Home prices and home sales in San Diego County are continuing to surge, despite mortgage interest rates at the highest levels in five months, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

Home prices and home sales in San Diego County are continuing to surge, despite mortgage interest rates at the highest levels in five months, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

Sales of existing, single-family homes in San Diego County increased 6.2% from April 2024 to May 2024. In a year-over-year comparison, between May 2024 and May 2023, the sales pace was 0.7% higher.

Also, the average existing, single-family detached home in San Diego is selling for more than $1 million. The median sales price in May 2024 was $1,025,000, a small 2.1% decline from $1,047,500 in April 2024. A year ago, in May 2023, the median price for a San Diego home was $935,000, a difference of 9.6% with May 2024.

Statewide, the May 2024 real estate market was a slightly different story.

Higher mortgage rates hampered California home sales, both on a monthly and an annual basis. In addition, the statewide median home price exceeded $900,000 for the second straight month to set another record-high.

May 2024 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 272,410 in May 2024, according to information collected from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the May pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

May 2024’s sales pace dipped 1.1 percent from the revised 275,540 homes sold in April 2024, and were down 6.0 percent from a year ago in May 2023, when a revised 289,860 homes were sold on an annualized basis. The sales pace remained below the 300,000-threshold for the 20th consecutive month and year-to-date home sales were flat.

“California home sales stalled in May as mortgage rates reached the highest level in five months and may have contributed to the slowdown in market activity,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “However, a moderation in interest rates in the past couple of weeks and recent improvements in housing inventory could create an opportunity for motivated buyers to reenter the market before the homebuying season peaks.”

The statewide median price set another record high in May 2024, edging up 8.7 percent from $835,280 in May 2023 to $908,040 in May 2024, exceeding the $900,000-benchmark for the second month in a row.

California’s median home price was 0.4 percent higher than April 2024’s $904,210. The year-over-year gain was the 11th straight month of annual price increases for the Golden State. CAR said seasonal factors and tight housing supply conditions are expected to put upward pressure on home prices in the coming months.

Stronger sales of higher-priced properties continued to contribute to solid median price growth in May 2024, especially since million-dollar home sales in California have been rising more rapidly than their more affordable counterparts in the state. Sales in the million-dollar-and-higher market segment rose 15.5 percent year-over-year in May 2024, while sales in the sub-$500,000 segment declined by 12.2 percent. Sales of homes priced above a $1 million now make up 36.6 percent of all sales, the biggest share in the last five years.

California easily boasts the most million-dollar cities where the median home price is above $1 million. New York and New Jersey follow behind California.

California is home to 210 million-dollar cities, more than the next five states combined, and 12 more than a year ago. In San Diego County, 10 cities or communities with typical home values above $1 million include Rancho Santa Fe, Del Mar, Coronado, Solana Beach, Encinitas, Carlsbad, Poway, Bonita, Pala and Bonsall.

“A persistent shortage of homes for sale, particularly in the more affordable market segments, continued to push up California’s median home price to new record highs over the past couple of months,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “With mortgage rates coming back down from their recent peaks and market competition heating up, the statewide median price may have more room to grow before the summer ends."

Other key points from C.A.R.’s May 2024 resale housing report include:

- At the regional level, home sales in all major regions continued to soften when compared to their year-ago levels, including -1.0% for Southern California.

- At the regional level, all major regions registered an increase in their median price from a year ago, including a double-digit price gain of 10.0% for Southern California.

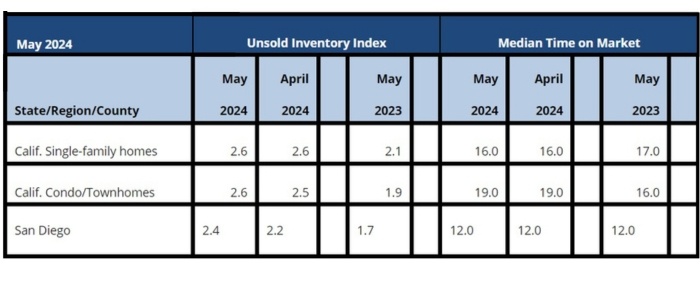

- The unsold inventory statewide index, which measures the number of months needed to sell the supply of homes on the market at the current sales rate, remained flat at 2.6 months in May 2024, the same number for April and March 2024. In May 2023, the index was 2.1 months.

May 2024 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- The unsold inventory index of available existing homes for sale in May 2024 in San Diego County was 2.4 months. The figure was 1.7 months in May 2023. For previous 2024 months, the figures were 2.2 months in April and March, 2.3 months in February and 2.6 months in January. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

- Active listings at the state level rose on a year-over year basis for the fourth straight month, and the increase was the largest in 15 months.

With recent economic reports showing some promising signs that inflation could be cooling in a more sustainable fashion for the rest of the year, mortgage rates may moderate in the coming months as the daily fluctuations in yields continue. Further improvement on the supply side could be observed in the California housing market before the end of the home buying season.

- The median number of days it took to sell a California single-family home was 16 days in May 2024 and April 2024, and 17 days in May 2023.

In San Diego, the median number of days it took to sell an existing, single-family home was 12 days in May 2024, a figure that was identical to April and March 2024 and May 2023. - C.A.R.’s statewide sales-price-to-list-price ratio was 100% in May 2024, a figure that was identical to April, March and February 2024, as well as May 2023.

- The 30-year, fixed-mortgage interest rate averaged 7.06 percent in May, up from 6.43 percent in May 2023, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.