The lowest mortgage interest rates in more than a year boosted California’s housing market and kept home sales level in March 2019, after a stronger performance the previous month, according to the latest housing market report for home sales and prices from the California Association of REALTORS® (C.A.R).

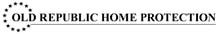

After hitting the lowest level in 12 months in February 2019, the statewide median home price bounced back and reached the highest point since October 2018. The statewide median home price rose 5.9 percent to $565,880 in March 2019 from $534,140 in February 2019 and was up 0.2 percent from a revised $564,820 in March 2018.

The statewide median home price in March 2019 was $565,880, down 5.9 percent from February’s $534,140 figure and up 0.2 percent from March 2018’s figure of $564,820.

In San Diego County in March 2019, the median single-family home price of $623,800 was 0.2 percent lower than the $6250,000 figure for February 2019 and 0.3 percent lower than the $62,400 figure for March 2018.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 397,210 units in March, according to information from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

“The lowest interest rates in more than a year gave would-be buyers the confidence to enter the housing market and provided a much-needed push to jump-start the spring homebuying season,” said C.A.R. President Jared Martin. “Pending sales also showed healthy improvement in March, which suggests a brighter market outlook could be in place in the second quarter.”

“The median price has been softening since it reached a peak last summer, and March’s year-over-year price increase was the smallest in seven years,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The flattening home prices, coupled with low mortgage rates, bode well for housing affordability and may bring more buyers who may have given up back to the market.”

Other key points from the March 2019 resale housing report included:

Other key points from the March 2019 resale housing report included:

-- The median number of days it took to sell a California single-family home rose from 16 days in March 2018 to 25 days in March 2019. This compares to 33 days in February 2019 and 37 days in January 2019. Meanwhile, in San Diego County, the median number of days a home remained unsold on the market stood at 19 days in March 2019, compared to 22 days in February 2019 and 12 days in March 2018.

-- Home sales in the Inland Empire declined 10.4 percent from a year ago as Riverside and San Bernardino counties posted annual sales declines of 9.3 percent and 12.2 percent, respectively. In the Southern California region, home prices increased in San Bernardino, Riverside and Ventura while they declined in Los Angeles, Orange and San Diego counties.

-- Active listings continued to climb from the prior year, increasing 13.4 percent from last March. It was the 12th consecutive month active listings rose year-over-year and the ninth month in a row they grew double digits from the prior year. The pace of increase, however, was the slowest since July 2018, and the growth rate has been decelerating since December 2018.

-- The Unsold Inventory Index (UII), which is a ratio of inventory over sales, improved on a year-over-year basis but decreased on a month-to-month basis. The Unsold Inventory Index was 3.6 months in March, down from 4.6 months in February but up from 3.0 months in March 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the moderate sales decline and the sharp increase in active listings.

-- The 30-year, fixed-mortgage interest rate averaged 4.27 percent in March, down from 4.44 percent in March 2018, according to Freddie Mac. The five-year, adjustable mortgage interest rate also declined in March to an average of 3.83 percent from 3.65 in March 2018.

In other recent real estate and economic news, according to news reports:

-- The number of San Diego County homebuyers who had their first offer accepted skyrocketed in the first quarter of this year, according to real estate firm Redfin. In the first quarter last year, only 38 percent of local homebuyers got their first offer accepted. That figure climbed to 53.4 percent in the first three months of 2019. Nationally, 56 percent of homebuyers got their first offer accepted in the first quarter, according to Redfin, the highest first offer acceptance rate in the past three years.

-- San Diego County's home inventory rose 20.4 percent year-over-year in March, significantly outpacing the national inventory growth of 1.2 percent, according to a recent Zillow report. Zillow said the increase is not because there are many new listings, but rather homes are staying on the market longer. Despite an increase in the total pool of for-sale inventory, the number of new listings on the housing market has fallen year-over-year in each of the past four months, Zillow said.

-- Median home prices were unaffordable to 71 percent of average wage earners in the U.S. in the first quarter. According to Attom Data Solutions latest report, median home prices in the first quarter of 2019 were not affordable for average wage earners in 335 of 473 U.S. counties analyzed in the report. Attom said San Diego County's annualized weekly average wage figure of $61,269 means an individual or family would have to spend 65.4 percent of their income to afford a median home price of $540,250. It's recommended that no more than a third of income should be spent on housing in any given month.

-- The number of San Diego County homes in foreclosure remains at a low level. Attom Data Solutions found local foreclosure filings amounted to 1,040 in the first quarter. While it marked a 280-unit quarter-over-quarter decline, it was up by nearly 150 foreclosures from a year ago. Foreclosures both in San Diego and nationally are still at or near 11-year lows.

-- Millennials are struggling to come up with a down payment to pay for a home, according to Clever Real Estate, a referral service. Nearly half of Californian millennials pay less than the traditional 20 percent down on a home. This leads to high monthly payments and, sometimes, buyer’s remorse. Also, a lack of funds to start with means many use credit cards, or loans, for home renovations.

-- San Diego County is the seventh most favored rental market in the nation. According to HotPads, monthly rent in San Diego County, combining both single-family units and apartments, has reached $2,740. Chicago, Los Angeles and Atlanta are currently the most popular rental markets in the United States, said HotPads.

-- The unemployment rate in San Diego County was 3.7 percent in March, edging up from a revised 3.5 percent in February, according to a monthly jobs report from the California Employment Development Department. During the same period, the unadjusted unemployment rate was 4.6 percent for California and 3.9 percent for the nation.

-- California’s population growth in 2018 was the slowest in state history, as births declined, student enrollment fell and the death rate continued to climb as baby boomers aged. According to the state Department of Finance, the state added 186,807 residents last year, bringing California’s estimated total population to 39,927,315 people as of Jan. 1. The overall growth rate slipped to .47 percent last year from .78 pecent in 2017, the slowest since data collection started in 1900. Births in the state in 2018 were down by more than 18,000, compared with the previous year.

.png?width=706&name=Leaders%20are%20the%20driving%20force%20of%20progress.%20(6).png)

.png?width=750&name=Chart%20for%20411%20-%20Feb%2022%20(1).png)

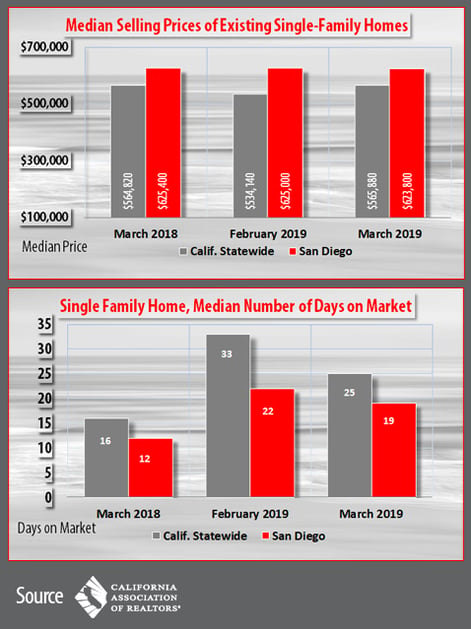

Lower seasonal home prices allowed more Californians to afford a home purchase in the fourth quarter of 2018, compared to the previous quarter, but higher interest rates pushed affordability lower compared to the previous year, according to the California Association of REALTORS®’ (C.A.R.) “Housing Affordability Index” (HAI).

Lower seasonal home prices allowed more Californians to afford a home purchase in the fourth quarter of 2018, compared to the previous quarter, but higher interest rates pushed affordability lower compared to the previous year, according to the California Association of REALTORS®’ (C.A.R.) “Housing Affordability Index” (HAI). PSAR members filled a packed room this week at the East County Service Center in El Cajon to look into the future and hear “2019 Housing Market Outlook,” a presentation from Oscar Wei, senior economist, California Association of REALTORS® (C.A.R.).

PSAR members filled a packed room this week at the East County Service Center in El Cajon to look into the future and hear “2019 Housing Market Outlook,” a presentation from Oscar Wei, senior economist, California Association of REALTORS® (C.A.R.). Get the latest facts on property management legislation!

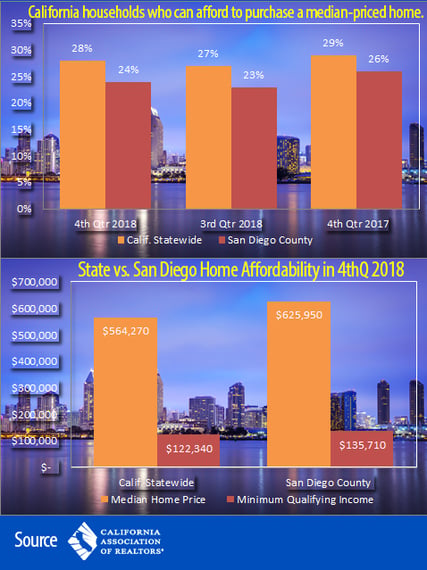

Get the latest facts on property management legislation! California home sales declined for the eighth straight month in December 2018, according to the latest housing market report for home sales and prices from the California Association of REALTORS® (C.A.R). The year finished with fewer sales for 2018 for the first time in four years. For the year as a whole, sales statewide were down 5.2 percent from 2017.

California home sales declined for the eighth straight month in December 2018, according to the latest housing market report for home sales and prices from the California Association of REALTORS® (C.A.R). The year finished with fewer sales for 2018 for the first time in four years. For the year as a whole, sales statewide were down 5.2 percent from 2017.