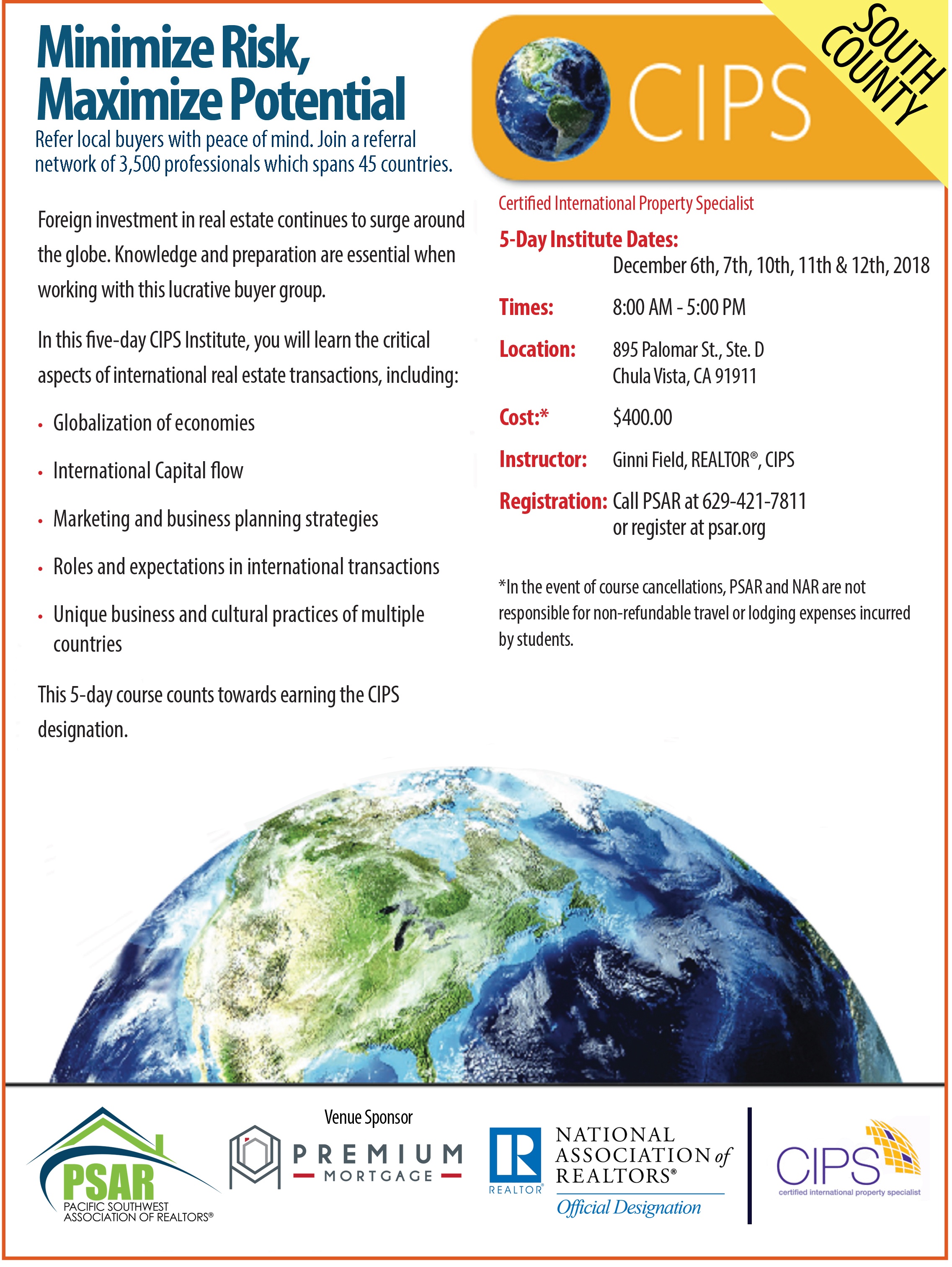

To Register for this 5-Day Course, please call 619-421-7811 or email george@psar.org.

To Register for this 5-Day Course, please call 619-421-7811 or email george@psar.org.

Topics: Education, Global Real Estate Council

The Pacific Southwest Association of REALTORS® (PSAR) has announced its endorsement of candidates for the Nov. 6th general election. Endorsed candidates include:

The Pacific Southwest Association of REALTORS® (PSAR) has announced its endorsement of candidates for the Nov. 6th general election. Endorsed candidates include:

![]() Brian Jones for California State Senate 38th District

Brian Jones for California State Senate 38th District

![]() Mary Casillas Salas, Chula Vista Mayor

Mary Casillas Salas, Chula Vista Mayor

![]()

John McCann, Chula Vista City Council, District 1

![]() Ditas Yamane, National City Mayor

Ditas Yamane, National City Mayor

![]() Ron Morrison, National City City Council

Ron Morrison, National City City Council

![]() Bill Wells, El Cajon Mayor

Bill Wells, El Cajon Mayor

![]() Gary Kendrick, El Cajon City Council

Gary Kendrick, El Cajon City Council

![]() Mark Arapostathis, La Mesa Mayor

Mark Arapostathis, La Mesa Mayor

![]() Guy McWhirter and Bill Baber, La Mesa City Council

Guy McWhirter and Bill Baber, La Mesa City Council

![]() Ronn Hall, Laura Rose Koval, Rob McNelis, Santee City Council

Ronn Hall, Laura Rose Koval, Rob McNelis, Santee City Council

![]() Jerry Jones, Lemon Grove City Council

Jerry Jones, Lemon Grove City Council

![]() Dan McMillan, Helix Water District, District 1

Dan McMillan, Helix Water District, District 1

![]() John Olsen, Grossmont-Cuyamaca Community College District Board of Trustees, Area 1

John Olsen, Grossmont-Cuyamaca Community College District Board of Trustees, Area 1

PSAR’s Government Affairs Committee recommended the endorsements to the board of directors, which then ratified the recommendation. The Government Affairs Committee is involved in political advocacy and public policy and its impact on homeownership and private property rights.

In addition, PSAR is recommending the following:

PSAR believes Prop. 10 is a flawed rent control initiative that would make housing more expensive, not less, and worsen the housing crisis. Vote “No” on Prop. 10.

In addition to positions on Prop. 5 and Prop. 10, C.A.R. is supporting Proposition 1, the Housing Programs and Veterans' Loans Bond. A “yes” vote on this measure would authorize the state to borrow up to $4 billion in general obligation bonds for housing-related programs benefiting veterans. If approved, additional affordable housing would be provided for veterans. The vast majority of the bonds, about $3 billion, would be set aside for various types of housing programs. The biggest share, or $1.5 billion, would go toward the construction and rehabilitation of permanent and transitional rental housing and apartments for California households who earn of up to 60 percent of the area median income. The second biggest portion of the $3 billion, about $150 million, would be earmarked for cities, counties, transit agencies, and developers to build higher density housing near transit stations. The remaining $1 billion would be earmarked for veterans participating in a home loan program. In addition to C.A.R., Prop. 1 has support from major California newspapers, including the San Francisco Chronicle, Los Angeles Times, and Sacramento Bee, as well as the League of Women Voters and Democratic state lawmakers.

The Pacific Southwest Association of REALTORS® (PSAR), a 2,600-member trade group for San Diego-area REALTORS®, offers educational training, advocacy and other services and resources to its REALTOR® members. Founded in 1928, PSAR has played a significant role in shaping the history, growth and development of greater San Diego County. The Association maintains a leadership role in the industry, empowering REALTORS® by leveraging our collective strength so they may serve homebuyers and sellers and the greater community. For more information, visit www.PSAR.org.Topics: Government Affairs

California’s housing market “continued to deteriorate” in September, according to the latest housing market report from the California Association of REALTORS® (C.A.R). Mortgage rates remain affordable while demand for existing homes is slowing, home prices are rising at a slower rate and a tight supply of available homes, still low, is increasing.

In September, C.A.R. said the state’s housing market posted its largest year-over-year sales decline since March 2014. In addition, home sales remained below the 400,000-level sales benchmark for the second consecutive month, indicating that the market is slowing as many potential buyers put their homeownership plans on hold.

C.A.R. said September’s statewide median home price dropped to $578,850 in September. The September 2018 statewide median price was down 2.9 percent from $596,410 in August 2018 but up 4.2 percent from a revised $555,400 in September 2017.

In San Diego County, the median price of a single-family home in San Diego County was $640,000 in September 2018, up from $605,000 during the same month a year ago, according to CAR. The median price in September 2018 was down 3 percent from $660,000 in August 2018.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 382,550 units in September, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

“The housing market continued to deteriorate and the decline in sales worsened as interest rates remained on an upward trend,” said C.A.R. President Steve White. “More would-be buyers are self-sidelining as they believe home prices will start to come down soon, making housing more affordable despite rising interest rates. Tax reform, which increases the cost of homeownership, also is contributing to the decline, especially in high-cost areas such as the San Francisco Bay Area and Orange County.”

“Price appreciations have slowed in the last few months and inventory has risen considerably since June when the statewide median price hit a new peak,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “Buyers are becoming increasingly concerned about market developments and are reluctant to purchase at the prevailing market price. As such, the deceleration in price growth will likely continue in coming months.”

Other key points from C.A.R.’s September 2018 resale housing report included:

Topics: Market Information

TESTIMONIALS FROM VERY RECENT STUDENTS:

"Great presentation,

"The review course was awesome." -- LF - Palm Springs

"Passed with flying colors - contribute it to your excellent teaching skills and fantastic study materials." -- MK - Walnut Creek

"My gosh, was it easy & easy to access." -- TR - Online

"Your class in Vista was unbelievable." -- EA - Vista

Topics: Education

Wednesday, October 24, 2018

Wednesday, October 24, 2018

11:30 AM - 1:00 PM

PSAR East County

1150 Broadway

El Cajon, CA 92021

Presented by PSAR's Tech Committee

The Tech Lunch & Learn Workshops are open to all REALTORS® and Affiliate Members regardless of what Association they are members of.

BE SURE TO BRING YOUR:

Cost: FREE - REGISTER HERE

Topics: Education

Topics: Education, Brokers/Managers, Leadership, CRMLS

Here is the latest in a series of occasional articles on “Best Practices” from PSAR members.

Here is the latest in a series of occasional articles on “Best Practices” from PSAR members.Topics: Brokers/Managers, Leadership

Code of Ethics Training REQUIRED BEFORE DECEMBER 31ST

Code of Ethics Training REQUIRED BEFORE DECEMBER 31ST

NAR Requires that members must complete 2.5 hours of ethics training, meeting specific learning objectives every two years.

All REALTORS with licenses expiring in 2019 or 2020 must complete the Code of Ethics training by December 31, 2018.

Don't beat yourself up next year by forgetting to take care of this now! You have options today.

FREE ONLINE CODE OF ETHICS TRAINING: REGISTER HERE

FREE LIVE CLASSROOM ETHICS TRAINING

Chula Vista Sign up: REGISTER HERE

or

Sign up online at psar.org: REGISTER HERE

PSAR's Chula Vista Service Centers Schedule:

REALTORS® are required to complete ethics training of not less than 2 hours, 30 min. of instructional time within a two-year cycle. The training must meet specific learning objectives and criteria established by the National Association of REALTORS®.

New members of local REALTOR® associations must complete similar training when they first join. A new member who has completed the New Member Code of Ethics Orientation shall not be required to complete additional ethics training until the next two-year cycle.

A REALTOR® who has completed the required ethics training within a two-year cycle in one association shall not be required to complete any further ethics training for that same training cycle if the REALTOR® becomes or is a member of another association. In addition, a member may take courses to satisfy this ethics training requirement through any association or outside training facility where the member can provide satisfactory documentation of completion.

IMPORTANT: Starting in 2017, the NAR ethics requirement becomes biennial, and members will need to obtain ethics training during the reporting periods during which they are not renewing their California real estate licenses.

OPTION 1 (Free): Take the Ethics course online through the National Association of REALTORS here. Login Required. The helpline number for the site is 800-874-6500.

NOTE: When you have successfully completed the online course, you will receive a confirmation by e-mail from www.realtor.org. Please forward the completion confirmation to PSAR at education@psar.org. Note that completion of this Ethics course will not meet the BRE license renewal requirement.

OPTION 2 (Free for Members): Attend a Live Ethics Class at PSAR- Register here

Consequences for Not Completing the Mandated NAR Code of Ethics Requirement

If the mandated NAR Code of Ethics requirement is not completed by the deadline of December 31, 2018, PSAR, CAR and NAR memberships will be suspended on January 1, 2019.

In the event of a REALTOR® broker’s suspension of membership, the memberships of all REALTOR® agents under his or her office will also become suspended. Further, upon a broker’s termination of membership, the same will apply to his or her agents’ REALTOR® memberships.

If a REALTOR® agent’s membership is terminated, that agent’s broker will incur a Non-Member Special Dues Assessment in the amount of $740 for that agent’s failure to remain an active REALTOR® member licensed under a REALTOR®.

Once a terminated REALTOR® who is in default of meeting the mandated NAR Code of Ethics requirement has completed the course, he or she will qualify for reinstatement of membership. However, please note that reinstatement fees will apply.

For questions, please email support@psar.org.

Topics: Education

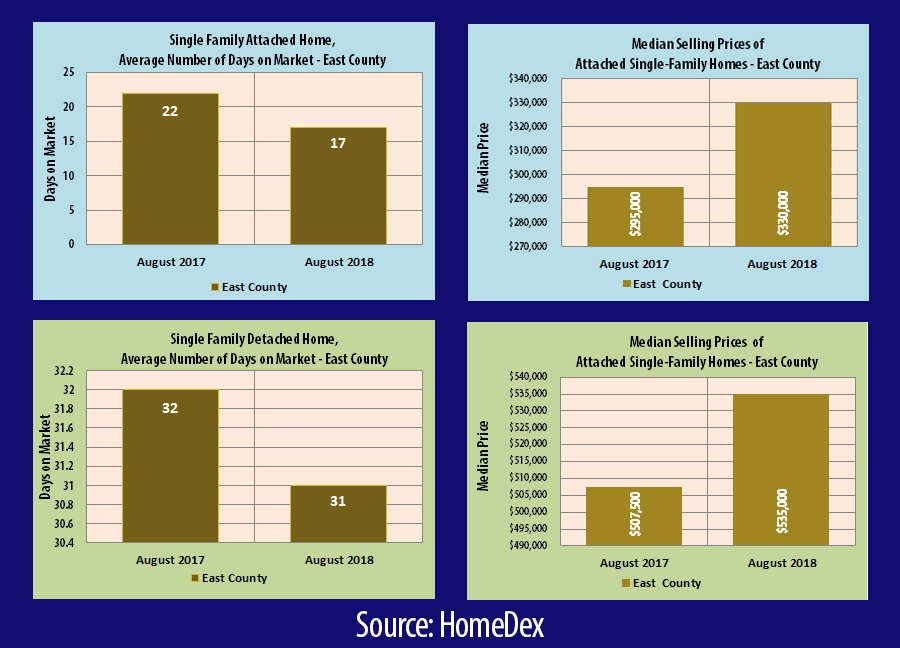

Here is the latest in the real estate market in the San Diego’s East County region in the following zip codes: 91901, 91905, 91906, 91916, 91917, 91931, 91934, 91935, 91941, 91942, 91945, 91948, 91962, 91963, 91977, 91978, 91980, 92004, 92019, 92020, 92021, 92036, 92040, 92066, 92070, 92086. The following statistics on housing market activity in the East County is from the HomeDex Housing Market Report for August 2018.

Topics: Market Information

Topics: Events

Comment on this blog below: