The California Association of REALTORS® (C.A.R.) recently conducted a consumer survey of California homebuyers. The survey examined the attitudes and behaviors of real estate consumers. According to its 2018 State of the California Consumer Survey, California’s competitive housing market and low housing affordability are forcing homebuyers to make compromises in their home purchases including price, size, location, and school quality.

The California Association of REALTORS® (C.A.R.) recently conducted a consumer survey of California homebuyers. The survey examined the attitudes and behaviors of real estate consumers. According to its 2018 State of the California Consumer Survey, California’s competitive housing market and low housing affordability are forcing homebuyers to make compromises in their home purchases including price, size, location, and school quality.

The survey revealed that 44 percent of buyers bought a more expensive home than they wanted, 33 percent purchased a smaller home than desired, 36 percent purchased a home further from school or work than wished, and 30 percent purchased in an area where schools were of lesser quality.

“Well-qualified homebuyers understand that buying a home can be challenging in a competitive housing market environment and they may not be able to buy the ideal home they want,” said 2019 C.A.R. President Jared Martin. “Instead of finding a home that’s a perfect fit, they are finding a home that’s a good enough fit.”

Buying Experience

Buyers were not deterred by higher home prices and tight housing supply conditions but waited until their financial situations improved or to save for a down payment. Buyers typically saved for five years, and nearly a quarter of those who purchased a home priced $1 million or higher saved more than 10 years.

The source of down payment for the majority of home buyers was their personal savings. Boomers were more likely to use the proceeds from the sale of a previous home since many were repeat buyers. Millennials were significantly more likely than Gen Xers or boomers to use funds received from parents or family or a gift.

California’s costly home prices gave nearly one in three home buyers cause to consider purchasing in another state, but buyers ultimately stayed because they liked the city or state they currently lived in or because of their job, family, or friends. Younger buyers and first-time buyers were more likely to consider leaving the state. With the state’s housing prices at 161 percent above the national average, California’s high housing costs are the biggest factor hurting young, middle-class, often minority families.

Buyers typically spent eight weeks on their home search, and nearly one in three spent 13 weeks or more. Reflecting the extremely tight housing market in the San Francisco Bay area, buyers in the Bay Area spent a median of 10 weeks in their home search. Buyers who bought homes $1 million or higher spent a median of seven weeks searching for a home, while those whose homes cost less than a $1 million spent a median of eight weeks. Generally, the more competitive the housing market is, the longer it takes to find a home.

Buyers made a median of three offers on other homes before having an offer accepted, but nearly one-fourth made more than 10 offers. Those who purchased a home for more than $1 million made five offers on other homes. The hyper-competitive, supply-constrained Bay Area had the highest incidence of multiple offers.

Buyers Preferences

Homebuyers’ preferences varied by age/generation, income, and home buyer status (first-time, repeat, investment buyer, etc.).

The typical first-time buyer purchased a three-bedroom, 1,500-square-foot, single-family home. Nearly half purchased a home in the suburbs, and two-thirds purchased a one-story home. Buying a home within their price range and with the desired number of bedrooms were the top requirements for first-time buyers. They selected their neighborhood primarily based on their budget (53 percent), safety (51 percent), and proximity to jobs/school (38 percent). First-time buyers were likely to purchase a home close to where they previously lived, with only 20 percent choosing to leave the county or state.

Being in a better financial situation, repeat buyers typically purchased a larger home with three bedrooms and a median square footage of 1,700. Three in four purchased a single-family home, and more than half purchased a one-story home. Nearly half bought a home in the suburbs, 26 percent bought a home in the city outside of downtown, 18 percent bought homes downtown, and 11 percent bought in a rural area.

With lower income and less equity under their belts, millennials tended to buy smaller, more affordable homes than older generations with a median of 1,500 square feet and a median price of $350,000. Millennials were more likely to purchase a condominium or townhome in a suburb (43 percent), followed by a home in the city outside of downtown (26 percent). They selected the neighborhood they wanted to live in based on their budget (52 percent), safety (49 percent), proximity to jobs/schools (40 percent) and family/friends (33 percent).

Similar to millennials, the Gen X group most commonly selected a home in the suburbs, trading up to a home a median of 300 square feet greater than that of their previous home. More than half of them selected a home with at least one bedroom larger than their previous residence. Most purchased a single-family home, and townhouses/condos accounted for nearly 20 percent of those purchased. The majority of Gen Xers chose to buy within the same county as they previously lived, presumably to minimize disruption from the relocation and maintain the same lifestyle.

Boomers were most likely to have purchased a single-family home in the suburbs without stairs and were also the most likely to buy a home in a rural area since many of them are approaching retirement age and planning to age in their home and seek a quieter lifestyle. They were less likely to purchase in the same county they previously resided in with 24 percent buying in another county perhaps to be closer to children/grandchildren or healthcare facilities.

C.A.R.’s 2018 State of the California Consumer Survey , conducted online between May 9 and July 9, 2018, was designed to understand the process of home buying and selling, as well as the motivation behind renting and owning from the perspective of the California consumer. Surveys were sent to 470,803 consumers ages 18 and older in the state of California, resulting in 6,144 participants, a 1.3 percent response rate. The margin of error was plus-or-minus 1.2 percent at a 95 percent confidence interval. For the buyers section, 1,441 buyers purchased a home in California within 18 months preceding survey participation.

PSAR is proud to announce that a new Service Center in San Diego’s Clairemont community.

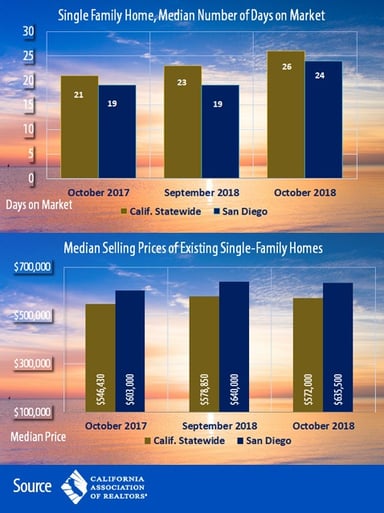

PSAR is proud to announce that a new Service Center in San Diego’s Clairemont community. California’s housing market declined for the sixth straight month in October, according to the latest housing market report from the California Association of REALTORS® (C.A.R). C.A.R. also found that existing home sales in the state dropped below the 400,000 level for a third consecutive month. The last time there were three straight months when the sales dipped below 400,000 was February 2015.

California’s housing market declined for the sixth straight month in October, according to the latest housing market report from the California Association of REALTORS® (C.A.R). C.A.R. also found that existing home sales in the state dropped below the 400,000 level for a third consecutive month. The last time there were three straight months when the sales dipped below 400,000 was February 2015.

REGISTER BELOW FOR THE FOLLOWING CLASSES AND

REGISTER BELOW FOR THE FOLLOWING CLASSES AND