Rapidly rising mortgage rates slowed home sales in September 2022 and continued the month-to-month declining trend that began in the spring, according to the latest home sales and price report from the California Association of REALTORS® (C.A.R.).

The question up for debate: How low will prices go while mortgage rates soar and demand wanes? Volatile mortgage rates, along with economic uneasiness and inflation, may prompt house hunters to rethink what they’re willing to pay here in the fall.

With mortgage rates rising and the average 30-year fixed-rate mortgage approaching 7 percent, home prices and sales are expected to continue dropping in the coming months as affordability remains a challenge.

The continuing price drop is a reversal from the pandemic era’s price boom. And keep in mind, the statewide median price is still up 42 percent from February 2020, which was the last month before COVID-19 upended the economy.

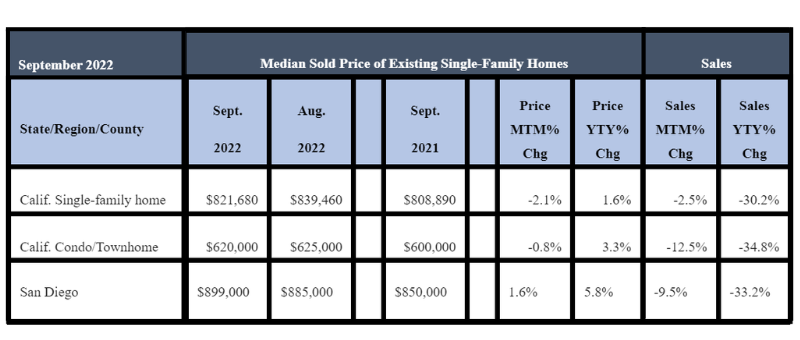

The September 2022 sales pace was down 2.5 percent on a monthly basis from 313,540 in August 2022 and down 30.2 percent from September 2021, when 438,190 homes were sold on an annualized basis.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 305,680 in September 2022, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the September 2022 pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

Home sales have dipped for 15 straight months on a year-over-year basis. September 2022 was the second time in the last three months that sales have exceeded 30 percent from a year ago.

The monthly 2.5 percent sales decrease was worse than the long-run average of zero percent change recorded between an August and a September in the past 43 years.

September statewide sales in all price segments continued to drop by 25 percent or more year-over-year, with the sub-$300k price range falling the most at 36.7 percent. Sales of million-dollar homes fell by double-digits again for the fourth consecutive month, with the high-end market segment dipping 25.6 percent from the same month last year.

In San Diego County, home sales dropped 33.2 percent in September 2022, compared to a year ago in September 2021, and 9.5 percent lower in a month-over-month comparison with August 2022.

Statewide, the median single-family home price fell to $821,680 in September 2022, off 2.1 percent from the $839,460 price in August 2022, up 1.6 percent from the $808,890 price in September 2021, and down 8.7 percent from the $900,000 all-time high set in May 2022.

The statewide median home price continued to increase on a year-over-year basis in September, but the growth rate remained very mild compared to those observed earlier this year.

At an increase of 1.6 percent year-over-year, September 2022 marked the fourth consecutive month with a single-digit annual increase. The less-than-2-percent growth rate in the statewide median price was much lower than the 6-month average growth rate of 6.7 percent recorded between March 2022 and August 2022.

The 2.1 percent, the month-to-month decline in September 2022 was slightly lower than the long-run average of 1.8 percent decrease recorded between an August and a September over the past 43 years.

Locally, the median sales price for an existing, single-family detached home in San Diego County increased 1.6 percent to $899,000 in September 2022, compared to $885,000 in August 2021. The September 2022 median price was 5.8 percent higher than the year-ago price of $850,000 in September 2021. The median is the price at which half of the homes sell for more and half for less.

“With interest rates rising rapidly since the beginning of the year, buyers and sellers are having difficulties adapting to the market’s new normal,” said C.A.R. President Otto Catrina, a Bay Area real estate broker and REALTOR®. “As the market continues to evolve in the next 12-to-18 months, REALTORS® will be playing an ever-more important role as trusted advisors to guide their clients through the complicated buying and selling process and help them overcome their obstacles during these challenging times.”

“September’s sales and price declines reaffirm our forecast for next year,” said C.A.R. Vice President and Chief Economist Jordan Levine. “High inflationary pressures will keep mortgage rates elevated, which will reduce homebuyers’ purchasing power and depress housing affordability in the upcoming year. With borrowing costs remaining high in the next 12 months, a pull-back in sales and a downward adjustment in home prices are expected in 2023.”

Other key points from C.A.R.’s September 2022 resale housing report include:

-- At the regional level, sales continued to fall sharply from last year, with four of the five major regions falling more than 25 percent from last year. Southern California had the biggest annual drop in sales at 32.6 percent, as every county within the region experienced a sales decline of more than 30 percent in September 2022.

-- All but three counties tracked by C.A.R. posted sales drops from a year ago. Of the counties that recorded sales drops from last September 2021, 45 of them fell more than 10 percent, and 36 counties plunged more than 20 percent from the same month last year.

-- Nearly two-thirds of all California counties experienced an increase in their median prices. Prices were up from last year by double-digits in five counties in September 2022, as compared to seven counties in the prior month.

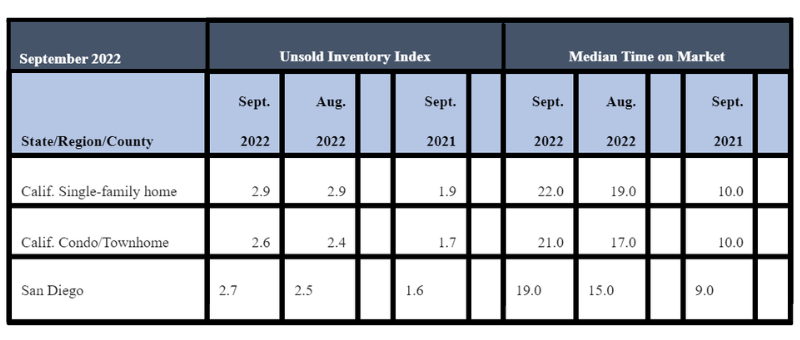

-- Housing supply in California improved from a year ago and was unchanged in September 2022, compared to August 2022, despite a decline in housing demand. The statewide unsold inventory index was 2.9 months in both September 2022 and August 2022, while the figure was 1.9 months in September 2021.

-- In San Diego, the inventory of available homes for sale increased to 2.7 months in September 2022, compared to 2.5 months in August 2022, and 1.6 months a year ago in September 2021. Other inventory figures in 2022 include 3.1 months in July, 2.4 months in June, 1.9 months in May, 1.6 months in April, and 1.4 months in March. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell out given the current rate of sales.

-- With closed sales dropping more than 25 percent and pending sales falling more than 40 percent, active listings have been staying on the market significantly longer, which contributed to a surge in for-sale properties by 51.5 percent in September 2022.

September 2022 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

-- The median number of days it took to sell a California single-family home was 22 days in September 2022, 19 days in August 2022, and 10 days a year ago in September 2021.

-- In San Diego, the median number of days it took to sell an existing, single-family home was 19 days in September 2022, compared to 15 days in August 2022, 10 days in July 2022, 8 days in June 2022 and 7 days in May 2022 and April 2022. A year ago, in September 2021, the figure was 9 days. The median represents a time when half the homes sell above it and half below it.

September 2022 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- The statewide, sales-price-to-list-price ratio was 97.7 percent in September 2022, similar to 98.4 percent in August 2022, which was below 100 percent for the second time since June 2022. The statewide sales-price-to-list-price ratio was 101.9 percent in September 2021 and 102.8 percent in August 2021. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio of 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

-- The 30-year, fixed-mortgage interest rate averaged 6.11 percent in September, up from 2.90 percent in September 2021, according to Freddie Mac. The five-year, adjustable mortgage interest rate averaged 4.87 percent, compared to 2.45 percent in September 2021.