Perhaps the greatest impact of the Covid-19 measures is on open houses. Going forward, instead of group open-house gatherings, expect fewer open houses with smaller numbers, as well as private home showings, featuring social distancing and plenty of disinfectant, masks and hand sanitizers available at the entryway.

The adaptability and ingenuity of realtors have come into play and a better and simpler way to conduct an open house has been developed-- a virtual open house using a laptop or cell phone.

“Covid has changed the way real estate is being bought and sold all over the world. It has created a lot of uncertainty as agents are unsure of what the new norms will be,” said PSAR REALTOR® member Anthony Manzon. “No longer can we have public open houses with hundreds of people in attendance. Gone are the days of aggressively pricing properties and getting every single person into the house to create bidding wars.”

Indeed, as the pandemic has spread across the country, many home sellers, spooked by an unsure economic future and/or the thought of buyers potentially leaving virus deposits throughout their homes, have taken their properties off the market.

“The more agents hosting virtual open houses means the practice will become standard in our profession, which is good for everybody,” said Manzon. “All agents will benefit as more buyers and sellers become comfortable and confident with high-level virtual open houses. We can show the public this is how we can transact in today’s market in a safe way.”

Manzon, who prefers using a laptop for his virtual open houses, has created a Facebook page, called “Realtors of the Virtual World,” that offers training and success stories about virtual open houses and other virtual industry tools.

According to Manzon, agents who become proficient at hosting a virtual open house will attract new clients, demonstrate how to be proactive and solution-based and will keep buyers and sellers and agents safe, thus reducing the spread of the virus.

“Be sure to have some sort of lead capture, provide more information than what the MLS provides and remember that with every virtual open house agents are interviewing for their next client,” Manzon said.

Clearly, the rapid migration to digital technologies driven by the pandemic will continue during the nation’s economic recovery and beyond. REALTORS® will need to keep pace. After the lockdowns end, this time will be remembered for the rapid deployment of digital access to services across nearly every business sector.

Recently, Rich D’Ascoli, CEO of PSAR, facilitated an online discussion about virtual open houses with several REALTORS®. Here is a sampling of their comments:

• “In my opinion, virtual open houses are the wave of the future,” said Amber Tannehill. “The ability to show a client a home virtually will assist us in identifying the buyers who are serious and ready to make an offer. As we adapt to what appears to be a new normal, we will certainly have some obstacles to overcome, but I find that buyers and sellers are understanding and appreciative as we make these adjustments."

• “Open houses are still happening, but with virtual open houses, we’re just filtering the effort through a different process,” said Jason Lopez.

• “Because of the restrictions, traditional open houses may be a thing of the past. But, in some ways, virtual open houses are a better way to get the word out,” said Denisse Roldan Newell. “It’s becoming more important to become tech-savvy, and it’s not that difficult. It’s how we embrace change.”

• “If you aren't willing to adapt as the market changes, then you will quickly learn what it’s like to be irrelevant,” said Sarah Heck. “Virtual open houses and new safety protocols are now the standard of care for our industry.”

• “Virtual open houses are the wave of the future and, as REALTORS®, we need to learn it because it’s an important listing tool. Otherwise, we might lose the listing,” said Jacklyn Lamkin Dougan. “We need to be fearless and embrace change and be willing to do whatever it takes.”

• “It might take a few practice runs, but I think clients are very understanding and excited about virtual open houses as a new technology,” said Patty Nesbitt. “It’s better than watching the news. We need to bring happiness and normalcy to people’s lives.”

• “I’m excited about virtual open houses because it will be one of the great real estate game-changers that comes out of the pandemic environment,” said Elaine Boyd. “Virtual open houses are a win for all sides. The sellers love having fewer people wandering through their homes. Great for agents, too. We can do as many or as few VOHs as we like. Even if you do just one, you can post it on YouTube, then anyone can “walk” through the home any time. The 3D imaging is key for getting a true sense of walking through the home. It’s the wave of the future, just amazing. The Virtual Open House is so more than a bridge for these strange days of Covid-19. It is a new style of open house that benefits us all and it is here to stay.”

Here are some general tips on hosting a virtual live open house.

To prepare for the virtual open house, first, select a time and date as you would for any open house. Allow 30-45 minutes to tour the property and answer questions from participants.

Next, select an online meeting platform, such as Zoom, Google Meet or others. Decide on a “private” open house private with a select group or streaming it to a platform like Facebook to be promoted widely.

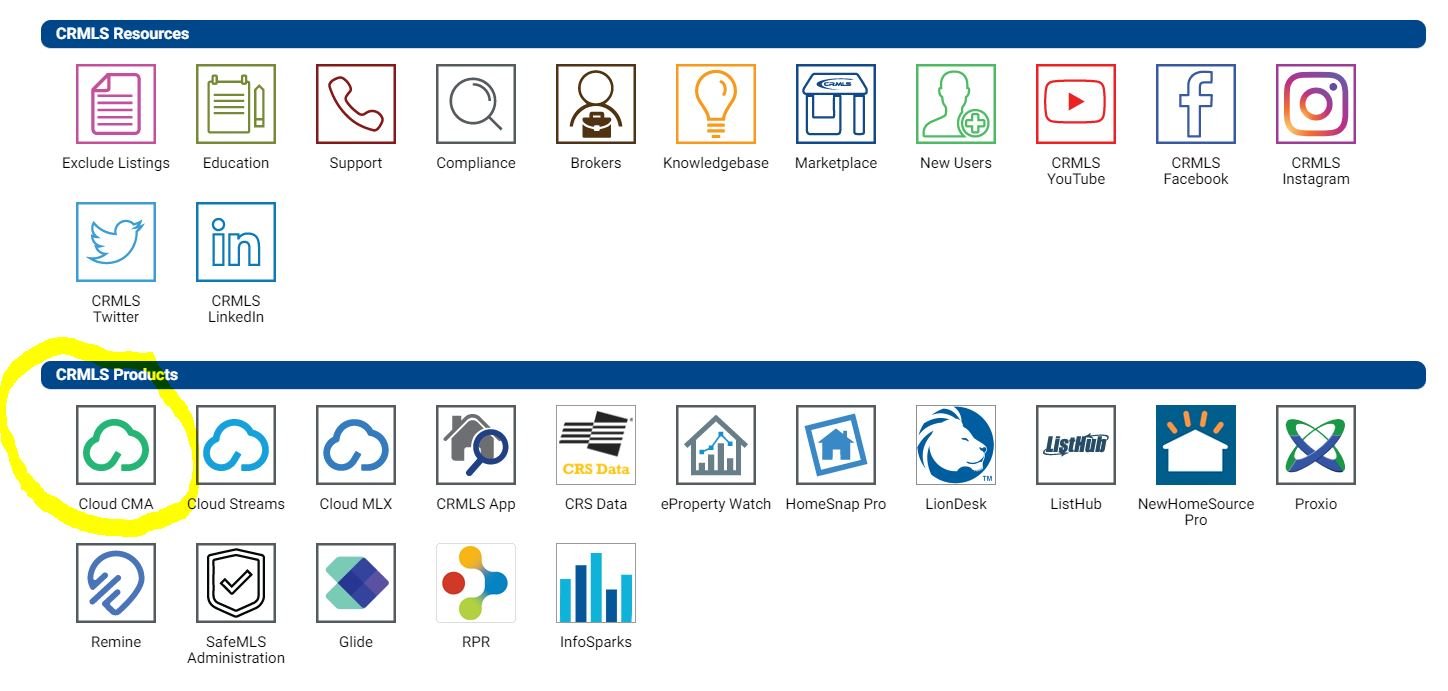

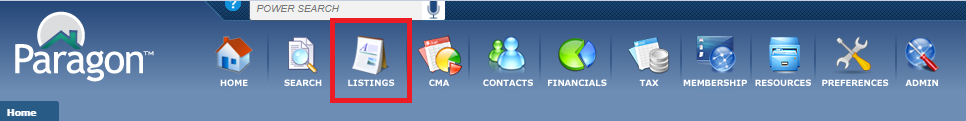

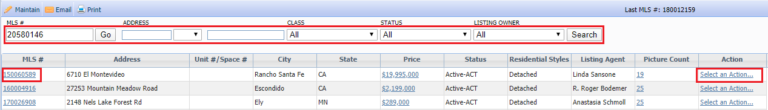

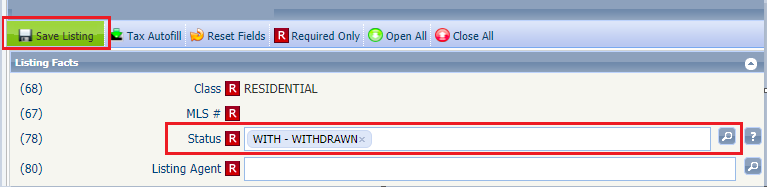

The following live web conferencing services are currently allowed on CRMLS Paragon: BlueJeans, bluejeans.com; Facebook Live, facebook.com; GoToMeeting, gotomeeting.com; GoToWebinar, gotowebinar.com; Google Hangouts, hangouts.google.com; Google Meet, meet.google.com; Join.me, join.me; Livestream, livestream.com; Periscope, periscope.com; Skype, skype.com; Microsoft Teams, teams.microsoft.com; Webex, webex.com; Whereby, whereby.com; YouTube Live, youtube.com; Zoho, zoho.com; Zoom, zoom.us.

Facebook is popular because it allows you to create an event from your Facebook business page. Under the “Events” tab create a new public event to share.

To drive traffic to your virtual open house, include the link in a shared event via Facebook and other social media platforms. Also email your client list and agents who will bring interested buyers.

On the event day, prepare the house as you would for a typical open house. Make sure it’s clean, presentable and properly lit.

If the home has a fast WiFi Connection and you feel confident with mobile technology, live streaming from the property is an option.

Another method is to prepare content like Matterport, video clips, and other multimedia in advance and review the content live from a home office.

Start the tour by opening your Facebook app on your smartphone, go to your business page, open-up the event you’ve previously created. Go to the “Say Something” option, click the “Live Video” option and then click “Start Live Video.” You’re on: “Hello, Facebook friends, thanks for tuning in to this live virtual open house.” The recording can then be posted on your Facebook timeline. And, don’t forget to follow-up with your viewers.

When using a smartphone, keep it in a horizontal position, not vertical, so participants see a wider view of the home as you’re touring. Put yourself on the other side of the camera and imagine how the audience is viewing the screen. Slowly move the smartphone and try not to shake it. There are gimbals available online for less than $100 that help to stabilize live video.

During the tour, think of your ideal buyer. Anticipate the questions they might ask and discuss the features they would find interesting. Some agents respond live to questions by looking at specific points of interest in a home.

.jpg?width=500&name=unnamed%20(2).jpg)