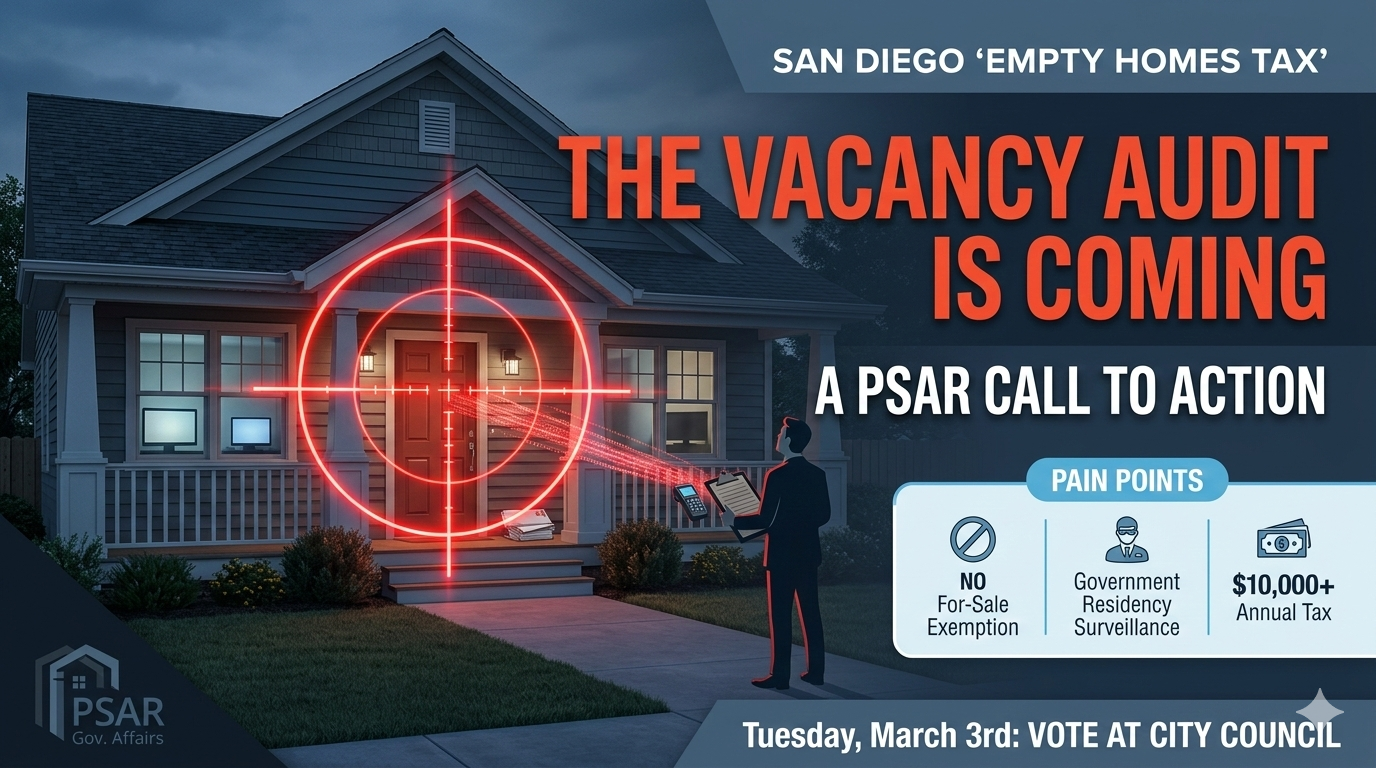

The San Diego City Council is moving rapidly to place a punitive "Empty Homes Tax" on the June 2026 ballot. While the news often portrays this as a "second home tax" targeting wealthy speculators, the reality buried in the ordinance is far more alarming: this is a universal audit mandate that affects EVERY homeowner in San Diego.

FOLLOW THIS LINK TO TAKE ACTION NOW!

The "Guilty Until Proven Innocent" Reality

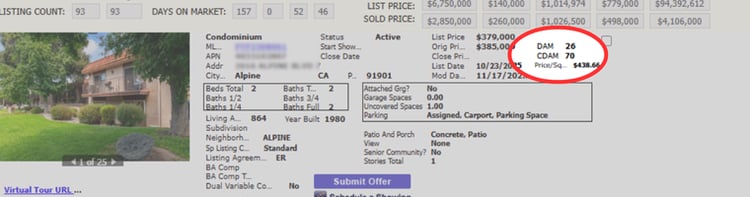

The language of the ordinance applies to all residential family dwellings—including condominiums, townhomes, and duplexes. Because the City must identify which homes are "vacant" for more than 183 days, the administrative burden falls on every homeowner to prove they don’t owe the tax.

Under this "guilty until proven innocent" framework:

- Annual Substantiation: You are required to proactively prove to the City Treasurer every year that your home was occupied.

- Government Surveillance: The City Treasurer is granted the power to inspect your private records at "all reasonable times" and apply "auditing procedures" to verify your residency.

- 10-Year Record Keeping: You are legally mandated to retain all records necessary to prove your residency for a full decade.

- Rebuttable Presumption: If the City decides to assess a tax against you, its estimate is legally presumed to be correct. The burden is entirely on you, the homeowner, to prove them wrong.

What It Will Cost You

This isn't just a fee; it is a massive financial penalty designed to increase every year.

- The Price Tag: $8,000 in 2027, rising to $10,000 per year in 2028.

- Automatic Inflation: Starting in 2029, the tax will increase automatically every year based on the Consumer Price Index.

- The Delinquency Trap: If you fail to prove your exemption by April 1st, you are automatically delinquent, triggering an immediate 10% penalty on top of the tax.

Who Gets Hurt?

The current draft lacks critical common-sense exemptions, putting families in impossible situations:

- Sellers in Escrow: There is no exemption for a home that is vacant simply because it is on the market or in the process of being sold.

- Military Families: Service members deployed overseas must navigate complex annual paperwork to prove a "Qualifying Military Service Period" or face the tax.

- The Elderly & Ill: Residents who must temporarily relocate for long-term medical care or rehabilitation must file "Owner in Care" documentation to avoid being taxed for being sick. Imagine being on your deathbed, considering filing complicated city bureaucratic paperwork.

- Criminal Charges: Willfully failing to remit the tax or refusing to allow an audit is a misdemeanor, punishable by fines and up to six months in jail.

A Pattern of "Bait and Switch"

We’ve seen this before. When the City asked for the "trash fee" (Measure B), voters were promised one thing. Today, the reality is far different, with fees already significantly higher than what the ballot initiative originally stated.

This ordinance explicitly allows the City to deposit these funds into the General Fund for "general municipal services". It is a revenue grab that creates a permanent audit department to monitor where you sleep.

ACTION REQUIRED: CONTACT YOUR COUNCIL MEMBER TODAY, OR DO ALL OF THE FOLLOWING

What can you do?

- Call or email your city council member using the contact information below. Express your opposition to this ordinance, and if possible, why.

- Click on the following link and scroll to item S501 S501: Consideration of an Empty Homes Tax Ballot Measure Proposal by Councilmember Sean Elo-Rivera. (Added 2/26/26), Click on

- Press the radio button next to: " "

- For Agenda Item Number (for Agenda items that are preceded by an S, please drop the S and simply insert the three-digit number in the field below) type 501

- Attend the meeting live at the City Administration Building, 202 C Street, San Diego, CA 92101. The meeting starts at 10:00 AM and continues at 2:00 PM. It is likely, although not certain, that this item will be heard in the afternoon.

Find your Council District Here

The full City Council votes this Tuesday, March 3rd, at 2:00 PM. We need every PSAR member and their clients to flood these offices with opposition.

Tell them: "No on the Empty Homes Tax. Stop the universal audit mandate!"

| District | Council Member | Phone | |

| 1 | Joe LaCava (Pres.) | JoeLaCava@sandiego.gov | (619) 236-6611 |

| 2 | Jennifer Campbell | JenniferCampbell@sandiego.gov | (619) 236-6622 |

| 3 | Stephen Whitburn | StephenWhitburn@sandiego.gov | (619) 236-6633 |

| 4 | Henry L. Foster III | HenryFoster@sandiego.gov | (619) 236-6644 |

| 5 | Marni von Wilpert | MarnivonWilpert@sandiego.gov | (619) 236-6655 |

| 6 | Kent Lee | KentLee@sandiego.gov | (619) 236-6616 |

| 7 | Raul Campillo | RaulCampillo@sandiego.gov | (619) 236-6677 |

| 8 | Vivian Moreno | VivianMoreno@sandiego.gov | (619) 236-6688 |

| 9 | Sean Elo-Rivera | SeanEloRivera@sandiego.gov | (619) 236-6699 |

Complete ordinance as of February 25, 2026 Full Ballot Language Link Here

.png?width=760&height=200&name=blog%20banner_%20Q4%20Good%20Neighbor%20(2).png)

Eight years ago, Nada turned a personal promise into a reality by founding the Nada Benny Scholarship at El Cajon Valley High School. What began as a small initiative has flourished into a significant community pillar, having provided financial assistance to 52 sensational students to date. Nada’s motivation stems from a desire to see young people pursue higher education, whether to become doctors, lawyers, or engineers, without compromising their future financial stability or their ability to eventually achieve the dream of homeownership. She is also proud of her scholars who have gone to trade school route and have been doing excellently. By easing the weight of student loans, she is helping her scholars build a foundation for lifelong success.

Eight years ago, Nada turned a personal promise into a reality by founding the Nada Benny Scholarship at El Cajon Valley High School. What began as a small initiative has flourished into a significant community pillar, having provided financial assistance to 52 sensational students to date. Nada’s motivation stems from a desire to see young people pursue higher education, whether to become doctors, lawyers, or engineers, without compromising their future financial stability or their ability to eventually achieve the dream of homeownership. She is also proud of her scholars who have gone to trade school route and have been doing excellently. By easing the weight of student loans, she is helping her scholars build a foundation for lifelong success..png?width=750&height=197&name=blog%20banner_%20Q4%20Good%20Neighbor%20(1).png)

The California Department of Real Estate (DRE) recently released several critical updates that every REALTOR® should review to start the new year informed and protected. From annual performance data to urgent fraud warnings, here is what you need to know.

The California Department of Real Estate (DRE) recently released several critical updates that every REALTOR® should review to start the new year informed and protected. From annual performance data to urgent fraud warnings, here is what you need to know.