On Friday, April 3rd, Doug McCauley, was appointed by Governor Gavin Newsom as Commissioner of the California Department of Real Estate.

On Friday, April 3rd, Doug McCauley, was appointed by Governor Gavin Newsom as Commissioner of the California Department of Real Estate.

Doug has served as chief deputy director of the California Department of Housing and Community Development since 2018, and has served as acting director of the Department since 2019. He was executive officer at the California Architects Board from 2001 to 2018. Doug earned a Master of Public Administration degree from Golden Gate University.

According to the DRE, this transition is expected to occur in early May.

Topics: Industry

Clerk of the Board office now by Appointment Only

I wanted to inform everyone that since the Sheriff Deputies are not letting members of the public into the building without an escort by an employee, the Clerk of the Board, has had to change the Map Recording Process that was previously set in place. In order to ensure we have staff available and can escort customers from the building entrance, we will now be providing map services by appointments only. If a customer’s map requires approval/signature of the Clerk of the Board (COB), the customer can call us at (619) 531-5600 or email us at cobmaps@sdcounty.ca.gov to schedule an appointment. Our website has been updated to reflect this information & I will also be posting signs at the entrances of the CAC.

Best Regards,

Samantha Lanham

Board Assistant

County of San Diego - Clerk of the Board of Supervisors

1600 Pacific Highway, Rm. 402, San Diego, CA 92101

Recorder’s Office

When a customer has a map to be recorded, they may call the supervisor line at (619) 531-5007, or email Vanessa.ross@sdcounty.ca.gov, Carlos.argandona@sdcounty.ca.

Please note: the above process will apply while the office remains closed to the public. Once the office re-opens, map recording will once again be processed on a walk-in basis.

Clerk of the Board

If the map first requires approval/signature of the Clerk of the Board (COB), the customer must first call the Clerk of the Board at (619) 531-5600 or email them at cobmaps@sdcounty.ca.gov for an appointment. They are only available Monday-Friday between 8-4 for map transactions. Once they have an appointment, they should then contact us at the above information to let us know their appointment time with the COB. Once done with the COB, the clerk or customer will call the Recorder’s Office, then they will walk the map down to the hall outside our office doors, where the supervisor or map staff will retrieve the map and fees for recording. Staff will return the receipt after transaction is completed.

Treasurer Tax Collector

If a Map Tax Clearance Certificate is required from the Treasurer-Tax Collector (TTC), the customer may request it by mail. They need to include the Map Tax Clearance Questionnaire, a 26” x 18” copy of the map and the $108.00 fee, mailed to: San Diego County Treasurer-Tax Collector, 1600 Pacific Hwy, Rm 162, San Diego CA 92101. The TTC will mail the original clearance back to the customer. If an immediate drop off or pick up is needed, contact the TTC staff at (619) 685-2622 or email Zina.poles@sdcounty.ca.gov (she is out of the office on Thursdays).

The Map Tax Clearance Certificate may be filed by mailing the original, along with the $8.00 filing fee to the San Diego Recorder/County Clerk, P.O.Box 121750, San Diego CA 92112-1750. The certificate may also be filed at the same appointment time the map is being recorded. We will not be making appointments to file the certificate only.

Topics: Brokers/Managers, PSAR Benefits, Industry

To help agents navigate practicing real estate during these challenging times, C.A.R. has released these best practice guidelines that reflect C.A.R.'s understanding of Governor Newsom’s stay-at-home order. This document details recommended best practices for marketing, showing and closing on properties while maintaining compliance with CDC recommendations.

To compliment new guidelines released by CAR yesterday, today two new forms were released:

- One is a Listing Agreement Coronavirus Addendum or Amendment (RLA-CAA) for sellers and listing agents to sign, and

- The other is a Property Viewing Advisory and Declaration (PEAD) that is to be given to and signed by the seller, buyer, agents and anyone else who will be entering a property.

The forms can be accessed here. These forms will be added to Zipforms.

Successful non-essential businesses, while remaining open, are changing the way they do business. For example, while they remain open, restaurants may not serve food. The first priority needs to be safety. If the public, the client and the Realtors is careful and safe, we will get through this crisis more quickly.

Topics: Brokers/Managers, PSAR Benefits, Industry

How does the (CARES) act provide Relief for Realtors?

The Senate has just passed the Coronavirus aid, relief and economic security (CARES) Act, a stimulus package that will provide assistants to Realtors. C.A.R. is closely monitoring the legislation. Review CAR's update here.

Topics: Announcements, Brokers/Managers, Market Information, Industry

The DRE closes offices. PSAR offers more online services.

Service information can be found here.

DRE Closes Offices

All DRE offices are closed to the public until further notice in compliance with Governor Gavin Newsom’s Executive Order N-33-20, issued March 19, 2020, ordering all California residents to shelter in place to slow the spread of COVID-19.

PSAR Launches New Temporary Processes to comply with the Governor's order.

PSAR will support sale of lockboxes and retail merchandise via pre-payment over the phone and pickup by appointment only. Boxes that need repairs, replacement, or new batteries will be exchanged for refurbished boxes following a pre-scheduled troubleshooting session.

Offices are closed, but member support will be provided by phone, chat, email or video call. The PSAR staff is ready to provide full support to our realty community while adhering to the mandated state guidelines.

We, like you, are working through this challenge by adapting to a dynamic environment. If you would like to express any concerns or comments, please email support@psar.org.

Topics: Announcements

EL CAJON CONSIDERING RAISING PROPERTY TAXES WITH SEWER BILL

PSAR Plans to protest proposal to hike property taxes with sewer bill.

The El Cajon City Council is attempting to add sewer charges to homeowners’ semi-annual property tax bills. The City Council is scheduled to discuss this proposal at their next meeting, located at 200 Civic Center Way, El Cajon, 92020, on Tuesday, March 10 at 3:00 pm.

PSAR encourages you to advise your El Cajon clients who own property (residential, commercial, industrial) to send a protest letter to the El Cajon City Clerk before 2:00 pm Tuesday, March 10, in protest of adding sewer charges to their property tax bills.

This may seem at first to be an innocent action by elected officials. However, in reality, adding sewer charges to property taxes would have a far-reaching impact to individual homebuyers and for the city of El Cajon overall.

If these additions are approved, future homebuyers would need more money to qualify for a mortgage. The reason is because higher property taxes always result in lower borrowing ability. Another negative effect would be lower housing values, including lost equity, because a higher property tax bill will shrink a homebuyer’s available pool of money available to purchase a home.

The bottom line is that anytime a property tax bill increases, the higher amount adversely affects the local real estate industry. Adding sewer charges to property taxes will reduce the buying power of homebuyers.

Here are some numbers to consider:

For a typical $400,000 home, purchased with 20 percent down and an 80 percent, 30-year mortgage loan at 5.5 percent, the monthly mortgage payment is approximately $1,817, insurance is $67 (based on $800/year) and property taxes are $367 (based on 1.1 percent of assessed value) for a total monthly payment of $2,251. However, if a sewer charge of $45 (based on property taxes of $540/year) were to be added, the total monthly mortgage payment for the same home would increase from $2,251 to $2,296. Sewer charges are calculated based on water use at each property.

Furthermore, with a 40 percent minimum qualifying income, the homebuyer would need an annual income of $68,880 instead of $67,530 without the sewer bill added to their property taxes. That translates to a 2 percent higher income needed to qualify for the same loan. A homebuyer’s purchasing power is reduced by $8,000 when an increased average sewer charge is added to the property tax bill.

There are many issues and questions with which residents should be concerned. Seniors and individuals on a fixed income will be hit by a large bill at the end of the year. What considerations have been made for these individuals? Who will ratepayers go to when there is an error on the sewer bill if those charges are added to the annual tax payment? Although billing through the tax roll may be slightly less expensive each month, an incorrect bill can be much more impactful. The city intends to defer income from sewer ratepayers until the end of the year. How is that money financed? Isn’t it better for the city to collect this money upfront rather than waiting until the end of the year to bill? How much will this cost taxpayers?

This is not the first time the El Cajon City Council has attempted this action. In July 2013, a proposal to add sewer charges to property tax bills was flushed down the proverbial toilet. Municipalities are attracted to pass-through wastewater sewer costs coupled with property taxes because it saves the city time and money in mailing and administrative processing costs. It also allows for an easier way for cities to earmark construction costs for necessary sewer line repairs. In El Cajon, the city maintains nearly 200 miles of underground pipeline, with the majority of piping constructed before 1965. Many lines date back to the 1920’s.

Last year, El Cajon approved higher sewer rates over the next five years. A typical customer paying $48.31 each month for sewer services will see his or her bill increase to $55.09 in 2020, $61.22 in 2021, $69.70 in 2022, $77.35 in 2023 and $88.76 in 2024. The city’s 17,000 residential customers haven’t seen a rate increase since 2011. Before then, the last adjustment to sewer rates in El Cajon was in 1999. Wastewater in El Cajon is piped to San Diego’s Point Loma treatment plant where it is treated and then released into the ocean.

The El Cajon City Council meeting on Tuesday, March 10 will begin at 3:00 p.m. at El Cajon City Hall, 200 Civic Center Way, El Cajon. The city council meeting is open to the public. PSAR members are encouraged to attend. Oral objections and/or protests may be made at the public hearing.

You are also encouraged to send an e-mail to the City of El Cajon stating your opposition. In your e-mail, refer to the “Sewer Billing System Change to the Property Tax Roll.” Protest emails must be sent prior to 2:00 p.m. on March 10. Any written objection or protest must include your name, Assessor Parcel Number (APN), sewer service address and a statement indicating your opposition to the placement of the sewer charges on the property tax bill. Protest emails can be sent to the City Clerk Angela Cortez at cityclerk@cityofelcajon.us, or the City Manager Graham Mitchell at gmitchell@cityofelcajon.us.

###

Topics: Announcements, Industry

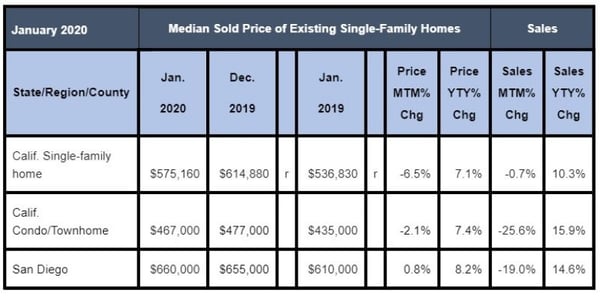

HOMES SALES SLOWER IN JANUARY COMPARED TO DECEMBER

January’s home sales were down by 19% from December 2019.

San Diego County’s housing market started this year with a 14.6 percent increase in existing home sales for January 2020, compared to January 2019, according to recent statistics from the California Association of REALTORS® (C.A.R.). However, January’s home sales were down by 19 percent from December 2019.

The median sales price of an existing single-family home in San Diego County in January 2020 was $660,000, a slight $5,000 increase from the $655,000 figure for December 2019. In January 2019, the median sales price in San Diego was $610,000, a decline of 8.2 percent from January 2020.

Statewide, in January, mortgage interest rates, which were at near or record lows, continued to sustain California home sales, while statewide home prices pulled back from one of the highest levels recorded last year.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 395,550 in January 2020, down 0.7 percent from the 398,370 level in December 2019 and up 10.3 percent from January 2019, when 358,540 homes sold. January was the second straight month for sales below the 400,000 benchmark.

January 2020’s statewide median home price was $575,160, down 6.5 percent from December 2019’s price of $614,880, and up 7.1 percent from January 2019’s price of $536,830.

January’s median price drop, the largest in the last seven years, was largely due to a change in the mix of sales with lower-priced properties making up a bigger share of the market, coupled with a seasonal slowdown. January marked the fourth straight month that the median price registered year over year growth of 6 percent or higher.

January 2020 County Sales and Price Activity

(Regional and condo sales data not seasonally adjusted)

“The strong sales momentum that we saw in the second half of last year carried over into the new year, thanks to favorable homebuying conditions,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “And while home sales were up double-digits from a year ago, it’s important to remember that current sales are being compared to a market that one year ago was at its lowest level in 10 years as economic uncertainties clouded the market outlook while the government shutdown delayed escrow closings.”

“With interest rates on a declining trend again due to concerns about the impact of the coronavirus, motivated buyers will have an opportunity to stretch their purchasing power in the housing market,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The economic outlook, however, is less clear than a month ago before the outbreak of the disease, and we should expect market uncertainties to continue to linger on for the short term.”

With prices rising faster in recent months as housing inventory continued to shrink, consumer optimism rose both month-over-month and year-over-year based on those who believe it is a good time to sell a home. According to a monthly Google poll conducted by C.A.R. in January, 62 percent said it is a good time to sell, up from 56 percent a month ago, and up from 50 percent a year ago.

The same motivating factors, however, may have curbed the optimism for homebuying as only 23 percent of the consumers who responded to the poll believe that now is a good time to buy a home, slightly less than last year (25 percent), when interest rates were 84 basis points higher.

Other key points from the January 2020 resale housing report include:

-- The available supply of homes for sale in the state inched up slightly after reaching an 80-month record low in December but declined on a year-over-year basis for the seventh consecutive month.

-- Housing inventory continued to dwindle, with active listings declining 26.9 percent in January following a 25.9 percent dip in December. The January drop was the largest since April 2013.

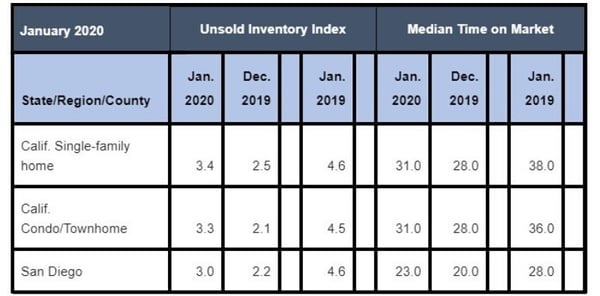

-- The median number of days it took to sell a California single-family home devreased from a year ago, to 38 days in January 2019 to 31 days in January 2020. That compares to 28 days in December 2019, 25 days in November 2019, 24 days in October 2019, 24 days in September 2019, 23 days in August 2019 and 21 days in July 2019.

-- In San Diego County, the median number of days an existing, single-family home remained unsold on the market was 23 days in January 2020, which compares to 20 days in December 2019 and 28 days in January 2019. In other months, the number-of-days figure was 17 days in November 2019, 18 days in October 2019, 18 days in September 2019, 17 days in August 2019, 15 days in July 2019, 13 days in June 2019, 14 days in May 2019, 17 days in April 2019, 19 days in March 2019 and 22 days in February 2019.

-- The sizable drop in active listings, together with the surge in sales, resulted in a decline in Unsold Inventory Index (UII) to 3.4 months from 4.6 months a year ago. On a month-to-month basis, supply climbed 1.6 percent from the prior month but was lower than the average December-to-January increase of 2.8 percent, based on data going back to 2008.

The 30-year, fixed-mortgage interest rate averaged 3.62 percent in January, down from 4.46 percent in January 2019, according to Freddie Mac. The five-year, adjustable mortgage interest rate was an average of 3.33 percent, compared to 3.91 percent in January 2019.

In other recent real estate and economic news, according to news reports:

-- After a slow start to the year, San Diego County home prices finished 2019 on a high note. Prices in the San Diego metropolitan area jumped more than any other West Coast market in December, according to the S&P CoreLogic Case-Shiller Indices. San Diego metro’s price gain was 4.7 percent, ahead of the national average of 3.8 percent. America’s Finest City ranked fourth in the 20-city index for annual price gains, its highest showing since November 2017.

-- San Diego County’s median home price opened the year at $585,000, up slightly from the previous month. Home prices in January were up 7.9 percent annually, said CoreLogic. The median was down from the peak reached in November 2019 of $594,909. The same factors that have pushed up national and local home prices the past few months, including a shrinking number of homes for sale, low interest rates and job demand, are expected to continue to put upward pressure on prices.

-- San Diego County's housing inventory plummeted 34 percent year-over-year in January, marking the third most precipitous decline in the U.S., according to a new Realtor.com report. San Diego's drop was exceeded only by San Jose-Sunnyvale-Santa Clara (37.3 percent) and Phoenix-Mesa-Scottsdale (35.4 percent). Nationally, housing inventory declined 13.6 percent from January 2019, the steepest year-over-year decrease in more than four years. It pushed the supply of “for sale” homes in the U.S. to its lowest level since Realtor.com began tracking the data in 2012.

January 2020 County Unsold Inventory and Days on Market

(Regional and condo sales data not seasonally adjusted)

-- San Diego County was the fourth least affordable housing market in the U.S. last year, according to a First American Financial Corp. survey that concluded the least affordable markets were along the California coast. The survey found San Jose was the nation's least affordable market when comparing median income to sales price. San Jose’s median household income of $128,570 was sufficient to purchase an $806,600 home, but the median price for a single-family home in the city was over $1.03 million in 2019. San Francisco was the second least affordable with a median household income of $114,763 and a median priced home of $945,547. San Diego’s median household income of $81,274 in 2019 was sufficient to purchase a $509,883 home, but the median price of a single-family home in the county was $564,813.

-- 90 percent of Americans are satisfied with the way things are going in their personal life, reflecting a new high in Gallup's four-decade trend. The latest figure bests the previous high of 88 percent recorded in 2003.These results are from Gallup's Mood of the Nation poll, conducted in January, which also recorded a 20-year high in Americans’ confidence in the U.S. economy. The percentage of Americans who report being satisfied with their personal life close to the 86 percent who said in December that they were very or fairly happy.

-- U.S. employers added 225,000 jobs in January, a higher number than expected. The unemployment rate ticked up slightly, at 3.6 percent. Wages increased 3.1 percent from the previous year; wages have grown at an average pace of 3 percent for the last 18 months. Also, the “labor-force participation rate,” meaning the percentage of Americans seeking employment, also increased.

# # #

Topics: Announcements, Industry

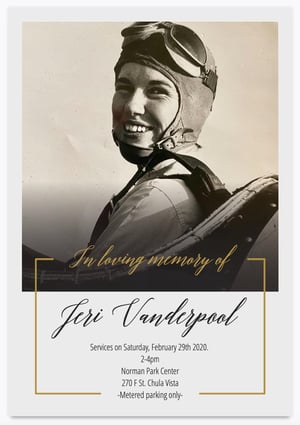

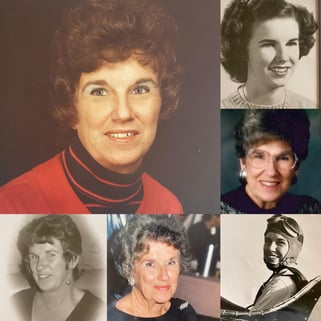

PSAR REMEMBERS PAST PRESIDENT JERI VANDERPOOL, 1929-2020

The PSAR family recently lost another former PSAR president. Jeri Norman Vanderpool, who served as PSAR president in 1994, passed away February 4, 2020, roughly one month before her 91st birthday. She died peacefully from natural causes at home, in her favorite chair, surrounded by family members. Jeri, a lifelong resident of Chula Vista, had been a PSAR member since 1975.

Jeri was born on March 18, 1929, in San Diego. Her parents were Chet and Idell Norman. She attended F Street Elementary School in Chula Vista and graduated as valedictorian of Sweetwater High School, class of 1946. As a young person, she enjoyed water skiing on the Colorado River.

She attended San Diego State College and worked at Southwestern College when it first opened in 1961. She worked as an office manager for Chula Vista surgeon Dr. George Cave and later joined Mascot Realty in Bonita. Following that, she earned her broker’s license and founded Vanderpool Properties, which offered real estate sales and property management services. She operated Vanderpool Properties for more than 40 years.

Jeri was active in real estate sales until age 90, when she turned over the business to a granddaughter, Meggan Copeland.

Family members remember Jeri as a fiercely independent single parent and a hard worker who enjoyed helping people with their real estate needs. She was a leader in the community, involved in the Girl Scouts, Republican Party and school activities, overseeing the PTA, Halloween Carnival and other special events. Active in the Chula Vista Chamber of Commerce, she was also an active participant in Toastmasters International. Jeri held a private pilot's license as well.

PSAR staff members remember Jeri for her humor, sultry voice and intelligence. She was fun, funny and very smart.

She is survived by a sister, Pat Greaser, a son, Richard Vanderpool, a daughter, Susan Giamanco and three grandchildren, David Vanderpool, Chelsea English and Meggan Copeland, as well as three great-grandchildren. She was preceded in passing by her son, Tom Vanderpool.

A Celebration of Life service for Jeri Vanderpool will be held at 2 p.m., Saturday, February, 29, at Norman Park Center, located at 270 “F” St., Chula Vista. RSVPs are not required. All are invited to attend.

The Norman Park Center, a community facility, is named after Jeri’s father, Chet Norman, who was the City of Chula Vista’s first Park Supervisor. The facility opened in 1963 as the Norman Park Center for Senior Citizens. Chet Norman passed away in the mid-1970s.

Everyone at PSAR extends their sympathies and condolences.

Topics: Announcements

DOES YOUR CLIENT EARN ENOUGH TO AFFORD A MEDIAN-PRICED HOME?

29% OF SAN DIEGO HOUSEHOLDS CAN BUY A MEDIAN-PRICED HOME

Slightly higher mortgage interest rates offset steady home prices and held California housing affordability constant during the 2019 fourth quarter, compared to the previous third quarter of the year. Fortunately, more Californians can afford a home purchase now, as compared to a year ago.

The percentage of home buyers who could afford to pay the $607,040 price for an existing, median-priced, single-family home in California in the fourth quarter 2019 was 31 percent, which was unchanged from the third quarter of 2019, but was up from 28 percent in the fourth quarter a year ago, according to the California Association of REALTORS® (C.A.R.) Housing Affordability Index (HAI). The statewide housing affordability index hit a peak of 56 percent in the fourth quarter of 2012.

The index is considered a fundamental measure of housing well-being for homebuyers in the state. Housing affordability is still the main reason for out-migration. Housing affordability is a much bigger problem for first-time buyers, with 49 percent of first-time buyers changing their county residency over affordability issues. The reasons why most buyers delay buying sooner include saving for a down payment, waiting for finances to improve, prices to stabilize and/or difficulty qualifying for a mortgage.

In San Diego County, 29 percent of local households could afford to purchase the $655,000 existing, median-priced home in the 2019 fourth quarter, up from 24 percent in the 2018 fourth quarter, but unchanged from the 2019 third quarter.

On a statewide basis, to qualify to purchase an existing, median-priced, single-family home of $607,040 in the 2019 fourth quarter, a household would need a minimum annual income of $119,600 to make the necessary monthly payments of $2,990.

In San Diego County, to qualify to purchase an existing, median-priced, single-family home of $655,000 in the 2019 fourth quarter, a minimum annual household income of $128,800 would be needed to make monthly payments of $3,220.

The monthly payments, including taxes and insurance on a 30-year, fixed-rate loan, assume a 20 percent down payment and an effective composite interest rate of 3.89 percent. The effective composite interest rate was 3.85 percent in third-quarter 2019 and 4.95 percent a year ago.

The affordability index for condominiums and townhomes also improved in the 2019 fourth quarter from a year ago but showed a decline compared to the 2019 third quarter because of higher median condominium prices. Forty-one percent of California households earned the minimum income to qualify for the purchase of a $480,000 median-priced condominium or townhome, down from 43 percent in the previous quarter. An annual income of $94,400 was required to make monthly payments of $2,360. Thirty-seven percent of households could afford to buy a condominium or townhome a year ago.

Compared with California, more than half of the nation’s households (57 percent) could afford to purchase a $274,900 median-priced home, requiring a minimum annual income of $54,000 to make monthly payments of $1,350.

Key points from the fourth-quarter 2019 Housing Affordability report include:

• Compared to a year ago, housing affordability improved in 44 tracked counties and declined in four counties.

• Affordability improved in all Southern California regions, with Orange County being the least affordable (26 percent) and San Bernardino County being the most affordable (51 percent).

• During the fourth quarter of 2019, the most affordable counties in California were Lassen (63 percent), Kings (55 percent), Tulare and Plumas (52 percent each). The minimum annual income needed to qualify for a home in these counties was less than $54,000.

• San Francisco (18 percent), San Mateo (20 percent) and Santa Cruz (21 percent) counties were the least affordable areas in the state. San Francisco County required the highest minimum qualifying income in the entire state. An annual income of $314,800 was needed to purchase a home in San Francisco County. San Mateo County also required an annual income exceeding $300,000 to purchase a median-priced home.

###

Topics: Announcements, Industry

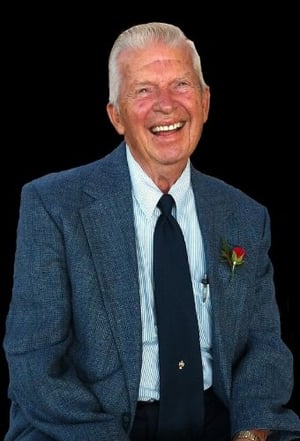

The PSAR family is sad over the recent passing of REALTOR® member and broker Herman “Hank” Miller. Hank passed away January 28 from lung cancer. He was 89.

A Celebration of Life service attended by family members was held Thursday, February 6, at the Little Chapel of the Roses in Bonita.

Hank was born June 16, 1930, in Barbourville, Kentucky In 1940, at age 10, Hank moved with his family to Chula Vista. As a teenager, Hank helped his father build homes in the South Bay community. He graduated from Chula Vista High School in 1948, when the school was located at Brown Field.

After high school, Hank worked at Rohr Industries. While at Rohr, Hank worked a second job as an owner and operator of one of San Diego’s first 7/Eleven convenience stores, located on Broadway in Chula Vista.

In January 1955, he got his barber's license. In 1960, he opened his first barber shop with good friend Paul Burton. Hank and Paul’s Barber shop, which operated for more than 50 years, was well known in Chula Vista. While working as a barber in his early days, he also practiced as a real estate sales agent.

In 1971, he became a member of PSAR. In 1975, he earned his broker’s license and opened Hank Miller Realty. His company also provided property management services. Some properties continue to remain under Hank’s property management company to this day.

The PSAR staff remembers Hank as someone who was full of love and laughter, always joking with a twinkle in his eye and a smile on his face, even when he wasn’t feeling well. He also cheered-on people in their business endeavors and made everyone around him feel as if he or she were the most important person in the world. Once you met him, you became his friend.

With his southern drawl, he would greet PSAR members by saying, “Well, hello PSAR. How are you doing today?” PSAR staff members also said he was a very happy, positive, compassionate, generous, and giving person who brightened up a room when he entered.

Several years ago, a fire damaged a neighbor’s home and Hank invited the neighbor to move into his home until he and his family could find another place to live. Hank even encouraged the family to continue their home Bible studies during their temporary stay.

Hank is survived by four of his five children; Kenny Miller, Dave Miller, Robert Miller and Debbie Miller. He also is survived by 10 grandchildren and 13 great-grandchildren and one great-great grandchild, a boy. He was preceded in death by wife Jean, who passed away in 2010, and a son, Fred Miller, who passed away of colon cancer on December 2, 2019.

Family members recall that Hank was deeply in love with Jean. They were married July 28, 1957. Hank visited Jean’s grave daily, even on the same day he was discharged from the hospital following heart surgery in 2010. He made sure the nearby landscaping was in order and the stone monument was clean. After his passing, family members found a letter Hank had written to them, expressing what a wonderful mother Jean had been, how she held the family together and just how much he loved her.

Family members also recall Hank as a friendly, genuine gentleman who loved people and life. He first battled lung cancer in 2018. Up to his last days, Hank’s words to family members were, “I’ll be okay, please don’t be sad.”

Janet Miller, a daughter-in-law, plans to continue his real estate brokerage under the name Hank Miller Realty. Hank renewed the company’s business license on January 15, 2020. Janet received her broker’s license January 30, 2020. “I will be proud to carry on his name,” said Janet. “He was a wonderful man.”

Everyone at PSAR extends their heart felt thoughts and condolences to Hank's family and friends.

# # #

Topics: Announcements

Comment on this blog below:

.jpg?width=635&name=capitol-22546_640%20(2).jpg)