A reprieve in mortgage interest rates helped the California housing market rebound in May 2023 with homes sales at an eight-month high, according to the latest home sales and price report from the California Association of REALTORS® (C.A.R.).

In San Diego during May 2023, both home sales and home prices were higher in month-over-month comparisons with April 2023.

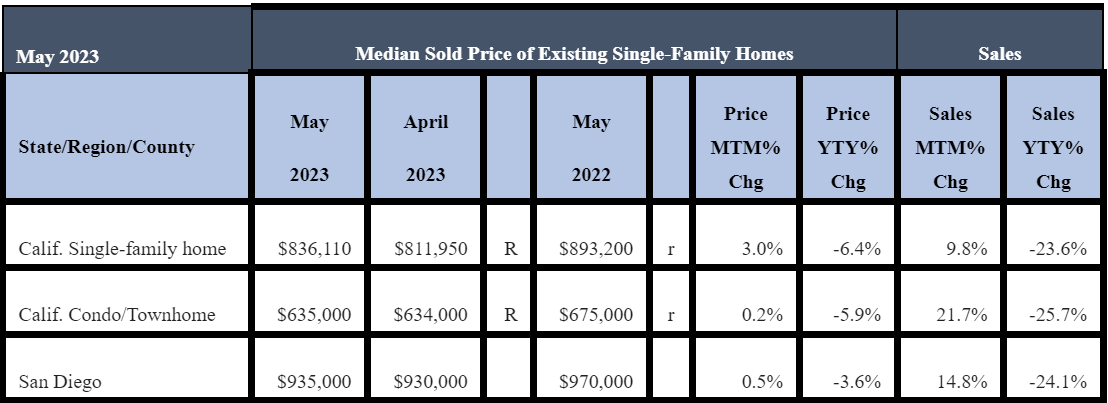

Sales of existing, single-family homes in San Diego County increased in May 2023 by 14.8 percent in a month-over-month comparison with April 2023, but the figure was 24.1 percent lower in a year-over-year comparison with May 2022.

Meanwhile, the median sales price for an existing, single-family detached home in San Diego County increased in May 2023 to $935,000, compared to $930,000 in April 2023, a 0.5 percent difference. In a year-over-year comparison, the median price was $970,000 in May 2022, a 3.6 percent difference.

May 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

Statewide, the sales pace for existing, single-family homes was up 9.8 percent in May 2023, compared to April 2023, and it as down 23.6 percent from May 2022.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 289,460 in May, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the May pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

May’s sales pace of 289,460 homes sold was up 9.8 percent on a monthly basis from 263,650 home sold in April 2023 and down 23.6 percent from a year ago in May 2022, when a revised 378,640 homes were sold on an annualized basis.

Sales of existing single-family homes in California remained below the 300,000-unit pace for the eighth consecutive month.

Year-to-date statewide homes sales were down 35.1 percent in May 2023.

Also statewide, the median home price in May 2023 increased by 3.0 percent to $836,110, compared to $811,950 in April 2023. It was the second straight month for the statewide median home price to exceed $800,000. In a year-over-year comparison, the statewide median home price was down 6.4 percent from $893,200 in May 2022.

The statewide median price continued to rise and reached the highest level in nine months. Tight housing supply and more high-end homes being sold relative to prior months continued to put upward pressure on prices.

“The bounceback in May’s home sales and price shows the resilience of California’s housing market and is a testament to the value that consumers place on homeownership,” said C.A.R. President Jennifer Branchini, a Bay Area REALTOR®. “The housing market is stabilizing and even showing signs of improvement as competition is on the rise again; nearly half of homes are selling above asking price, fewer sellers are reducing listing prices, and homes for sale are going into pending status in just two weeks compared to more than 30 days early this year.”

“While home sales rose solidly in May, we don’t expect to see a rapid recovery because of the lock-in effect that’s keeping prospective sellers with low interest rate mortgages from listing their homes on the market and keeping inventory extremely tight.” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “Consequently, we expect prices to continue to rise on a month-to-month basis for the next few months because of the shortage of homes for sale. Even with reduced homebuyer demand, California still has more homebuyers than homes to put them in. It is this imbalance between supply and demand that continues to put upward pressure on home prices and nudge the median price up month over month since the beginning of the year.”

Other key points from C.A.R.’s May 2023 resale housing report include:

-- At the regional level, all major regions recorded year-over-year sales declines in May 2023. Southern California declined 22.3 percent from May 2022.

-- At the regional level, median home prices dropped from a year ago in all major regions. Southern California home prices declined by 5.3 percent in May 2023.

-- Despite mortgage rates rising sharply since mid-May and peaking at their highest point in six months, the number of pending sales recorded in May remained steady and only dipped slightly by less than 2 percent from the prior month. The consistent level of open-escrow sales suggests that the California housing market will register closed sales in June at around 275,000, a similar level between what was recorded in April and May.

-- Housing inventory in California dipped in May after a brief bounce-back in April, as sales improved while supply remained tight. The statewide unsold inventory index in May 2023 was flat from last year and declined 16 percent on a month-over-month basis. Assuming a softer sales level in June 2023, the market could see a minor inventory improvement in the upcoming month, but the upward adjustment would be due to a change in demand.

May 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- Housing inventory increased in all price ranges in May 2023, compared with May 2022. In year-over-year comparisons, the unsold inventory index recorded a gain of 21.1 percent in the $1 million-and-higher price sector and remained flat in the $500,000-$749,000 price range (zero percent). Lower inventory levels dipped year-over-year in the $750,000-$999,000 sector (-9.1 percent) and the sub-$500,000 sector (-4.3 percent).

-- The statewide unsold inventory index on a monthly basis declined to 2.1 months for May 2023, compared to 2.5 months for April 2023 and 2.1 months for May 2022.

-- In San Diego, in May 2023, the inventory of available homes for sale was 1.7 months, compared to 1.9 months in April 2023, 1.7 months in March 2023, 2.3 months in February 2023, 2.7 months in January 2023 and 1.9 months in May 2022. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

-- Statewide, the median number of days it took to sell a California single-family home was 17 days in May 2023, 20 days in April 2023 and 11 days in May 2022.

-- In San Diego, the median number of days it took to sell an existing, single-family home was 12 days in May 2023, compared to 12 days in April 2023, 15 days in March 2023 and eight days in May 2022. Other median-time-on-the-market figures in San Diego in 2023 include 17 days in February and 26 days in January. The median represents a time when half the homes sell above it and half below it.

-- The statewide, sales-price-to-list-price ratio was at 100 percent in May 2023, 100 percent in April 2023, 99.1 percent in March 2023, 97.7 percent in February 2023 and 96.5 percent in January 2023. A year ago, in May 2022, the ratio was 103.4 percent. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 6.43 percent in May, up from 5.23 percent in May 2022, according to Freddie Mac.