Persistently high mortgage rates are causing fewer home sales and lower home selling prices in the California housing market, according to the latest home sales and price report from the California Association of Realtors (C.A.R.).

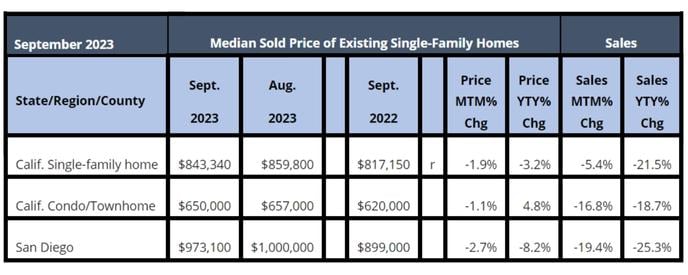

In San Diego, sales of existing, single-family homes in September 2023 declined 19.4 percent in a month-over-month comparison with August 2023, while the decline was 25.3 percent in a year-over-year comparison with September 2022.

Statewide, the sales pace for existing, single-family homes in September 2023 was down 5.4 percent with 254,740 units sold in August 2023, and down 21.5 percent compared to September 2022, when 307,000 homes were sold on an annualized basis. Statewide year-to-date home sales were down 28.5 percent in September 2023.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 240,940 in September, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2023 if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

Sales of existing single-family homes in California remained below the 300,000-unit pace for the 12th month in a row. It was the fourth consecutive month for lower statewide home sales and the 27th straight drop in annual comparisons.

Year-to-date statewide home sales were down 28.5 percent in September.

Meanwhile, the median sales price for an existing, single-family detached home in San Diego County in September 2023 dipped by 2.7 percent to $973,100 from the $1 million mark posted in August 2023. A year ago, in September 2022, the median price for San Diego was $899,000, a year-over-year difference of 8.2 percent.

September 2023 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

Statewide, in September 2023, the median price was $843,340, which was 2.7 percent lower than the August 2023 figure of $859,800, and 3.2 percent lower than the September 2022 figure of $817,150. The median represents a price where half of the total number of homes sold above it and half below.

While September’s median price took a step back from the 15-month high recorded in August, the month-to-month decline was in line with the long-run August-to-September price adjustment of -1.8 percent observed in the last 44 years. Prices are likely to experience monthly declines in the next couple of months, following the traditional seasonal pattern. Positive year-over-year price growth is expected to persist through the remainder of the year as housing supply is expected to remain tight.

“With the market being less competitive, there are greater opportunities for consumers who need to purchase a home for personal reasons or those who can qualify to purchase at today’s interest rates,” said C.A.R. President Jennifer Branchini, a Bay Area REALTOR®. “More sellers are making concessions as homes are taking longer to sell, fewer homes are selling above asking price, and there are more homes to choose from.”

“As mortgage rates surge to new highs not seen in more than two decades, home sales are being tested and are likely to remain tepid for the next few months,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “With the Fed planning on holding rates higher for longer, the cost of borrowing will remain elevated and may not come down much in the near term. Housing affordability will continue to hinder sales activity for the rest of the year, especially in the low- and mid-price ranges.”

Other key points from C.A.R.’s September 2023 resale housing report include:

- At the regional level for Southern California, year-over-year sales declined in September 2023 by 21.7 percent. In August 2023, the figure was 13.9 percent.

- At the regional level for Southern California, median home prices in September increased from a year ago by 4.7 percent. In August, the figure was 4.4 percent.

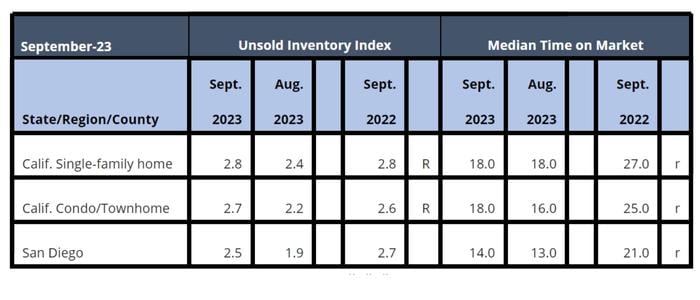

- Housing supply in California continued to shrink from a year ago in September as mortgage rates remained elevated. The statewide unsold inventory index, which measures the number of months needed to sell the supply of homes on the market at the current sales rate, was 2.8 in September 2023. It increased 16.7 percent on a month-over-month basis and was unchanged from a year ago in September 2022.

September 2023 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

- In San Diego in September 2023, the inventory of available homes for sale was 2.5 months, compared to 1.9 months in August, 2.0 months in July 2023 and 2.5 months in August 2022. Other unsold inventory figures in 2023 in San Diego included 2.0 months in June, 1.7 months in May, 1.9 months in April, 1.7 months in March, 2.3 months in February and 2.7 months in January. Inventory levels indicate the number of months it would take for the available supply of homes on the market to sell-out given the current rate of sales.

- Active listings at the state level continued to dip on a year-over year basis for five straight months, with the decline in each of the last six months all registering more than 20 percent year-over-year. With rates remaining high and the market transitioning to the low season, active listings will not likely improve much, if at all, before the end of the year.

- The median number of days it took to sell a California single-family home was 18 days in September and 27 days in September 2022.

- In San Diego, the median number of days it took to sell an existing, single-family home was 14 days in September, compared to 13 days in August 2023, 12 days in July 2023 and 18 days in August 2022. Other median-time-on-the-market figures for San Diego in 2023 include 11 days in June, 12 days in May and April, 15 days in March, 17 days in February and 26 days in January. The median represents a time when half the homes sell above it and half below it.

- The statewide, sales-price-to-list-price ratio on a monthly basis in 2023 was at 100 percent in September, August, July, June, May and April, 99.1 percent in March, 97.7 percent in February and 96.5 percent in January. A year ago, in September 2022, the ratio was 97.6 percent. The sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

- The 30-year, fixed-mortgage interest rate averaged 7.20 percent in September, up from 6.11 percent in September 2022, according to C.A.R.’s calculations based on Freddie Mac’s weekly mortgage survey data.