time since April 2010, leading to the lowest sales level since June 2020 and the largest year-over-year decline in five months.

The latest home sales and price report from the California Association of REALTORS® (C.A.R.) also showed San Diego County’s home sales dropping 13.9 percent in May 2022, compared to May 2021, and a 4.6 percent decline from April 2022.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 377,790 in May, according to information collected by C.A.R. from 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the May pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

Statewide, May 2022’s sales pace was down 9.8 percent on a monthly basis compared to 419,040 in April 2022 and down 15.2 percent from May 2021, when 445,660 homes were sold on an annualized basis. Home sales dipped below the 400,000 level for the first time since June 2020.

While public health concerns and market uncertainty were the triggering factors that resulted in the sales decline two years ago, tight supply and the higher cost of borrowing is believed to be responsible for the near double-digit decline this time around.

The statewide median home price in May 2022 set another record at $898,980, surpassing the record set in April 2022 of $884,890. The May 2022 price was 1.6 percent higher than the April 2022 median price and 9.9 percent higher than the $818,260 recorded last May 2021.

The higher prices can largely be attributed to the mix of sales with the high-end market, which continues to outperform the more affordable market segments. The share of million-dollar home sales in May 2022 increased for the fourth straight month and reached the highest level on record at 35.3 percent, while home sales priced below $500,000 dipped again in May 2022 and hit the lowest level of all time.

Home prices could be leveling off as the monthly gain in price appears to be moderating. The month-over-month increase of 1.6 percent for the May 2022 median home price was still higher but only slightly above the long run average of 1.1 percent recorded between April 2022 and May 2022 in the last 43 years.

The median price of a single-family home in San Diego declined a mere $5,000, or 0.5 percent, to $970,000 in May 2022 from $975,000 in April 2022. The May 2022 median price was still 14.0 percent higher from the year-ago price of $851,000 in May 2021, marking an increase of nearly $150,000 in one year. The median represents a price where half of the homes sell above and half below.

“We’re beginning to see signs of a more balanced housing market with fewer homes selling above list price and homes remaining on the market a little longer than in previous months,” said C.A.R. President Otto Catrina, a Bay Area real estate broker, and REALTOR®. “What this tells us is that there is slightly more supply, fewer- and less-intense bidding wars, and those who've experienced ‘buyers' fatigue’ may now have a window of opportunity.”

“Pending home sales declined 30.6 percent in May, the biggest drop since the first month of the pandemic, likely due to eroding affordability, rising mortgage rates and home prices, and the increased risk of a recession,” said C.A.R. Vice President and Chief Economist Jordan Levine. “The combined effect of the aforementioned factors resulted in a record increase in the average monthly mortgage payment to a typical home by more than 40 percent in May. With the Fed expected to raise rates further in the second half of the year, the 30-year fixed-rate mortgage could surge past 6 percent by year's end and lead to more affordability challenges for potential homebuyers.”

Other key points from C.A.R.’s May 2022 resale housing report included:

-- At the regional level, all major regions declined in sales from last year, with four of the five regions falling by double-digits on a year-over-year basis. Compared to the pre-pandemic average calculated using sales from May 2017, May 2018, and May 2019, the Southern California region’s sales were also down 19.8 percent in May 2022.

-- At the regional level, home prices in all major California regions increased in price from last year by more than 10 percent, with the Far North and Southern California setting new record medians in May. The Far North also had the highest year-over-year growth in price with a surge of 16.4 percent, followed by the Central Valley (12.4 percent), the San Francisco Bay Area (12.3 percent), Southern California (11.9 percent), and the Central Coast (10.6 percent).

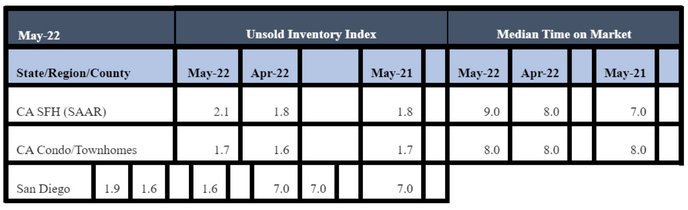

-- California’s unsold inventory of homes improved in May 2022 to 2.1 months, compared to 1.8 months in April 2022, 1.7 months in March 2022, and 1.8 months in May 2021.

-- With both closed sales and pending sales slowing by double-digits, total active listings experienced a gain of 46.7 percent in May 2022, the largest year-over-year growth in at least the last 89 months. Active listings in May 2022 also climbed to the highest level since July 2020 and had a month-to-month increase of 26.4 percent from April 2022.

May 2022 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted).png?width=750&name=blog_211210_chart1%20(1).png)

-- In San Diego, the inventory of available homes for sale in May 2022 was 1.9 months, compared to 1.6 months in April 2022, 1.4 months in March 2022 and 1.6 months in May 2021. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell out given the current rate of sales.

-- The median number of days it took to sell a California single-family home was 9 days in May 2022 and 7 days in May 2021.

May 2022 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- In San Diego, the median number of days it took to sell an existing, single-family home in May 2022 was 7 days, which was the same number in April 2022 and May 2021. The median represents a time when half the homes sell above it and half below it.

-- The statewide median sales-price-to-list-price ratio remained above 100 percent at 103.4 percent in May 2022, compared to 104.2 percent in April 2022, 103.3 percent in March 2022, and 103.8 percent in May 2021.

Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and sellers under current market conditions. The ratio, expressed as a percentage, is calculated by dividing the final sales price of a property by its last list price. A sales-to-list ratio of 100 percent or above suggests that the property sold for more than the list price, while a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 5.23 percent in May, up from 2.96 percent in May 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 4.06 percent, compared to 2.62 percent in May 2021.