Fall is the new spring for the California’s housing market as record-low mortgage rates, skyrocketing buyer demand and shrinking inventory are making this fall season resemble a typical, active springtime for homebuyers and sellers. In October 2020, home sales and prices recorded double-digit increases compared to a year ago, according to the most recently monthly report from the California Association of REALTORS® (C.A.R.).

C.A.R. said California’s homebuying season is extending into the fall as home sales and prices remained elevated in October. Continued record low mortgage interest rates sustained the housing market in October as home sales and prices took a breather from September’s record high levels.

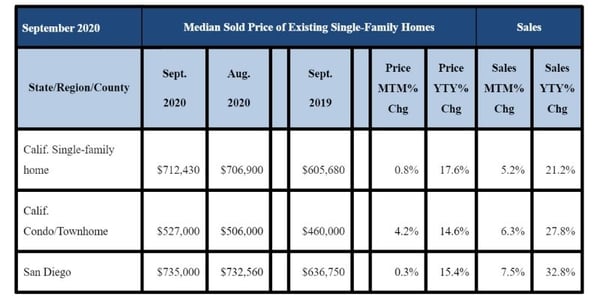

October’s sales total climbed above the 400,000 level for the fourth straight month since the Covid-19 crisis depressed the housing market earlier this year and was just 15,000 units shy of the 500,000 benchmark. Existing, single-family home sales totaled 484,510 in October 2020 on a seasonally adjusted annualized rate. October 2020 sales dipped 1.0 percent from 489,590 in September 2020 but were up 19.9 percent from a year ago, when 404,240 homes were sold on an annualized basis.

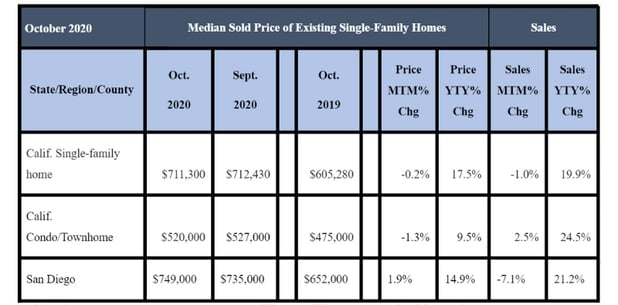

In San Diego County, October 2020 home sales decreased 7.1 percent compared to September 2020, but increased 21.2 percent higher than in October 2019.

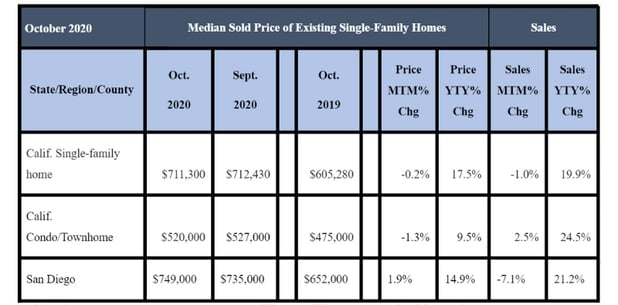

After setting new record highs for four straight months, California’s home median price dipped on a month-to-month basis for the first time in five months. The statewide median price stayed essentially flat in October 2020, slipping 0.2 percent to $711,300 from September 2020’s record high of $712,430. However, the year-over-year growth rate continued to increase by double-digits for the third consecutive month and was the second highest gain since February 2014. There was a 17.5 percent difference between October 2020’s median price of $711,300 and October 2019’s median price of $605,280. October 2020’s median price also was higher than the six-month average of 6.8 percent observed between April 2020 and September 2020.

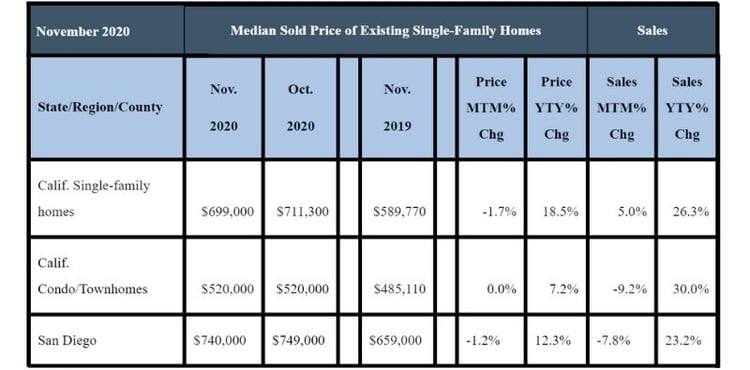

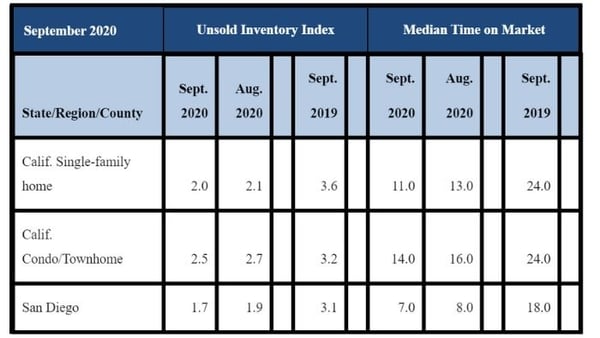

October 2020 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

In San Diego County, the median price for a single-family home in October 2020 was $749,000, a 1.9 percent increase from $735,000 in September 2020, and a 14.9 percent leap than the $652,000 figure in October 2019.

The coronavirus pandemic has heightened the desire for more spacious, multi-functional homes as more people have been forced to homebound distance learning for school and working remotely for the job.

Normally, the housing market experiences a cool-down in the fall as students return to school. However, timelines that normally revolve around the start of the school year are no longer applicable. That dynamic has changed with Covid delaying the reopening of schools for in-person learning.

As a result, sellers are continuing to receive top dollar for their homes outside the prime selling season. Homes are selling quickly and buyer demand shows no signs of tapering off anytime soon.

“California’s housing market continues to exceed expectations as this year’s traditional homebuying season has shifted into late summer and fall instead of spring and early summer,” said 2021 C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. “The market is unseasonably strong, as motivated buyers continue to take advantage of the lowest interest rates in history. The ongoing momentum will keep home sales elevated for the next couple of months, and the housing market will remain a rare bright spot in a struggling economy.”

“An extremely favorable lending environment and a renewed attitude towards homeownership is prolonging the homebuying season and extending the market’s V-shaped recovery to the off season,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The question that remains to be answered, however, is whether the strong market is sustainable in the longer term as market fundamentals continue to be tested by tight supply, eroding housing affordability, and most of all, the rising number of Coronavirus cases.”

Reflecting the rise in home prices, consumers continue to say it is a good time to sell, according to C.A.R.’s monthly Consumer Housing Sentiment Index. Conducted in early November, the poll found that 59 percent of consumers said it is a good time to sell, up from 56 percent a month ago, and up from 47 percent a year ago. Meanwhile, low interest rates continue to fuel the optimism for homebuying; 31 percent of the consumers who responded to the poll believed that now is a good time to buy a home, up from last year, when 24 percent said it was a good time to buy a home.

Other key points from the October 2020 resale housing report included:

-- At the regional level, sales increased in October 2020 in all major regions compared to last year with growth rates of more than 10 percent, except in the Central Valley, which grew by 9.9 percent from a year ago.

-- Sales in resort communities remained robust in October 2020. Housing demand in Big Bear, including Big Bear City and Big Bear Lake, continued to surge with sales growing 125.6 percent from last October. Lake Arrowhead and South Lake Tahoe both recorded strong sales in October, with year-over-year growth rates of 47.7 percent and 29.1 percent, respectively. Sales in Mammoth Lakes also jumped in the latest month with a gain of 55.6 percent from last October.

-- At the regional level, all major regions posted double-digit, year-over-year median price increases. The Central Coast led the pack again with an increase of 25.9 percent, as high-end home sales in Santa Barbara and Monterey continued to surge. The San Francisco Bay Area had the second largest price increase of 17 percent, followed by Southern California (15.4 percent), the Central Valley (14.7 percent), and the Far North (12.8 percent).

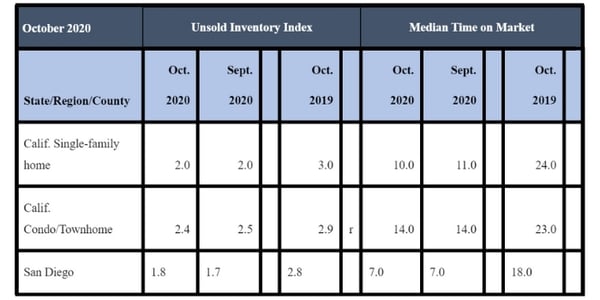

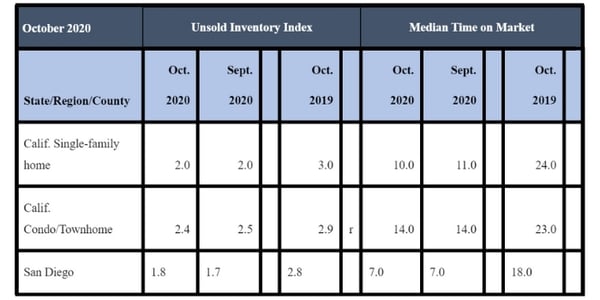

-- With active listings dipping slightly from the prior month, while the momentum of sales continued to push forward into the traditionally off-season months, the Unsold Inventory Index (UII) in October was unchanged from September, when it reached the lowest level in nearly 16 years. The UII fell sharply from 3.0 months in October 2019 to 2.0 months this October.

-- The unsold inventory of available homes for sale in October 2020 in California remained unchanged at 2.0 months, compared to September 2020, when it reached the lowest level in nearly 16 years since November 2004. Statewide inventory in October 2019 was 3.0 months.

-- In San Diego County, the inventory of available of homes for sale in October 2020 was 1.8 months, compared to 1.7 months in September 2020 and 2.8 months in October 2019. Inventory levels in months refers to the number it would take for the current inventory of homes on the market to sell-out given the current sales pace.

-- Active listings continued to decline significantly in October 2020, with most regions declining more than 40 percent from last year. The Central Valley had the biggest year-over-year drop of 49.6 percent in October, followed by Southern California (-46.6 percent), the Central Coast (-46.5 percent), the Far North (-40.9 percent), and the San Francisco Bay Area (-23.8 percent).

-- The median number of days it took to sell a California single-family home was 10 days in October 2020, compared to 11 days in September 2020 and 24 days in October 2019. The October 2020 figure was the lowest ever recorded.

October 2020 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was seven days in October 2020, which the same number in September 2020. However, the timeframe was 18 days a year ago in October 2019. The seven-day figure compares to eight days in August 2020, 10 days in July 2020, 12 days in June 2020, 11 days in May 2020, eight days in April 2020, 10 days in March 2020, 12 days in February 2020 and 23 days in January 2020.

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was seven days in October 2020, which the same number in September 2020. However, the timeframe was 18 days a year ago in October 2019. The seven-day figure compares to eight days in August 2020, 10 days in July 2020, 12 days in June 2020, 11 days in May 2020, eight days in April 2020, 10 days in March 2020, 12 days in February 2020 and 23 days in January 2020.

-- The 30-year, fixed-mortgage interest rate averaged 2.83 percent in October, down from 3.69 percent in October 2019, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 2.89 percent, compared to 3.38 percent in October 2019.

In other recent real estate and economic news, according to news reports:

-- CoreLogic said San Diego County median home price in October remained unchanged from September at $650,000, which is 13 percent higher than a year ago. It was the first time for no monthly price increase since May. The price represents all homes, including single-family, condos and townhomes.

-- San Diegans searching for out-of-state homes for sale on Redfin are most frequently looking at lower-cost cities Phoenix and Las Vegas, along with areas in Riverside County. The homebuying website said 24.3 percent of searches originating from metropolitan San Diego in the 2020 third quarter included out-of-town communities, compared to 18.8 percent the same time last year. The most active metro area people were looking to leave was New York City at 35.8 percent.

-- Redfin also reports that San Diego had the second highest number of multiple offers on homes for sale in the U.S. in October, with 73.2 percent of Redfin homes in a bidding war, second only to Salt Lake City’s 75 percent. Nationwide, 56.8 percent of Redfin offers on home faced competition from at least two prospective buyers.

-- Zillow says homes are remaining unsold on the market for 12 days, which is 17 days less than last year. Also, sales listings in San Diego County are about 34 percent lower than a year ago.

-- The percentage of would-by homebuyers who could afford to purchase the $729,000 median-priced, existing single-family home in the 2020 third quarter in San Diego County was at 27 percent, compared to 30 percent in the 2020 2Q and 29 percent in the 2019 3Q, according to housing affordability index (HAI) statistics from the California Association of REALTORS®. Statewide, the HAI percentage of all California households that could afford to purchase the $693,680 median-priced, single-family home in 2020 3Q was 28 percent, which was the lowest in nearly two years.

-- Every metro area tracked by the National Association of REALTORS® (NAR) experienced annual home price increases in the 2020 third quarter, which was attributed in large part to record-low mortgage rates and depleted nationwide housing inventory. NAR said eight of America’s 10 most expensive metro areas were located in the West, led by San Jose ($1.4 million for a median-priced, single-family home), San Francisco ($1.125 million) and Anaheim, ($910,000). San Diego had the fifth highest median price for a single-family home in the U.S. at $729,000, according to NAR.

It’s no surprise that Merriam-Webster, the dictionary publisher, selected “pandemic” as its 2020 Word of the Year. The COVID-19 coronavirus pandemic changed life in ways that none of us could have imagined in 2019. It was on every TV channel, every news website and part of every conversation. Everyone was impacted, including homebuyers and sellers.

It’s no surprise that Merriam-Webster, the dictionary publisher, selected “pandemic” as its 2020 Word of the Year. The COVID-19 coronavirus pandemic changed life in ways that none of us could have imagined in 2019. It was on every TV channel, every news website and part of every conversation. Everyone was impacted, including homebuyers and sellers.