The coronavirus pandemic has led to challenging and stressful times, full of ambiguity and uncertainty. The virus fallout has hit all business sectors to their respective cores - and our real estate industry is no exception. And even while we are all in the middle of finding ways of conducting business and helping our clients, we are wondering what will be the long-term impact to our industry? What will “normal” be after the COVID-19 lock-down ends?

The answer is: It depends on your definition of “normal.” It’s likely we will see a different way of life in real estate. It’s unlikely that way of life will be exactly as it was pre-Covid-19. The stay-at-home mandate is now in its second month, and the dial is beginning to inch in the opposite direction. Some states are beginning to lift restrictions while others lay out roadmaps. Our economy’s reopening is coming, but “normal” is still a ways down the road.

Here are a few thoughts about the coronavirus impact on our real estate profession and our PSAR members.

-- The virus-driven economic shutdown hit the normally active spring home-buying season hard by limiting supply and dampening demand. Inventory, which already was tight, is now even tighter with fewer numbers of new listings. Many sellers pressed pause on putting their home on the market. Their hesitation to list is understandable given the dynamic economic outlook and the uncertainty it generates. Coronavirus fears also made many more buyers cautious fence-sitters.

-- Expect better times in 2020 Q3. Much of the economic disruption will continue throughout the second quarter. But I’m expecting that many potential sellers who hesitated due to anxiety will list their properties in the third quarter. I’m also expecting a more balanced market with fewer unrealistic sellers, over-pricing their homes and refusing to negotiate. Concern among our members is increasing tempered with a“this too shall pass” perspective.

-- Low mortgage rates will fuel demand and spur a quicker recovery in Q3. Rates will hover in the 3 percent range. Refinancing activity will remain constant as homeowners scramble to lock in record-low rates.

-- Open house activity will change going forward. Instead of group open-house gatherings, I see an increase in private showings of homes. Fewer open houses with smaller numbers to maintain social distancing will be scheduled. I’m proud to see how our PSAR members are exhibiting ingenuity and adapting open house strategies to meet head-on the Covid-19 reality. PSAR members are using video virtual showings and video tours on mobile devices, with disinfectant, masks and hand sanitizers available at in the entryway of every house shown. Some open house tips: Require all visitors to disinfect their hands upon entering the home, provide alcohol-based hand sanitizers at the entryway, as well as soap and disposable towels in bathrooms; before and after the open house, ask your client to clean and disinfect their home, especially commonly touched areas like doorknobs and faucet handles.

-- The coronavirus has been the catalyst of a greater reliance on technology by our industry. Overnight out industry, out of necessity, evolved from a a high-touch, in person process. I see more REALTORS® using technology, that has in fact existed for years, to finalize remote home closings and other steps of the transaction process. Technology is helping us find workarounds to navigate legal requirements and consumer anxiety.

-- iBuying, or automated home flipping without the expertise of a REALTOR®, certainly has been impacted by Covid-19. Algorithms that were built to snap-up real estate bargains and put cash offers on the table are being used less. The use of algorithms to evaluate and flip homes has been slowed considerably.

-- New home developers have also been hit hard because they normally depend on sales and marketing events that are now not allowed. Several new developments originally scheduled to launch in the spring will now be deferred until later this year, if not next. Private appointments and an increasing use of digital viewing options are now key aspects of new home marketing.

PSAR members will always be called upon to adapt to and leverage changing market realities and use their knowledge, negotiating skills and technology to treat all parties fairly, get deals done and keep the local economies strong. We will always find new ways to add value to our clients. Something good comes out of every crisis because we make changes that make us better, smarter and stronger. Tough times teach you so much, lessons you’ll use throughout your careers. We will get through this tough time as we have done in the past. I believe our industry is in a position to thrive when this is over. Our clients will need us more than ever, so hang in there!

.png?width=500&name=unnamed%20(1).png)

.png?width=500&name=unnamed%20(2).png)

.jpg?width=635&name=capitol-22546_640%20(2).jpg)

Current state regulations allow granny flats up to 1,200 square feet in size. They can be attached to, or built separate from, full-sized homes on the same parcel, and include kitchens, bathrooms, living areas and private entrances. They cannot be sold as individual homes, but they can be rented out by homeowners or used to provide additional living space for family members, friends, students, the elderly, the disabled, or in-home health care providers. Properties must meet all zoning requirements, such as setbacks that meet fire safety and building codes.

Current state regulations allow granny flats up to 1,200 square feet in size. They can be attached to, or built separate from, full-sized homes on the same parcel, and include kitchens, bathrooms, living areas and private entrances. They cannot be sold as individual homes, but they can be rented out by homeowners or used to provide additional living space for family members, friends, students, the elderly, the disabled, or in-home health care providers. Properties must meet all zoning requirements, such as setbacks that meet fire safety and building codes..png?width=750&name=Chart%20for%20411%20-%20Feb%2022%20(1).png)

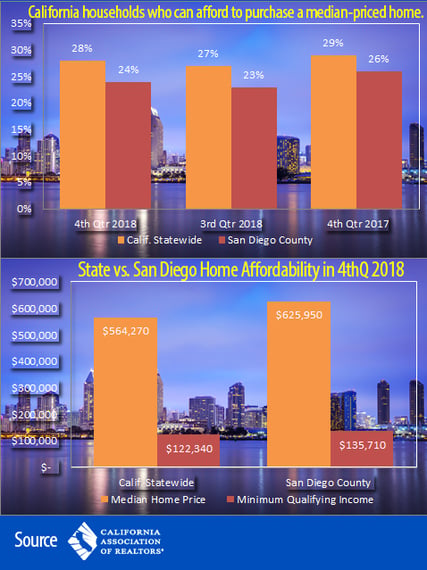

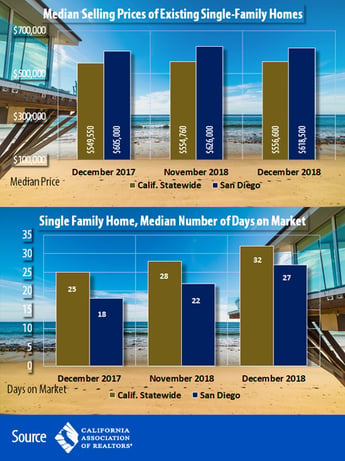

Lower seasonal home prices allowed more Californians to afford a home purchase in the fourth quarter of 2018, compared to the previous quarter, but higher interest rates pushed affordability lower compared to the previous year, according to the California Association of REALTORS®’ (C.A.R.) “Housing Affordability Index” (HAI).

Lower seasonal home prices allowed more Californians to afford a home purchase in the fourth quarter of 2018, compared to the previous quarter, but higher interest rates pushed affordability lower compared to the previous year, according to the California Association of REALTORS®’ (C.A.R.) “Housing Affordability Index” (HAI). PSAR members filled a packed room this week at the East County Service Center in El Cajon to look into the future and hear “2019 Housing Market Outlook,” a presentation from Oscar Wei, senior economist, California Association of REALTORS® (C.A.R.).

PSAR members filled a packed room this week at the East County Service Center in El Cajon to look into the future and hear “2019 Housing Market Outlook,” a presentation from Oscar Wei, senior economist, California Association of REALTORS® (C.A.R.). California home sales declined for the eighth straight month in December 2018, according to the latest housing market report for home sales and prices from the California Association of REALTORS® (C.A.R). The year finished with fewer sales for 2018 for the first time in four years. For the year as a whole, sales statewide were down 5.2 percent from 2017.

California home sales declined for the eighth straight month in December 2018, according to the latest housing market report for home sales and prices from the California Association of REALTORS® (C.A.R). The year finished with fewer sales for 2018 for the first time in four years. For the year as a whole, sales statewide were down 5.2 percent from 2017.