California’s housing market remained red hot in November 2020 with statewide home sales reaching the highest level in 15 years. Record-low mortgage rates and flexibility to work from home has driven home-buying interest to levels not seen since the last decade, according to the California Association of REALTORS® (C.A.R.).

November 2020’s statewide sales total broke the 500,000-units benchmark for the first time since January 2009.

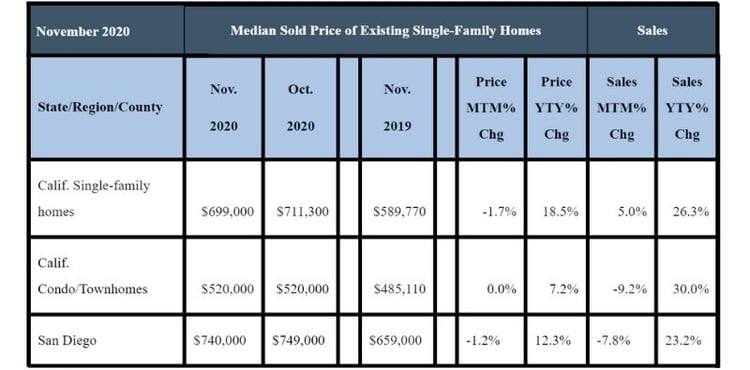

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 508,820 for November 2020. It was an increase of 5 percent from 484,510 homes in October, and 26.3 percent higher from November 2019, when 402,880 homes were sold.

The year-over-year, double-digit home sales gain recorded in November was the fourth consecutive month and the largest increase over a year’s time since May 2009.

Meanwhile, California’s median home price for November 2020 dipped slightly after breaking the $700,000 benchmark over the past three months. The statewide median price dropped to $699,000 in November 2020, down 1.7 percent from $711,300 in October 2020.

However, home prices continued to gain on a year-over-year basis with the statewide median price surging 18.5 percent from $589,770 recorded in November 2019. The double-digit increase from 2019 was the fourth month in a row and the highest 12-month gain since February 2014. The gain was also higher than the six-month average of 9.7 percent observed between May 2020 and October 2020.

November 2020 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

In San Diego County, November 2020 home sales decreased 7.8 percent, compared to October 2020, but increased 23.2 percent higher than in November 2019.

Similarly, the median home price for a single-family home in San Diego County dropped slightly in November 2020 to $740,000, a 1.2 percent decrease from October 2020’s figure of $749,000, but a 12.3 percent increase from November 2019’s figure of $659,000.

“Home-buying interest is at levels that we have not seen for years, setting the stage for a stronger-than-expected comeback that fully recovered all the sales that the market lost in the first half of the year due to the pandemic,” said 2021 C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. “Housing supply remains an issue, however, as we will likely to see a shortage of homes for sale in the near term, which will put upward pressure on prices and dampen affordability for those who haven’t been able to take advantage of low rates.”

“California’s housing market continues to be the bright spot in the economy, but the direction and pace of the recovery will hinge on the coronavirus pandemic and the distribution of the vaccine in the coming months,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The rise in COVID-19 cases and tighter constraints on economic activity recently imposed will likely have implications for the housing market as renters and homeowners face adverse impacts to their incomes, which is why Congress should pass additional relief for renters, homeowners, and workers as soon as possible.”

Perhaps due to rising cases of the Coronavirus, fewer consumers said it is a good time to sell in December, according to C.A.R.’s monthly Consumer Housing Sentiment Index. Conducted in earlier this month, the poll found that 55 percent of consumers said it is a good time to sell, down from 59 percent a month ago, but up from 51 percent a year ago. Meanwhile, low interest rates continue to fuel the optimism for homebuying; just over one-fourth (27 percent) of the consumers who responded to the poll believed that now is a good time to buy a home, up from last year, when 24 percent said it was a good time to buy a home.

Even with low inventory levels, the coronavirus pandemic has increased the demand for spacious, multi-functional homes as more homeowner families are dealing with homebound distance learning for school and working remotely for the job.

Other key points from C.A.R.’s November 2020 resale housing report included:

-- Home sales from a regional perspective continued to increase in November 2020 by double-digits in year-over-year comparisons for most California regions. The San Francisco Bay Area had the highest gain of 34.4 percent over last year, followed by the Central Coast (33.4 percent), Southern California (19.1 percent) and the Central Valley (18.3 percent).

-- Median home prices from a regional perspective also posted double-digit increases in November 2020 in year-over-year comparisons. The San Francisco Bay Area median price remained at its record high in November, rising 18.9 percent from last year. The Central Coast region had the second largest median price increase at 18.7 percent, followed by the Central Valley (17.6 percent), Southern California (14.4 percent), and the Far North (13.6 percent).

-- With a resurgence in Covid-19 cases in recent weeks and the market entering the traditional holiday season, active listings declined from the prior month as expected, contributing to a substantial decline in inventory. Active listings fell 46.6 percent from last year and continued to drop more than 40 percent on a year-over-year basis for the sixth straight month.

-- The unsold inventory of available homes for sale fell sharply from 3.1 months in November 2019 to 1.9 months in November 2020. Statewide inventory in October 2020 was 2.0 months. Inventory levels measured in months refers to the number it would take for the current supply of available homes on the market to sell-out given the current rate of sales.

November 2020 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- In San Diego County, the inventory of available homes for sale in November 2020 was 1.6 months, compared to 1.8 months in October 2020 and 2.7 months in November 2019.

-- Active listings in all major California regions continued to decline in November 2020 in year-over-year comparisons. The Central Valley had the biggest year-over-year drop of 53.3 percent in November, followed by Southern California (49.0 percent), Central Coast (-46.3 percent), Far North (-40.1 percent), and the San Francisco Bay Area (-18.7 percent).

-- The median number of days it took to sell a California single-family home was nine days in November 2020, compared to 10 days in October 2020, 11 days in September 2020 and 25 days in November 2019. The nine-day November 2020 figure was the lowest ever recorded.

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was seven days in November 2020, which was the same number in October 2020 and September 2020. The timeframe a year ago in November 2019 was 17 days. The November 2020 seven-day figure compares to eight days in August 2020, 10 days in July 2020, 12 days in June 2020, 11 days in May 2020, eight days in April 2020, 10 days in March 2020, 12 days in February 2020 and 23 days in January 2020.

-- The housing market in California’s mountain resort areas has generally outperformed the state during 2020’s first 11 months due to increased demand in second homes and vacation homes, as available supply continues to decline. In a comparison of home sales between November 2020 and November 2019, Mammoth Lakes saw a 400 percent increase, followed by South Lake Tahoe (81.4 percent), Big Bear (73.9 percent) and Lake Arrowhead (58.1 percent). Similarly, median home prices jumped in Big Bear by 40.8 percent from last year, followed by South Lake Tahoe (39.6 percent) and Lake Arrowhead (32.0 percent). In contrast, home prices declined by 2.5 percent Mammoth Lakes in November 2020, compared to 2019.

-- The 30-year, fixed-mortgage interest rate averaged 2.77 percent in November, down from 3.70 percent in November 2019, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 3.0 percent, compared to 3.41 percent in November 2019.

In other recent real estate and economic news, according to news reports:

-- The average rate for a 30-year, fixed-rate mortgage continued to plummet, dropping to 2.67 percent in the second week of December. It was the lowest rate since Freddie Mac began tracking the data in 1971. A year ago at this time, it averaged 3.73 percent.

-- Mortgage applications increased 1.1 percent for the week ending Dec. 11, according to the Mortgage Bankers Association’s week-over-week comparison report. Refinance applications also increased 1 percent during the same week and 105 percent in a year-over-year comparison.

-- CoreLogic said San Diego County median home price in November remained unchanged from October and September at $650,000, which is 9.3 percent higher than a year ago. It was the second consecutive time for no monthly price increase since May. The price represents all homes, including single-family, condos and townhomes.

-- A group of top real estate economists speaking at a forecast forum hosted by the National Association of Real Estate Editors recently predicted that home prices will continue to rise in 2021 fueled by low mortgage interest rates and lack of homes for sale.

-- Californians are pessimistic about their economic future with 73 percent of survey respondents in San Diego and Orange counties anticipating bad financial times during the next 12 months, according to a report released in early December by the Public Policy Institute of California. The survey of 2,325 Californians conducted after the November election showed the statewide average of pessimism at 68 percent.

-- Realtor.com is predicting prices for existing single-family homes will continue to climb in 2021, making affordability a continued problem. San Diego is projected for an 11.3 percent year-over-year increase in existing home sales and a 5.5 percent rise in home prices. Realtor.com also expects mortgage rates to climb from 3 percent at the beginning of 2021 to 3.4 percent by year’s end. Realtor.com admits there are numerous wildcards that could shake up the housing market, including what happens with Covid-19 vaccines or more government-imposed shutdowns.

-- Rental applications in San Diego County were lower by about 7 percent for the third quarter in a year-over-year comparison as many grown children moved back in with their parents, or doubled up in apartments to make their dollars go further, according to the data firm Rent Café. The report said in 18 of the 30 largest U.S. cities, including San Diego, more renters left than moved into rental properties. The firm also said apartment rents decreased in 2020 in the nation’s top 10 most expensive cities.