Link to: Location and Direction | Pitch Details | Property Coverage | Agenda | How To Pitch

To enter a property for a PSAR pitch session, use this link: "Request Pitch".

Join REALTORS® Trish Nuñez & Karina Souza as they moderate the Central Pitch!

Showcase listings, receive live feedback, network with fellow local agents. Coverage includes Bay Ho, Clairemont, La Jolla, Linda Vista, Mission Beach, Mission Hills, Morena, Ocean Beach, Pacific Beach, & Point Loma There's nothing like person-to-person interaction!

PSAR's Central Pitch will deliver these benefits:

- Live listing Pitch: Promote your listings to a room full of engaged and motivated local agents

- Improve Your Marketing: Gain valuable insights through the interactive Q&A session that will help you market your listings more effectively.

- Network: Meet, mingle, and build important relationships with fellow top-producing agents who can bring qualified buyers to your listings.

Tuesday| March 12th, 2024

9:30 AM - 10:30 AM

...and every Tuesday thereafter at 9:30 AM

There will be coffee and some breakfast nosh items available as well!

PSAR Central Office in Clairemont

4340 Genesee Ave, San Diego, Suite 203*

*Located on the second floor. Please enter through the rear entrance of the building. Signage will direct you to the correct room once you reach the office.

Pitch Details

Great listing exposure! The property will be listed in the "pitch email" sent to agents in corresponding areas of the county the evening prior. This email has a consistently high open rate.

At this time, pitched properties are not required to be held open after the pitch session, but it is encouraged due to the momentum generated at the session.

Here are the pitch guidelines:

-

Properties "Coming Soon" and "Active" properties can be pitched. Coming soon properties may not be shown Here are the rules.

-

Only "Active" properties may be part of the broker's open.

-

If the listing agent cannot come in and pitch, no need to worry as you can assign another MLS subscriber to make the pitch for you. Make sure to indicate it in the pitch form!

-

Cancellations must be received by 12:00 pm the night before via email (pitch@psar.org), or you will be considered a "No Show." No Shows without an email cancellation will be suspended from the Pitch Session for 90 days.

-

All MLS subscribers are welcome regardless of association affiliation. Those marketing properties must be licensed subscribers or participants in an MLS.

-

PSAR affiliate members are welcome to participate and network. More information is available on sponsoring a pitch session and addressing attendees.

Registration & Questions:

-

Call 619-421-7811 or email pitch@psar.org with any questions.

-

To enter a property for a PSAR pitch session, use the "Request Pitch" form.

-

Pitches MUST be submitted by 3:00 pm the day before the meeting (Monday) to be included.

Coverage Area

Properties in the following zip codes may be included: Bay Ho, Clairemont, La Jolla, Linda Vista, Mission Beach, Mission Hills, Morena, Ocean Beach, Pacific Beach, Point Loma (92037, 92103, 92107, 92108, 92110, 92111, 92121, 92122, 92123,92037.) (Out-of-area pitches are allowed as time permits)

Caravan Tour Number To Come

Pitch Agenda

-

Host introductions

-

We request the attendees to keep mobile phones silent as a courtesy to the pitch speaker

-

Introduce this week's sponsor: Pitch session begins: each agent pitches their property (2 minutes each)

-

Coming soon properties: agents highlight listings coming soon

-

Price changes: agents announce recent price changes

-

Additional announcements: relevant industry news/updates

-

Upcoming PSAR events and classes

-

Reminder of open houses: agents state if they are holding opens after the pitch

Meeting announcements / Market Update

Pitch sessions provide a valuable platform to gain insights from industry experts on current real estate trends, vital updates and announcements for REALTORS® in the county, that could impact their business.

-

Meeting announcements: cover any PSAR updates/news

-

Market update: provide an overview of the latest market trends and statistic

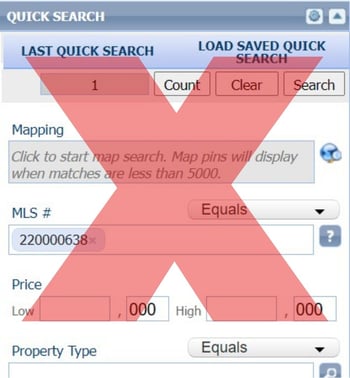

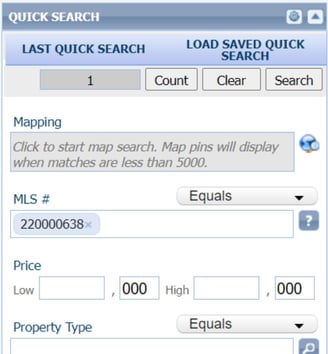

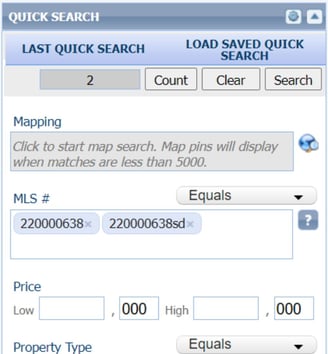

How to Pitch Your Property

When it's your turn to pitch:

-

Walk to the front of the room

-

State your name, company, and phone number clearly and slowly

-

We will display photos while you provide key property details:

-

Address

-

Property type (e.g. single-family home, condo, etc.)

-

Asking price

-

Brief description

-

Key features and details

-

Why agents should see this property

-

Will you be holding an open house after the pitch session?

-

-

Wrap up the pitch by repeating:

-

Your name

-

Company

-

Phone number (slowly and clearly)

-

-

Allow agents to ask questions after your pitch

-

Limit pitch to 2 minutes maximum

.png?width=200&height=200&name=2024%20elections%20(2).png)