The California housing market reached a milestone in April that the San Diego market already has experienced.

The state’s median home price for an existing, single-family detached home exceeded the $800,000 benchmark for the first time ever in April 2021, according to the monthly home sales and price report from the California Association of REALTORS® (C.A.R.). The median price represents the point at which half of homes sell above a price, and the other half below it.

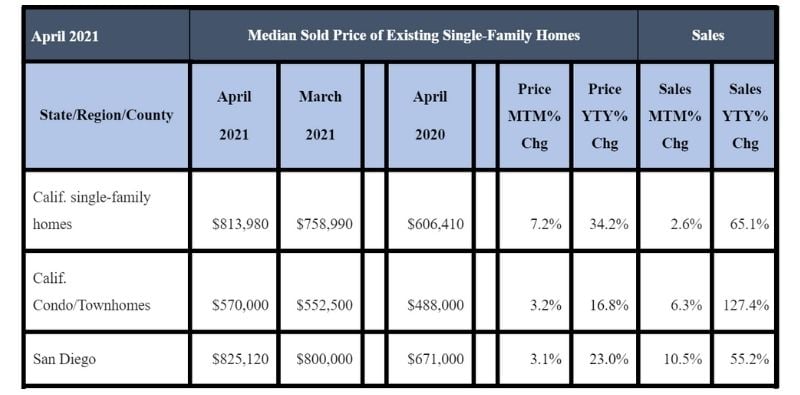

Heated market conditions and a shortage of homes for sale continued to put upward pressure on home prices in the state in April, driving California’s median price to $813,980, almost as high as San Diego’s April monthly figure of $825,120.

The statewide median home price set a new record high in April 2021, breaking the previous record set in March 2021. The statewide median home price of $813,980 in April 2021 was 7.2 percent higher compared to $758,990 in March 2021 and 34.2 percent higher when compared to the $606,410 figure for April 2020.

April 2021 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

The year-over-year price gain was the highest ever recorded, and it was the first time since June 2013 that the state recorded an annual increase of more than 30 percent.

San Diego’s median price for a single-family detached home of $825,120 in April 2021 was 3.1 percent higher than the median home price of $800,000 in March 2021 and 23 percent higher compared to $671,000 in April 2020.

Meanwhile, California home sales in April 2021 soared from last year’s pandemic-level lows with the start of the spring home buying season.

Home sales in the state increased on a monthly basis for the third consecutive month, rising 2.6 percent to 458,170 homes from 446,410 homes in March 2021 and up 65.1 percent from April 2020, when 277,440 homes were sold on a seasonally adjusted annualized basis. The statewide annualized sales figure represents what would be the total number of homes sold during 2021 if sales maintained the April pace throughout the year.

The sharp sales jump in April 2021 was expected following last year’s pandemic shutdown when home sales dropped more than 30 percent from the previous April. Year-to-date statewide home sales were up 26.2 percent in April 2021.

In San Diego County, the number of home sales in April 2021 was 10.5 percent higher compared to March 2021, and 55.2 percent higher than April 2020.

“California continues to experience one of the hottest housing markets as homes sell at the fastest pace ever, with the share of homes sold above asking price, the price per square foot and the sales-to-list price all at record highs, while active listings remain at historic lows,” said C.A.R. President Dave Walsh, vice president and manager of the Compass San Jose office. “The high demand and shortage of homes for sale, driven by these market factors, continued to drive up home prices and shatter the record-high set just last month.”

“Not only do skyrocketing home prices threaten already-low homeownership levels and make it harder for those who don’t already have a home to purchase one, it also brings to question the sustainability of this market cycle,” said C.A.R. Vice President and Chief Economist Jordan Levine. “As vaccination rates increase and the state reopens fully, higher home prices will hopefully entice prospective sellers who have held off putting their homes on the market during the pandemic to feel more comfortable listing their homes for sale, which would alleviate pressure on home prices.”

Other key points from C.A.R.’s April 2021 resale housing report included:

-- Home sales in April from a regional perspective saw sharp gains with each region growing more than 38 percent from last year. The San Francisco Bay Area had the highest year-over-year increase of 101.4 percent, with five of its nine counties growing by triple digits from a year ago. The Central Coast came in second with an increase of 81.7 percent, followed by Southern California (65.5 percent), the Central Valley (39.8 percent), and the Far North (38.8 percent).

-- All but two of the counties tracked by CAR, 49 of 51, recorded a year-over-year sales increase in April, with 31 counties increasing more than 50 percent from a year ago, and 11 counties growing by triple digits. Six of the counties with an annual growth rate of more than 100 percent had a median price above $1 million in April 2021. Counties with an increase from last year had an average gain of 70.7 percent in April 2021, compared to 32.9 percent in March.

-- Sales growth in California in April 2021 remained concentrated in higher-priced markets, while home sales in the lower-end continued a lackluster performance. The million-dollar segment in April increased in demand by more than 200 percent in year-over-year comparisons, with sales of homes priced $2 million and higher surging more than 300 percent from a year ago. Meanwhile, sales of properties priced below $300,000 continued to fall precipitously, with the year-over-year growth rate dropping 34 percent in April 2021, compared to April 2020. Tight housing supply continues to be the primary constraining factor for fewer sales in the lower-price category.

-- New record median prices were set in all major regions in April 2021, with each region growing more than 20 percent from April 2020. The Central Coast region continued to have the highest year-over-year gain of 40.8 percent, followed by the San Francisco Bay Area (35.6 percent), Southern California (28.6 percent), the Central Valley (25.5 percent) and the Far North (22.8 percent).

-- Active listings in California fell more than 50 percent in April 2021 from April 2020, marking four straight months when the housing supply was cut in half from the same month a year ago.. The ongoing decline in inventory is due to the surge in demand over the past 10 months, as well as a lack of new listings. While new active listings in April 2021 experienced robust year-over-year growth compared to April 2020, when the government-imposed pandemic shutdown was underway, the level of newly added supply is still significantly below pre-pandemic levels. On a month-to-month basis, for-sale properties inched up by 7.4 percent in April 2021, compared to March 2021, and should climb further in the coming months if the market follows its typical seasonal pattern.

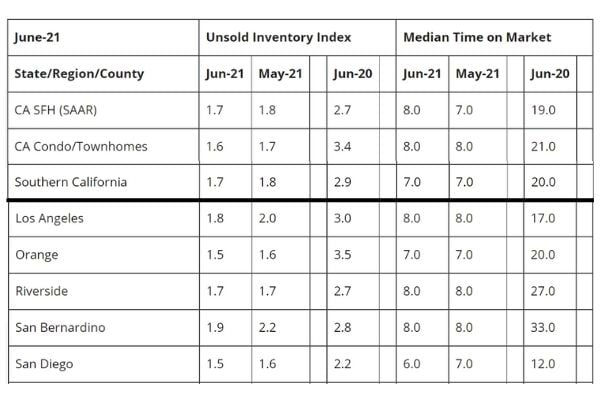

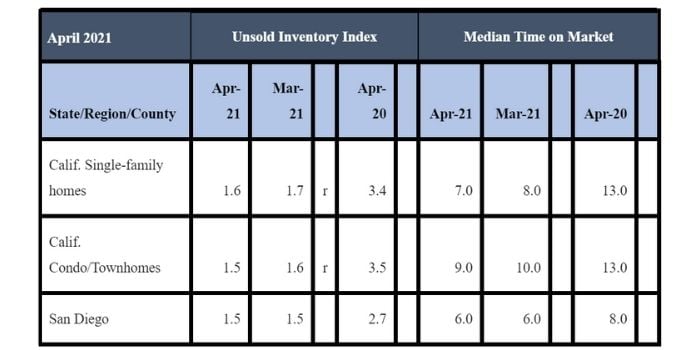

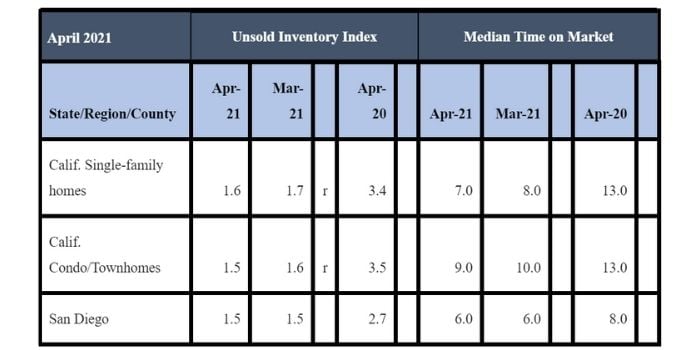

-- Statewide, the unsold inventory of available homes for sale dropped to 1.6 months in April 2021 from 1.7 months in March 2021 and was down sharply from April 2020, when there was 3.4 months of housing inventory. Inventory levels measured in months indicate the number it would take for the available supply of homes on the market to sell-out given the current rate of sales.

April 2021 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- In San Diego County, the inventory of available homes for sales in April 2021 remained at 1.5 months, the same number for March 2021, compared to 1.8 months in both February 2021 and January 2021 and 2.7 months in April 2020.

-- The median number of days it took to sell a California single-family home hit another record low of seven days in April 2021, down from 13 days in April 2020. The seven-day figure is lower than the eight days in March 2021, previously the lowest ever recorded. The eight-day figure compared to 10 days in February 2021, 11 days in January 2021, 11 days in December 2020, nine days in November 2020, 10 days in October 2020, 11 days in September 2020 and 15 days in March 2020. Prior to setting record low numbers in March and April 2021, the previous statewide record was nine days in November 2020.

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was six days in April 2021, which was the same number in March 2021. That number compares to seven days in both February 2021 and January 2021, as well as eight days in December 2020 and seven days in November, October and September 2020. The timeframe a year ago in April 2020 was eight days.

-- The 30-year, fixed-mortgage interest rate averaged 3.06 percent in April, down from 3.31 percent in April 2020, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 2.81 percent, compared to 3.31 percent in April 2020.

"Testing refers to the use of individuals who – without any bona fide intent to rent or purchase housing, purchase a mortgage or vehicle loan, or patronize a place of public accommodation – pose as prospective renters, borrowers, or patrons for the purpose of gathering information. This information may indicate whether a provider is complying with federal civil rights laws. The primary focus of the Section's Fair Housing Testing Program has been to identify unlawful housing discrimination based on race, national origin, disability, or familial status in violation of the Fair Housing Act. The Section also has responsibilities to enforce Title II of the Civil Rights Act of 1964, the nation's public accommodations law; the Equal Credit Opportunity Act, which prohibits discrimination in credit; and the Servicemembers Civil Relief Act, which provides protections for military members as they enter active duty. The Fair Housing Testing Program also conducts testing under these statutes, as well as under the Americans with Disabilities Act, which is enforced by the Disability Rights Section of the Civil Rights Division."

"Testing refers to the use of individuals who – without any bona fide intent to rent or purchase housing, purchase a mortgage or vehicle loan, or patronize a place of public accommodation – pose as prospective renters, borrowers, or patrons for the purpose of gathering information. This information may indicate whether a provider is complying with federal civil rights laws. The primary focus of the Section's Fair Housing Testing Program has been to identify unlawful housing discrimination based on race, national origin, disability, or familial status in violation of the Fair Housing Act. The Section also has responsibilities to enforce Title II of the Civil Rights Act of 1964, the nation's public accommodations law; the Equal Credit Opportunity Act, which prohibits discrimination in credit; and the Servicemembers Civil Relief Act, which provides protections for military members as they enter active duty. The Fair Housing Testing Program also conducts testing under these statutes, as well as under the Americans with Disabilities Act, which is enforced by the Disability Rights Section of the Civil Rights Division."